Perhaps we should not have been surprised. In what now looks like a well-worn negotiating tactic, President Trump yesterday did a complete 180-degree U-turn from his previous threats and said he would not use military force to invade Greenland, would not impose tariffs on European countries resisting a U.S. takeover of Danish territory, and would accept “additional discussions” instead. The markets breathed a big sigh of relief. S&P 500 futures were up 0.64% this morning after the index rose 1.16% yesterday, putting it back into positive territory for the year to date (up 0.44%). Inevitably, traders piled into the “Trump TACO trade”—the notion that “Trump Always Chickens Out.” The TACO trade (buying the dips when Trump says something scary and then enjoying the upside when he compromises) has been so reliable over the last year that some traders are worrying that the market will become complacent to Trump’s more outlandish threats.

The S&P has, in fact, performed worse under Trump 2.0 than it did under Obama, Biden, and Trump 1.0. And the dollar has declined 9% against foreign currencies over the last 12 months. Both are signals that global investors are more cautious about U.S. assets than they used to be.

There is one set of financial institutions that is actively hedging against Trump’s ability to inject volatility into global markets, contributing to the dollar’s fall: Central banks, which are hoarding gold.

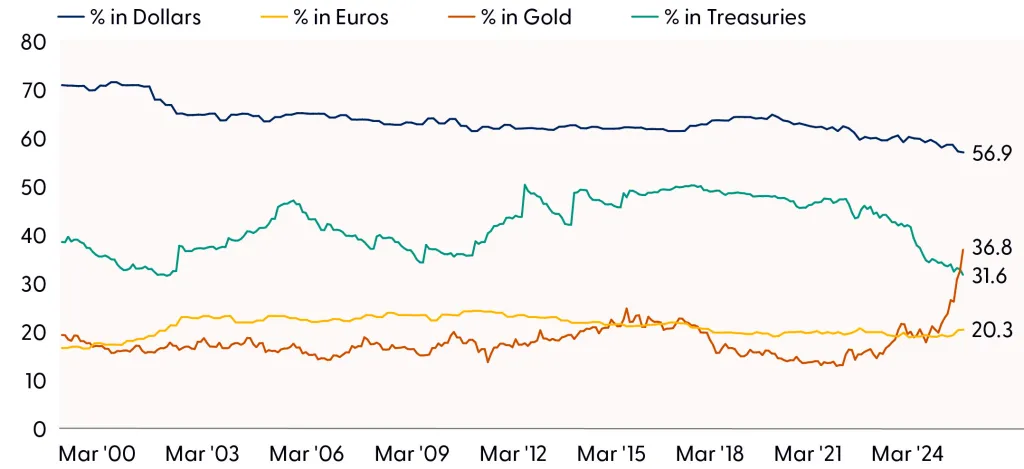

Traditionally, central banks have fuelled their reserves with the U.S. dollar. Although they still do that, they have also stepped up their purchases of gold. That is happening for two main reasons, analysts say. The first was Europe’s decision to seize $300 billion in Russian central bank reserve assets as a sanction for the invasion of Ukraine. That was “an event that reshaped perceptions of currency safety,” according to Adam Turnquist and Thomas Shipp of LPL Financial.

The second is “macro policy risk,” the polite phrase Wall Street uses to describe events like Trump scaring everybody.

Goldman Sachs this morning revised its gold price prediction upward to $5,400 per troy ounce by the end of the year. The Comex gold contract price sat at $4,828.40 this morning, just below its all-time high. Gold is up 11.24% year-to-date, a far better performance than the S&P.

Goldman’s Daan Struyven and Lina Thomas gave three main reasons they think gold has further to go: Gold ETFs continue to pile in; high-net worth families buying gold as a hedge against uncertainty; and central banks.

Central banks bought a monthly average of 17 tonnes of gold per month, pre-2022. Today, the Goldman analysts say the 12-month average is 60 tonnes per month.

“The November 2024 U.S. election process … pushed realized gold prices above our model-implied estimates based on observed flows in October 2024 but unwound rapidly once the electoral outcome in November provided a clean resolution,” they told clients this morning, carefully avoiding the T-word.

Since then, “elevated perceived macro policy risk in 2025 has not reversed. The perception of these macro policy risks appears stickier. We thus assume that [gold-based] hedges of global macro policy risks remain stable as these perceived risks (e.g. fiscal sustainability) may not fully resolve in 2026,” they said.

The LPL team noticed the same trend.

“Although we do not believe the dollar is at risk of losing its reserve‑currency status — given the lack of a viable alternative — central banks continue to diversify away from the greenback and U.S. Treasuries,” they wrote. “Gold has now surpassed both Treasuries and the euro as a share of global reserves, making it the second‑largest holding behind the dollar.”

LPL Financial

LPL FinancialHere’s a snapshot of the markets ahead of the opening bell in New York this morning:

- S&P 500 futures were up 0.64% this morning. The last session closed up 1.16%.

- STOXX Europe 600 was up 1.36% in early trading.

- The U.K.’s FTSE 100 was up 0.83% early trading.

- Japan’s Nikkei 225 was down 0.41%.

- China’s CSI 300 was flat.

- The South Korea KOSPI was up 0.87%.

- India’s NIFTY 50 was down 0.3%.

- Bitcoin was up to $89.9K.

The post The Trump TACO trade is driving up the price of gold as central banks hoard bullion to hedge against the dollar appeared first on Fortune.