Michael S. Selig is chairman of the U.S. Commodity Futures Trading Commission.

We are at a pivotal moment in the evolution of American financial markets. Advances in technology are enabling the creation of entirely new products, platforms and business models, in turn transforming the financial services landscape as we know it.

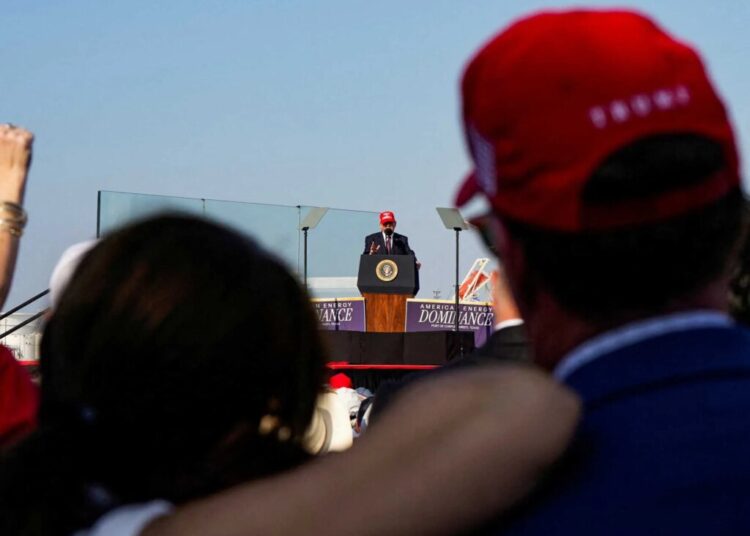

And thanks to President Donald Trump’s leadership, Congress is now on the cusp of enacting the Digital Asset Market Clarity Act,which would provide long-overdue regulatory clarity to an American industry that embodies the promise of the future.

The Commodity Futures Trading Commission has an important role in developing the rules for this new frontier of finance. The CFTC was initially formed to promote orderly operations in markets for the future delivery of agricultural products. But as innovation has enabled capital to reach ever greater efficiencies, policymakers have recognized that the agency with experience regulating everything from pork bellies to credit default swaps is uniquely capable of overseeing novel and emerging markets.

Today, innovators are leveraging technologies such as blockchain and artificial intelligence not just to modernize legacy financial systems, but also to build new ones. The same spirit that drove American farmers to cultivate the Great Plains inspires today’s entrepreneurs to leave traditional finance behind and conquer new, unexplored territories.

Anyone with a smartphone and an internet connection can access blockchain-native financial markets that are peer-to-peer and open 24 hours a day, seven days a week, 365 days a year. Meanwhile, advancements in artificial intelligence are making it possible to uncover methods for hedging risk even the savviest professionals would overlook. These technologies are lowering barriers to entry, expanding risk-management tools and allowing market participants to tailor strategies to their individual needs and preferences. The excitement surrounding the infinite possibilities created by these technologies is palpable, and we are witnessing increased participation in markets the prior administration sought to overlook — or eliminate altogether.

Instead of developing guardrails that foster ingenuity, the Biden administration focused on regulation by enforcement — subjecting novel products such as digital assets and perpetual futures to legacy rules that could not fit the product, but could fit the prosecutor. This aversion to innovation sent many of the most enterprising businesses offshore, and everyday Americans paid the price.

Under my leadership, the CFTC is charting a new course.

Despite the prior administration’s missteps, America is still home to the greatest innovators, and our markets remain the deepest and most liquid in the world. Legacies like these are built over decades, but they cannot stand on their own. The CFTC and other financial regulators must develop clear and fit-for-purpose regulations that allow entrepreneurs to build new things, while continuing to protect the public from fraud, scams and market manipulation.

To future-proof the CFTC for tomorrow’s innovations, the agency’s regulations must adapt to meet our nation’s builders where they are. That is why I have launched the “Future-Proof” initiative. While decades-old rules designed for agricultural futures contracts may still suit those markets today, they do not contemplate nascent products or trading venues. Just as American businesses are modernizing legacy financial systems by harnessing new technologies, the CFTC must upgrade its approach to unleash innovation. As part of this initiative, the CFTC’s staff will undertake a comprehensive review of the agency’s existing rules and regulations and modernize these requirements to ensure a level playing field for new entrants and incumbents alike.

As new asset classes emerge and the CFTC’s role evolves, guidelines we establish should not just fit the product, but also serve a tailored regulatory purpose. Prediction markets have exploded in popularity as broad swaths of market participants seek to hedge portfolio risks and test their abilities to forecast truth. Similarly, the digital asset economy has grown from a mere experiment in cryptography to a more than $3 trillion market with ever greater types of assets being generated on blockchain networks.

Should Congress deliver on making America the crypto capital of the world and send digital asset market structure legislation to the president’s desk, the CFTC will have a broad set of new responsibilities. Pass us the torch, and we will ensure that these markets flourish at home with tailored regulatory frameworks that keep American markets the best in the world.

Arbitrary, cumbersome and opaque rules will not stand the test of time. The CFTC’s approach should be to deliver the minimum effective dose of regulation — nothing more and nothing less. This means an end to policymaking through enforcement. And this means the agency’s policymaking divisions will develop clear rules of the road for market participants that will be codified through notice-and-comment rulemaking to ensure that the regulatory requirements do not change wildly from administration to administration.

The president has assembled a remarkable team in the financial regulatory space, of which I am humbled to be a part. To achieve the golden age of American financial markets, as the president might call it, regulators must break with the rigid and restrictive regulatory practices of the past. The CFTC will seize this generational opportunity to modernize and future-proof its approach to regulation and ensure that the great innovations of today and tomorrow are made in America.

The post America’s financial markets are ready for a golden age appeared first on Washington Post.