In late December, White House official and tech investor David Sacks made a cryptic poston X: “Message received,” he wrote, above a photo of anti-billionaire demonstrators gathered in front of his San Francisco mansion.

The post made public what Sacks and other billionaires had been planning privately: They were plotting to leave California in protest of a proposed wealth tax that would impact the state’s richest residents.

Anger at the proposal, which would levy a one-time five percent tax on the assets of California residents worth more than a billion, had simmered in group chats and at holiday parties since the provision was announced in November. “It was all anyone was talking about,” said Mike Solana, chief marketing officer of billionaire Peter Thiel’s Founders Fund, who has written about the tax on his right-leaning news platform, Pirate Wires.

“There is not a founder who comes to San Francisco or California to work in the technology industry who does not think they are going to be creating a billion plus dollar company,” he said. “This has spooked a lot of people.”

Now a slew of founders and other ultra-wealthy industry leaders are reducing their ties with the state, including investors Sacks and Thiel. Thiel’s family office, Thiel Capital, sent out a press release about its relocation to Miami in late December; Sacks recently said that he had relocated to Austin, and was opening a branch of venture capital firm, Craft Ventures there. Google co-founders Larry Page and Sergey Brin both made moves to reduce their footprints in California by transferring entities they control to other states, according to two people familiar with the matter, who spoke on the condition of anonymity to describe private deliberations. The effort was first reported in The New York Times. Brin and Page did not respond to comment requests. Sacks and Thiel declined to comment.

The wealth tax proposal is sponsored by the health care union, Service Employees International Union-United Healthcare Workers West, and is intended to offset federal budget cuts to social services. It requires 875,000 signatures to get on the state ballot in November and must then win approval.

Tax lawyers and advisers to California tech elites say clients began making hasty preparations in December, in part because of language in the proposal that would apply the tax retroactively to anyone who was a California resident on Jan. 1, 2026. (That language, tax lawyers said, is almost certain to be litigated.)

David Lesperance, a tax attorney, said that four of his clients, worth $600 billion collectively, have set relocation plans into motion — three to Florida and one to Texas. “Every one of my clients who ran the numbers [after Thanksgiving] came back immediately and said get me the hell out of here,” he said. “This is now a no-brainer.”

While tech elites have long threatened to leave the politically progressive, high-tax state, championing efforts to build new tech capitals in places like Austin and Miami, few have permanently resettled, according to academics who specialize in the very rich. But the current proposition has given new ammunition to those who have long urged relocation — reigniting a campaign to vacate a state that some have argued doesn’t value the industry’s contributions.

Though ire at the proposal has united many in the tech world, relocation is a complex process for the ultra-wealthy. Researchers say that while these elites appear to be stateless, jet-setting around the world to multiple homes and yachts on private aircraft, they tend to cluster together. Most stay where they built their business empires and where their social stock is high — officially changing their state of residence far less often than the average American, said Cristobal Young, a sociology professor at Cornell University who has written a book on how different tax structures impact the migration patterns of wealthy people.

“They are powerful insiders, and they are really well connected, and for them moving away to a place where they are really less connected and their personal, professional, and business networks aren’t there with them anymore,” said Young. “That’s not a good deal.”

The proposal has already divided Democrats. California Gov. Gavin Newsom opposes it, while local congressman Ro Khanna, formerly a tech industry darling, has backed the measure. And it has been attacked online by tech leaders across the political spectrum, igniting a conversation that has consumed the industry.

Some have argued the proposal is unusually punitive for founders, whose sky-high net worth is often tied up in privately held start-ups. To pay the tax, critics say some elites would have to sell large amounts of stock, potentially destabilizing their companies value and causing them to lose control.

The provision’s co-author, University of Missouri law professor, David Gamage, says these interpretations are exaggerated and the intention of the law is to tax roughly 200 identified billionaires in the state, not those whose wealth is tied up in stock, who some call billionaires on paper only.

Yet efforts to sow concern about the proposal have been effective, he added, pointing to a letterhe and his co-authors posted to an academic journal platform on Thursday pushing back against assertions made online. He described the online discourse about the proposal as “a mix of bad faith behavior on some and good faith confusion on others.”

Young said previous efforts to tax the income of the wealthy — including in California in 2016 — garnered virtually no opposition. But this proposed tax, he said, appeared to trigger a different reaction because it was so sweeping and targeted private company shares.

“In general this story that the rich are mobile … is just not true and is the basis of a weak argument against taxing the rich,” he said. “But everyone has a tipping point.”

Billionaire venture capitalist Ben Horowitz, who resides in Las Vegas, recently echoed the point on a tech podcast: “It’s been so hard to break the Silicon Valley network effect,” he said. The tax, however, was “the best strategy I’ve seen.” Horowitz didn’t respond to a request for comment.

Not everyone in this elite set agrees. Nvidia CEO Jensen Huang told Bloomberg TV earlier this month that he has no plans to leave the state over the tax. And Brian Chesky, the Airbnb founder who spent months in 2022 living in Airbnbs around the world, still plans to keep his company and life headquartered in San Francisco, a spokesperson for the company told The Washington Post.

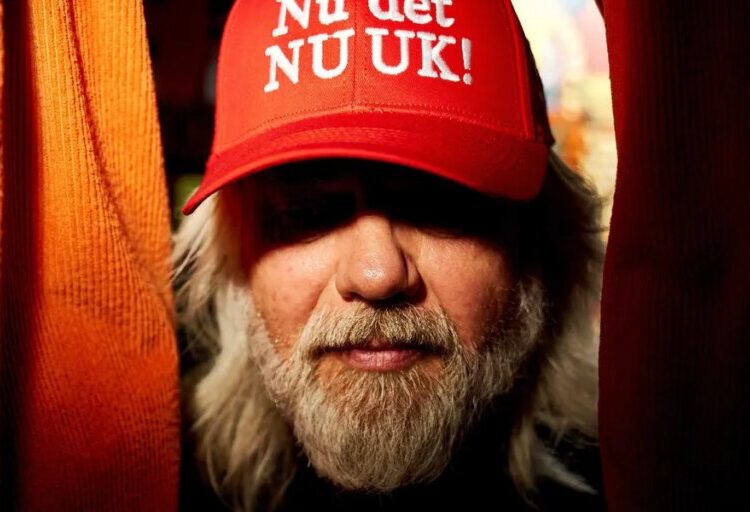

Leading the online crusade to flee the state are Sacks, who serves in the Trump administration as cryptocurrency and AI czar, and his fellow co-hosts of the “All-In” podcast. Online, the men have dubbed wealth tax, officially called the California Billionaire Tax Act, the “asset seizure tax.”

Garry Tan, the CEO of the prominent start-up incubator Y-Combinator, has said that the provision would “kill and eat the golden goose of technology start-ups in California,” in one of numerous X posts attacking the wealth tax (Tan told The Post that he is not a billionaire, but he cares about the issue because he helps “create billionaires” at Y-Combinator). Andy Fang, the co-founder of the food delivery company DoorDash, which is public, posted that the provision “could wipe me out,” and that it would be “irresponsible for me not to plan [on] leaving the state.”

Many other non-billionaire entrepreneurs have jumped into the conversation, posting the results of informal polls taken among billionaire friends, infographics mapping potential impacts, and screenshots of text messages from people deciding whether to leave.

As the country faced the pandemic and the industry has become polarized, tech leaders have made a show of trashing the San Francisco Bay Area, with some moving to Miami or Austin. Thiel famously bought a home and opened an office of his venture capital firm in Miami in 2020 and 2021 respectively, arguing to friends that the Bay Area had become an enclave of woke intolerance. Sacks called his hometown of San Francisco “a cesspool” of homelessness and crime in a speech at the 2024 Republican National Convention.

But now there’s a feeling that “SF is back, or on its way back, and that was exciting,” Solana said. “People seemed excited to live together again in one place and build. … And then this happened.”

According to the Institute of Taxation and Economic Policy, a nonpartisan left-of-center think tank, the top 1 percent contribute 38 percent of California’s annual tax collections. But overall, tax experts say that wealthier people pay lower tax rates than the working middle class on average, because more of their income comes from investments, which are taxed at a lower rate.

For the very affluent, who own multiple homes, companies, yachts, aircraft, and employ staff, officially relocating is not as simple as buying a house in a different state.

Tax lawyers frequently cite the case of Gilbert Hyatt, an inventor who patented chip technology and moved to Nevada in the early 1990s. The state of California was so skeptical of Hyatt’s claim to have relocated just before a multimillion dollar payday it sent tax inspectors to his house to dig through his trash and peer through his windows, two tax attorneys recalled.

Hyatt ultimately sued the state, but his case serves as a reminder of how meticulous wealthy residents looking to leave must be.

The primary factor in determining where a person lives is where they spend most of their time. Tax lawyer Tim Noonan, who has been advising tech clientele on the proposed law, said people accustomed to a jet set lifestyle regularly spending nights on yachts and hotels around the world must, for a period of at least a year, try to settle down.

“You have to stick the landing,” he said. “That means spending a lot of time in one place even though that might not be your normal rhythm.”

Another method tax auditors use to determine a person’s official domicile is called the “near and dear” test, which looks at the physical location of the individuals’ most prized possessions.

“I have a dog, and she’s my baby. I’m probably living wherever my dog is,” said Marty Dakessian, a tax lawyer in Southern California. “If you’re an athlete, where is your trophy case? If you’re a wine collector, where is your wine cellar?”

Gamage, a co-author of California’s proposed billionaire tax, said threats of an exodus typically peak when a wealth tax is adopted, as they did around Massachusetts’s so-called Millionaire’s Tax in 2022. In the end, he said, wealthy residents did not leave the state in unusually large numbers.

Gamage has worked on many wealth tax proposals over his career and says he believes that most billionaires “have earned their billions in a way that is laudable. But we also need tax revenue to fund health care, education and the general operating of society. … A balancing act needs to be made.”

The post Rich people are leaving California, inspired by tech founders’ online campaign appeared first on Washington Post.