BlackRock isn’t seeing any cockroaches scurrying out of its private credit portfolio yet.

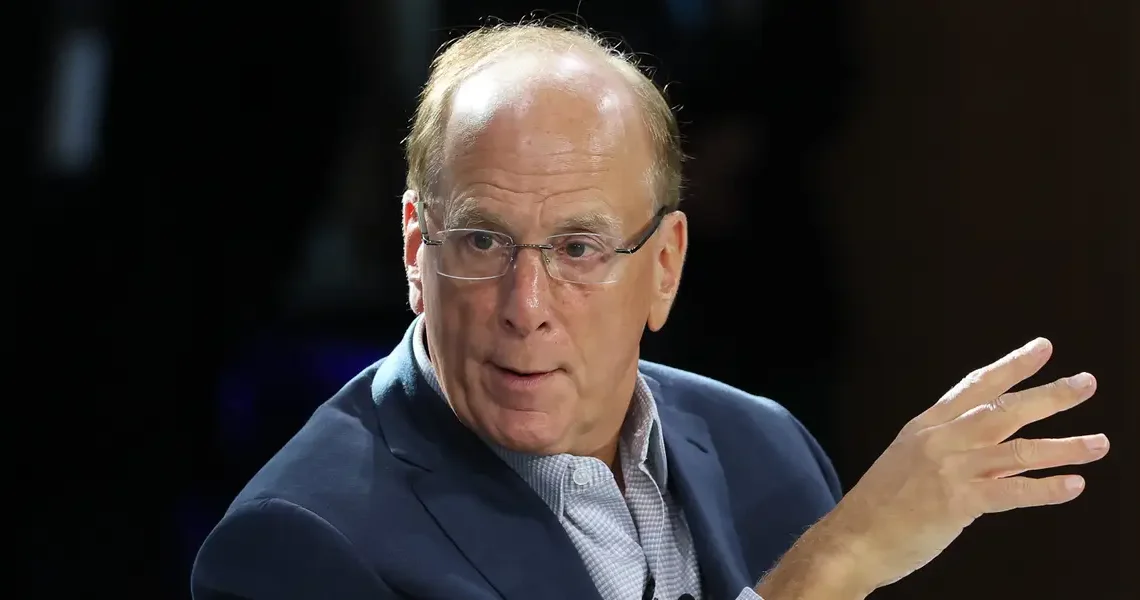

The $14 trillion asset manager has become a major player in the private lending space after it acquired HPS at the end of 2024. The firm has been focused on fundraising for private markets, and CEO Larry Fink said Thursday during BlackRock’s earnings call that the firm’s distribution team was pitching HPS offerings to advisors for wealthy people at wirehouses like Morgan Stanley and Merrill Lynch.

Private credit has seen explosive growth in recent years, as strategies brought in more than $220 billion in 2025, according to S&P. Still, several high-profile defaults, including auto parts supplier First Brands and auto lender Tricolor, have some wondering if there are more hidden risks in the credit market.

“When you see one cockroach, there’s probably more,” JPMorgan Chase CEO Jamie Dimon colorfully put it in October.

BlackRock CFO Martin Small said the manager deployed $25 billion into private-market investments in 2025, including in private lending, and sees “generally stable credit conditions.”

Defaults are rising, he said, but that is to be expected after a period of historically low defaults, thanks to low interest rates.

“Returning to normal defaults is something we expect,” he said, adding that “context is critical” when looking at headlines about bankruptcies.

Fitch Ratings said that private credit default rates for the past 12 months were 5.7% at the end of November, up from 5.2% a month prior. In November, Fitch recorded 13 default events, more than double the monthly average of 5.5.

“It’s not that there’s nothing to see here,” he said, but this is an “expected catch-up.”

BlackRock’s portfolios are further insulated, he said, because they focus on lending to companies with sufficient earnings to repay loans. In the firm’s closed-end investment company, HLEND, for example, loans have been made to companies with average annual earnings of $250 million.

Small companies bringing in less than $50 million in annual earnings that took out loans when they were at their peak valuation “are the credits we’d expect to struggle,” Small said.

BlackRock ended the year with more than $145 billion in private credit assets, and “we see the structural pipeline of private credit fundraising and deployment as intact,” Small said.

Read the original article on Business Insider

The post Why BlackRock isn’t worried about rising defaults as it dives into private credit appeared first on Business Insider.