Business leaders have mixed reviews of President Donald Trump’s new plan for credit cards.

In a post on Truth Social on Friday, Trump said he would call for a one-year cap of 10% on credit card interest rates, arguing that consumers are being “ripped off” by rates that he said can be as high as 20% or 30%. Congress, not the president, has the power to implement such a cap. Similar proposals have previously stalled on Capitol Hill.

Major banks, including JPMorgan Chase, UBS, and Citi, warned that a 10% cap could reduce access to credit; others in the financial sector applauded the plan.

Here is how business leaders have responded so far:

Ed Bastian

The CEO of Delta said the proposed cap would “upend the whole credit card industry.”

“I think one of the big issues and challenges with the potential order is the fact that it would restrict the lower-end consumer from having access to any credit,” said Ed Bastian during the company’s fourth-quarter earnings call on Tuesday.

Bastian said Delta will be “working closely with American Express,” which the company partners with for its co-branded credit cards.

He added that he did not “see any way we could even begin to contemplate how that [the cap] would be implemented.”

Sebastian Siemiatkowski

Klarna CEO Sebastian Siemiatkowski backs Trump’s plan.

Siemiatkowski told CNBC in an interview on Monday that traditional credit cards are built to encourage consumers to put most of their spending on credit, and then carry big balances at steep interest rates. That dynamic, he said, pushes people to borrow more than they should and results in higher losses, especially among lower-income borrowers.

“I think Trump is wise here and is proposing something that makes a lot of sense,” Siemiatkowski told CNBC on Monday.

“Capitalism is great, but anarchy is not,” Siemiatkowski added regarding consumer protection.

In another interview with CNN, Siemiatkowski also said that credit card rewards like cash back and airline miles largely benefit wealthier consumers while lower-income cardholders shoulder more of the costs.

Jeremy Barnum

JPMorgan’s CFO said that Trump’s plan could upend the company’s business model.

“It’s a very competitive business, but we wouldn’t be in it if it weren’t a good business for us,” said Jeremy Barnum during the company’s fourth-quarter earnings call. “And in a world where price controls make it no longer a good business, that would present a significant challenge.”

JPMorgan said on its fourth-quarter earnings call that debit and credit card sales volume rose roughly 7% year over year and described the business as central to its retail-focused offerings.

Jamie Dimon

The CEO of JPMorgan also weighed in on Trump’s credit card proposal.

Jamie Dimon told investors on the company’s fourth-quarter earnings call that reducing card interest rates could adversely affect customers with lower credit scores by limiting access to credit.

“If it happened the way it was described, it would be dramatic,” Dimon said.

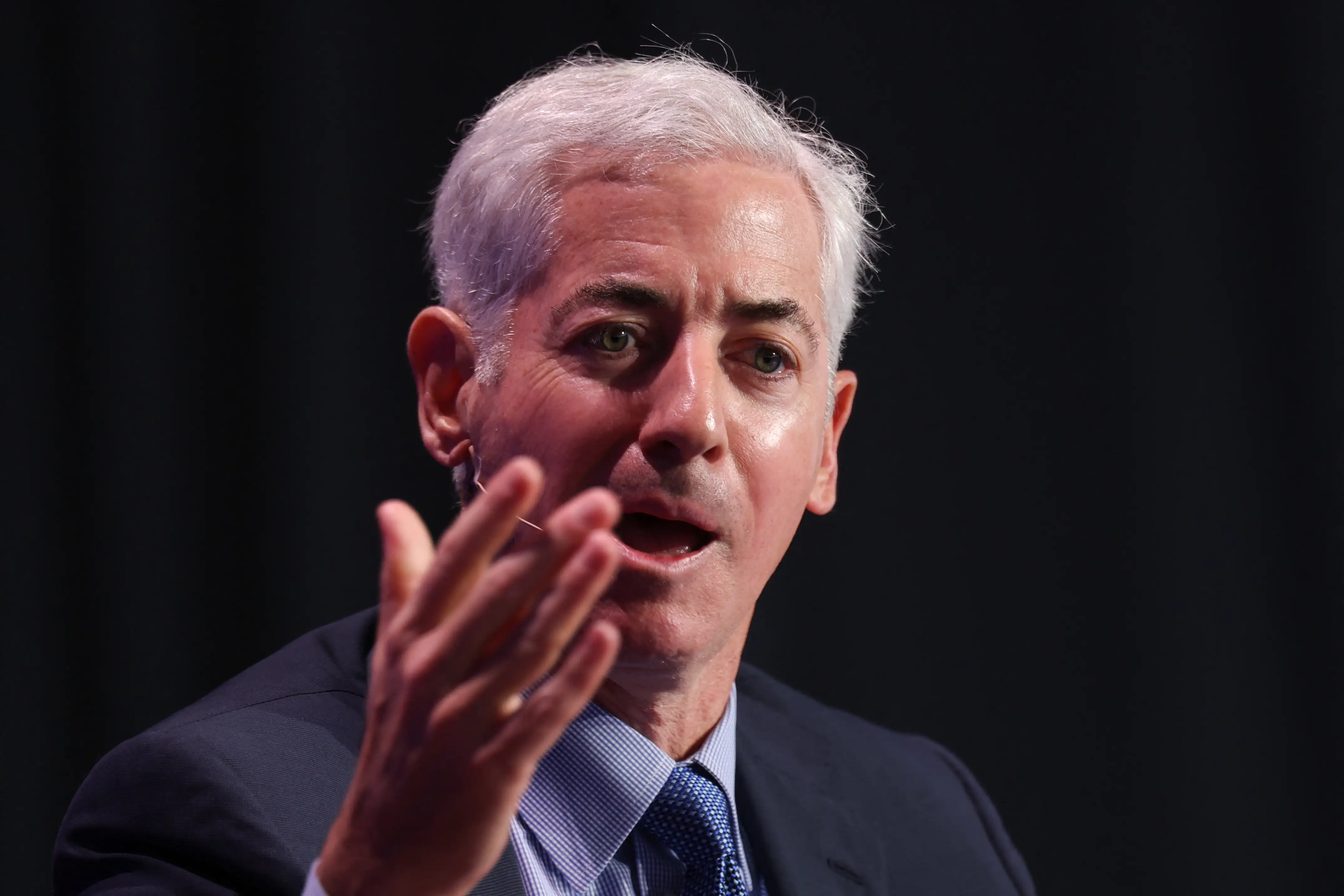

Bill Ackman

“This is a mistake, President,” Bill Ackman, the billionaire CEO of Pershing Square Capital Management, wrote on Friday on X in a now-deleted post.

“Without being able to charge rates adequate enough to cover losses and to earn an adequate return on equity, credit card lenders will cancel cards for millions of consumers who will have to turn to loan sharks for credit at rates higher than and on terms inferior to what they previously paid,” Ackman added.

Ackman said in another post on Saturday that although Trump’s goal is one that’s “worthy and important,” the rate cap is not the way to achieve it.

“The best way to bring down rates would be to make it more competitive by making the regulatory regime more conducive to new entrants and new technologies,” Ackman wrote.

Anthony Noto

The SoFi CEO believes that his business and consumers could stand to benefit from Trump’s credit card rate cap.

“If this is enacted — and that’s a big if, though part of me hopes it is — we would likely see a significant contraction in industry credit card lending,” Anthony Noto wrote in a post on X. “Credit card issuers simply won’t be able to sustain profitability at a 10% rate cap.”

“Consumers, however, will still need access to credit. That creates a large void — one that @SoFi personal loans are well positioned to fill,” Noto added.

Noto also said that personal loans could be an alternative to addressing debt, though that would make underwriting discipline and borrower education “even more important.”

Mark Mason

Citi’s Chief Financial Officer Mark Mason said on a call with reporters ahead of the bank’s fourth-quarter earnings call that the cap would have a “very negative impact on the economy.”

“An interest rate cap is not something that we would, or could, support, frankly,” he said at a different point in the call. “At the end of the day, I think an interest rate cap would restrict access to credit to those who need it the most, and frankly would have a deleterious impact on the economy.”

Mason said that he did not want to speculate about the impact of the potential cap since there are few available details, and said Citi would work with the administration to address the issue of affordability.

Brian Moynihan

The Bank of America CEO, which has one of the country’s largest retail banking and credit card operations, said in an investor call that proposals to lower interest-rate caps come with unintended consequences.

“The explanation we’ve always made sure people understood is that if you bring the caps down, you’re going to constrict credit, meaning less people will get credit cards, and the balance available to them on those credit cards will also be restricted,” Moynihan said, adding that those realities have to be balanced against affordability goals.

He noted that BofA has introduced products intended to keep people from resorting to payday loans that can come with exorbitant interest rates, including short-term loans with a flat fee and no-frills credit cards with a lower rate.

“We believe in affordability, but with instruments that cap, you will see unintended consequences,” Moynihan said.

Read the original article on Business Insider

The post What Jamie Dimon, Brian Moynihan, and other business leaders are saying about Trump’s plan to cap credit card interest rates appeared first on Business Insider.