Never before has the insurance industry faced such big losses tied to floods, severe thunderstorms and wildfires, according to a fresh study that links rising temperatures to increasingly dangerous weather patterns.

Insured losses for so-called nonpeak perils — also sometimes referred to as secondary perils — reached a record $98 billion last year, Munich Re said in a report released Tuesday. Overall insured losses from natural disasters, including peak perils such as hurricanes, were $108 billion, it said.

Tobias Grimm, the German reinsurer’s chief climatologist, said secondary perils are “becoming more severe and more frequent in many parts of the world.” And the evidence points to climate change playing “an increasing role in this development,” he said in an interview.

The threat posed by these water, storm and fire secondary perils has steadily mounted in recent years, forcing insurers and investors in insurance-linked securities such as catastrophe bonds to rethink their approach to risk. Investors have also noted that it’s more challenging to model such weather events than it is to model peak perils.

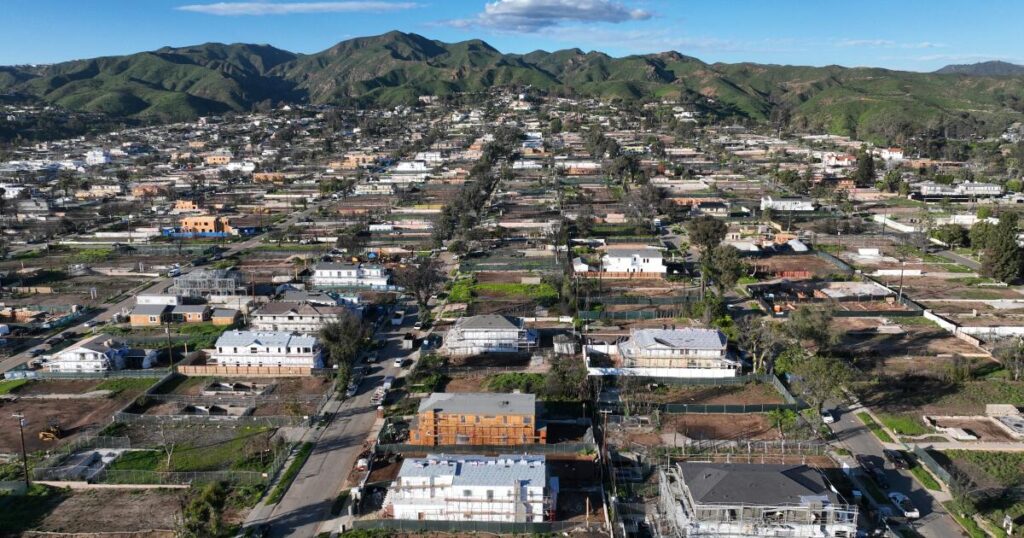

Wildfires that engulfed Los Angeles in January last year were by far the costliest natural disaster of 2025, according to Munich Re. But losses were also driven by severe thunderstorms in central and southern U.S. states in March, it said.

Last year probably matched 2023 as the second-hottest on record, according to data by the European Union-backed Copernicus Climate Change Service. The warmest year was 2024.

Grimm said Munich Re and other reinsurers and insurers have invested heavily in models to help them better predict the losses that secondary perils can cause, noting that these are already working “very well” for wildfires and floods.

But it’s “somewhat more challenging with severe weather such as hail and tornadoes, because these are very local phenomena,” he said. Ways to reduce losses include avoiding building in high-risk zones and improving construction standards, Grimm said.

At Munich Re, “there is a strong will to continue growing in this area,” he said. As long as “risk-adequate pricing is possible,” he added.

Kahl writes for Bloomberg. Gautam Naik of Bloomberg cotributed.

The post Insured losses from wildfire, storms and floods hit record high globally appeared first on Los Angeles Times.