Trading platforms like Coinbase and Robinhood are rushing to offer all things to all customers—from stocks to crypto to prediction markets. This has created an opportunity for Alpaca, which provides infrastructure to brokerage firms, and on Wednesday announced a hefty new funding round.

Alpaca, which builds software that lets companies more easily offer stocks, ETFs, and other financial instruments, raised $150 million in a Series D fundraise that valued the startup at $1.15 billion. Columbus, Ohio-based venture firm Drive Capital led the round, while market-making giant Citadel Securities, the crypto exchange Kraken, and the venture arm of the bank BNP Paribas also contributed. As part of the financing, Alpaca secured a $40 million line of credit.

The startup’s fundraise comes as the dividing lines between once-separate forms of trading blur, and the Coinbases and Robinhoods of the world begin to more closely resemble each other.

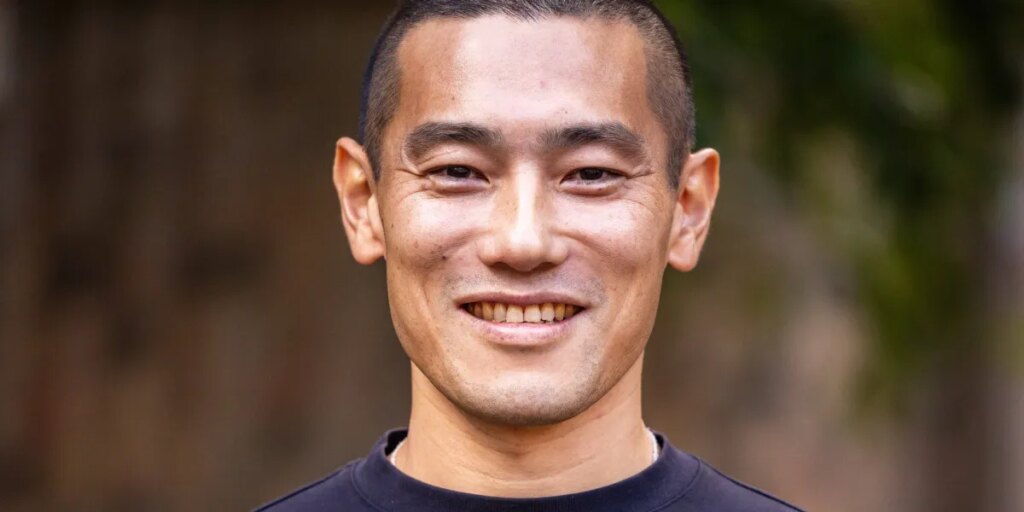

“Crypto players have to combat against fiat players coming into the crypto. Crypto players have to combine with TradFi as well. So, it’s merging into one,” Alpaca cofounder and CEO Yoshi Yokokawa told Fortune. “Everyone who’s missing some components of the final shape of the application, they have to figure out how to add that very quickly.”

Metallic to colorful

Yokokawa and his cofounder Hitoshi Harada have been working on their trading platform for more than a decade. Best friends from college, the duo founded Alpaca in 2015—years after Yokokawa had a crash course in finance at Lehman Brothers before it went bust during the Great Recession.

The two recognized that what they wanted to build together was “very mechanical” and not the flashiest venture. “I see no colors, right?” said Yokokawa, when describing databases and financial services. “It’s metallic.”

The pair decided to name their startup after something in nature, “which is something live, something bloody,” Yokokawa said. The cofounders settled on the name Alpaca after seeing the mammals roam across a billionaire’s estate in the Bay Area.

Despite the playful name, Yokokawa and Harada have since built Alpaca out to be a serious competitor in brokerage services. Rather than secure their own licenses and build out their own trading infrastructure, customers use the pair’s startup to quickly offer their customers stocks, options, and cryptocurrencies. The crypto exchange Kraken has tapped Alpaca for help in offering equities trading, and Alpaca’s customers have grown to include hundreds of businesses across more than 40 countries.

It’s that breadth of coverage that motivated Drive Capital to invest. “They have been able to essentially build an inventory, one of the largest, most impressive inventories that we’ve seen of any company on planet Earth,” said Chris Olson, cofounder of Drive Capital.

While Yokokawa wouldn’t disclose in detail how much his startup is raking in, he said that its annual recurring revenue is more than $100 million. And he’s hoping that Alpaca will be able to challenge a giant in the brokerage services space: Interactive Brokers. “They’re actually our key competitor,” said Yokokawa. “We’re taking market share away from them.”

The post Brokerage tech firm Alpaca raises $150 million in push to compete with trading giant Interactive Brokers appeared first on Fortune.