The U.S. stock market turned in an eye-popping performance in 2025, for the third consecutive year. This remarkable string of repeated, compounded, double-digit gains has bolstered the wealth of anyone with broad stock holdings.

Celebrate your good fortune, certainly, if you’ve been riding the market’s impressive rise. But this is also a good time to assess whether it would be wise to pare back some of the risks that stock investing entails, especially in this inconstant environment.

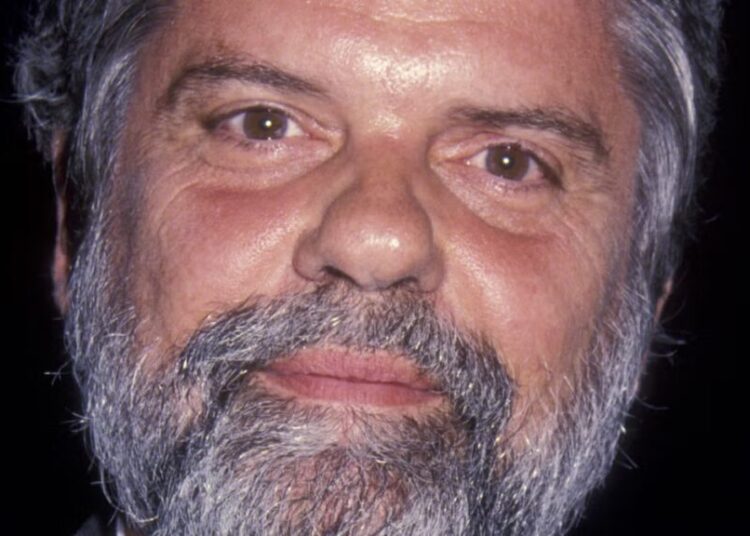

Where the markets are going in 2026 is the big question. Geopolitical tensions are high. Stocks of some oil drillers, traders and refiners have surged, but most investors have largely shrugged off the decision by President Trump to order the capture of Nicholas Maduro, the president of Venezuela, by U.S. forces.

The potential for trouble spilling into the markets is enormous, however. President Trump’s expansive view of U.S. prerogatives in the Western Hemisphere — he says “we need” Greenland, might intervene militarily in Colombia and can expect Cuba “to fall” — has alarmed American allies. U.S. military forces could easily be overextended. And the U.S. actions and threats might embolden Russia and China in what they consider to be their own spheres of influence.

Aside from global conflicts, any number of problems within the United States, including the slowly unfolding effects of tariffs, could set back the seemingly unstoppable U.S. stock market.

Yet there are plenty of arguments for the bull market to continue through a fourth year and beyond, starting with momentum — the propensity of a rising market to continue on an upward path.

Enthusiasm for the purported benefits of artificial intelligence remains strong. While stocks are expensive based on historical measures like the relationship between share prices and corporate earnings, U.S. companies are expected to churn out even richer profits in 2026.

The widening U.S. budget deficit may cause problems for the bond market eventually, but for now, tax cuts combined with increased government spending are expected to add fiscal stimulus to the economy. What’s more, interest rates have already dropped, and Mr. Trump will have more leverage over the Federal Reserve in 2026. He says he will announce his choice for a new Fed chair soon, and expects his desire for even lower interest rates to be heeded by whomever he appoints. The Fed is widely seen as a crucial economic guardian, and if its vaunted independence were to be tainted, markets could plummet.

Still, Wall Street is forecasting a great year. I’ve pointed out that such forecasts are based on little more than hopes and dreams. Nonetheless, for three years running, the stock market has outstripped the consensus forecasts.

Remarkable Returns

How strong has the market been?

Well, suppose you simply invested in the S&P 500, the most widely followed benchmark for the U.S. stock market, using a standard low-cost index fund like Vanguard’s S&P 500 ETF, often known by its ticker, VOO.

Including dividends, VOO gained 17.8 percent in 2025. That followed surges of 25 percent in 2024 and 26.3 percent in 2023. Over three years, with compounding, the fund rose 86 percent through December. That means that if you had put $100,000 into the S&P 500 index fund three years ago, your stash grew to $186,000.

Whether you have been investing for retirement or for a home or a child’s education — or if you are rich enough to dabble in the market for the prospect of seeing your money grow — this has been a remarkably good stretch for most U.S. investors. Financial portfolios, on average, have grown far more rapidly than average wages, or the rate of inflation — an imbalance that may help to explain the strength of the economy, despite relatively negative readings in consumer confidence surveys. Affluent people have been spending with gusto, stimulated by the “wealth effect” — a greater propensity to consume when the value of financial assets appreciates.

I wouldn’t push this too far, though. Not everyone reacts to rising stock prices. Many people don’t look at their brokerage statements regularly and may not be aware of what’s happened to their money. But if that describes your habits, then this would be a good time to pay closer attention to your portfolio. Returns this gaudy don’t typically last long.

Risks abound, and if you think you may need some of your money for an important purpose in the next few years, it may make sense to shift some investments from stocks to safer holdings, like high-quality bonds and cash — a category that includes short-term Treasury bills, money market funds and high-yield bank accounts.

The recent performance of international stock markets suggests that diversifying globally may help protect your returns, too.

Fresh Figures

The final numbers for 2025 have arrived from Morningstar, the financial services company that has been tracking the performances of mutual funds and exchange-traded funds for The New York Times for many years. Those figures show that as great as U.S. stock fund performance has been, many other global stock markets have been better over the last year. Bonds have also fared well, though corporate bonds are now richly priced.

Here are some of the annualized returns for the average stock and bond funds for three months, 12 months and five years through December:

-

Domestic stock funds, including both actively managed and index funds: Up 1.9 percent over three months, 13 percent over 12 months, and 9.9 percent over five years. The average fund underperformed the S&P 500 stock index, and simple tracking funds like the VOO, in each period.

-

Taxable bond funds: Up 1.2 percent over three months, 7.6 percent over 12 months and 2 percent over five years.

-

Municipal bond funds: Up 1.4 percent over three months, 3.6 percent over 12 months and 0.9 percent over five years.

-

International stock funds: Up 3.9 percent over three months, 31.4 percent over 12 months and 6.5 percent over five years.

-

Diversified asset allocation funds with 50 percent to 70 percent stock and most of the remainder in bonds: Up 2.3 percent over three months, 13.7 percent over 12 months and 7.7 percent over five years.

Wonderful as many of these returns may be, investing in diversified funds has its limits. While you get some protection, you miss out on the performance of a few brilliant stocks. Nvidia, for example, had a poor quarter, with a loss of .04 percent, but its return over five years was extraordinary: 70.3 percent, annualized, according to FactSet, or nearly five times the performance of the S&P 500.

Funds that focused on narrow sectors had extreme performances, for better and for worse. Here are some annualized returns through December:

-

Precious metal stock funds, which include gold miners, rose 16.7 percent over three months, 152.8 percent over 12 months and 18.6 percent over five years.

-

Latin America stock funds rose 6.2 percent over three months, 48.8 percent over 12 months and 6.2 percent over five years.

-

Funds investing in digital assets like Bitcoin fell 24.5 percent over three months and 11.5 percent over 12 months. This volatile category is too new for five-year returns.

Trying to pick the right fund or stock at the right time is hazardous, and I favor a simpler route.

Looking Ahead

I invest in public markets based on several important assumptions.

While history may not repeat itself, I assume that over the long haul, the stock market will continue to outperform the bond market but will be far more volatile. These markets are supported by the economy, which I assume will grow, despite chronic problems and periodic upheavals. And I assume that no single market will always outperform all others. Therefore, diversifying globally, and including safer assets like bonds and cash, makes sense.

This isn’t easy. There are important questions to consider. What proportion of each asset makes sense at different stages of life? Should you make adjustments based on the state of the market and the economy? I expect to spend more time discussing these issues this year.

In the meantime, enjoy the positive returns, if you have had them, but hedge your bets.

Jeff Sommer writes Strategies, a weekly column on markets, finance and the economy.

The post After Three Hot Years, Will Stock Markets Sizzle Again? appeared first on New York Times.