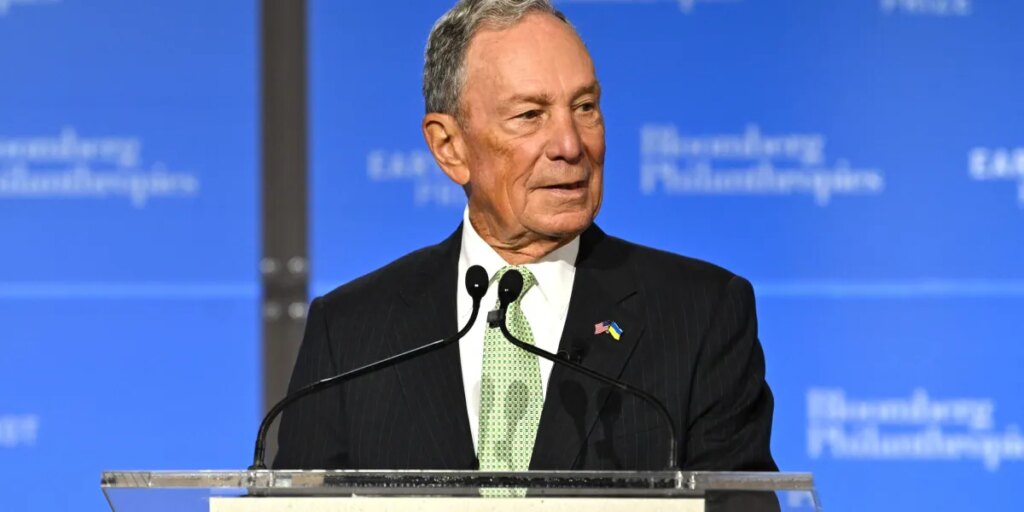

When billionaire Michael Bloomberg launched his career after college in the 1960s, he was only making $11,500 a year. To be sure, that was a decent salary back then, and would be equivalent to roughly $114,000 today.

But Bloomberg, fresh off earning a bachelor’s degree from Johns Hopkins University and an MBA from Harvard University, actually had the option to make more. Another company had offered him a $14,000 salary, but he preferred the people he had met at Wall Street investment bank Salomon Brothers.

Salomon Brothers had actually originally offered Bloomberg only $9,000, but he negotiated. They offered him a $9,000 salary with a $2,500 loan, ultimately launching Bloomberg’s storied business career. In his first year there, he earned a $500 bonus toward paying down his loan, and a $2,000 bonus for loan forgiveness the following year.

While it may have seemed like an odd choice for Bloomberg to have foregone a higher salary, it was the first of many smart career choices he made.

“In the end, it worked out fine,” Bloomberg told Norges Bank Investment Management’s In Good Company podcast in an episode published Wednesday. “Don’t feel sorry for me, but I’ll never forget that people make the mistake of going to work for a place where they get paid the most.”

‘Certain jobs you shouldn’t take’

Another finance world legend, Warren Buffett, also shares the same mentality about prioritizing the people you work with over how much you get paid.

“Don’t worry too much about starting salaries and be very careful who you work for because you will take on the habits of the people around you,” Buffett warned the next generation of workers during his final Berkshire Hathaway annual shareholder meeting. “There are certain jobs you shouldn’t take.”

That’s curious advice for a generation facing inflation, a soft job market, and an ongoing housing affordability crisis. But at the end of the day, both Buffett and Bloomberg were somewhat in Gen Z’s shoes when they were first starting out. Most recent college graduates share the experience of fearing the unknown and not knowing what career path to take.

Making money “is not what life’s about,” Bloomberg said. “You’ve got to get experience, you’ve got to build friendships, you’ve got to try things and see what works and what doesn’t.”

“All these young people are just looking at the wrong thing,” continued Bloomberg, who ultimately grew his own media and business intelligence empire and has a $110 billion net worth.

Buffett had also repeatedly emphasized the importance of choosing wisely the people you work with.

At Berkshire Hathaway’s 2004 annual shareholders’ meeting, a 14-year-old boy and young shareholder from California posed a question: “What advice would you give a young person like me on how to be successful?”

“It’s better to hang out with people better than you,” said Buffett, who just recently retired after an epic 60-year reign as CEO of Berkshire Hathaway. “Pick out associates whose behavior is better than yours, and you’ll drift in that direction.”

The post Michael Bloomberg and Warren Buffett agree on advice to Gen Z: Choose vibes over money in your job search appeared first on Fortune.