For the past decade, the archetypal founder was creeping up from someone in their 20s to someone a bit older. The average age of a “unicorn” founder—an entrepreneur who builds a startup valued at more than $1 billion—had steadily climbed to 33 by 2024, as investors gravitated toward seasoned veterans to navigate a complex market. However, a new report by global venture capital firm Antler, looking closely at the unicorn phenomenon, suggests the artificial intelligence (AI) boom is quickly reversing this trend, empowering a new generation of twenty-somethings to build massive companies at unprecedented speeds.

According to Antler’s “The Anatomy of Greatness,” released on Jan. 7, the arrival of generative AI has created a distinct before and after in the startup ecosystem. While the broader founder population is aging, the average age of AI unicorn founders has plummeted from a peak of 40 in 2020 to just 29 in 2024.

“We’re seeing that potentially 25 is the new 30,” Fridtjof Berge, cofounder and chief business officer at Antler, told Fortune in an interview. “There’s just for smart people now [the ability] to use a lot of the tools presented to them … perhaps you need to rely less on networks or less on sector-specific expertise.”

While cautioning it’s probably too soon to draw a decisive conclusion on this space, he added “if you’re someone who’s quite confident, fast-working, not afraid of trying things and then quickly iterating,” then the current AI space is a great fit because it’s a “constant iteration.” Berge added he thinks a “fundamental shift” is happening in terms of the age of AI founders and their urgency to get things done. He said he sees a “drive and willingness to constantly iterate on what’s working … I think that’s really the key for successful founders in 2026.”

Doing more with less

The driving force behind this youth movement, as Berge says, is efficiency. In the previous era of unicorns dominated by software-as-a-service (SaaS) companies, scaling required massive capital injections to hire large teams for coding, sales, and operations. Today, AI allows lean teams to automate low-skill tasks and analysis, fundamentally changing the economics of company building.

“We are also seeing something quite interesting, which is in many cases, it means they’re doing more with less,” Berge explained. “Perhaps you can do now with a hundred thousand [dollars of funding] what you could do with a few million dollars before.”

This efficiency is compressing the “time-to-unicorn”—the number of years required to hit a $1 billion valuation. While the historical average for startups has held stubborn at roughly seven years, AI companies are now achieving the milestone in an average of just 4.7 years. The report highlights extreme outliers like the Swedish AI firm Lovable, an Antler portfolio company, which reached unicorn status in just eight months.

A shift from the ‘Supernova’ of 2021

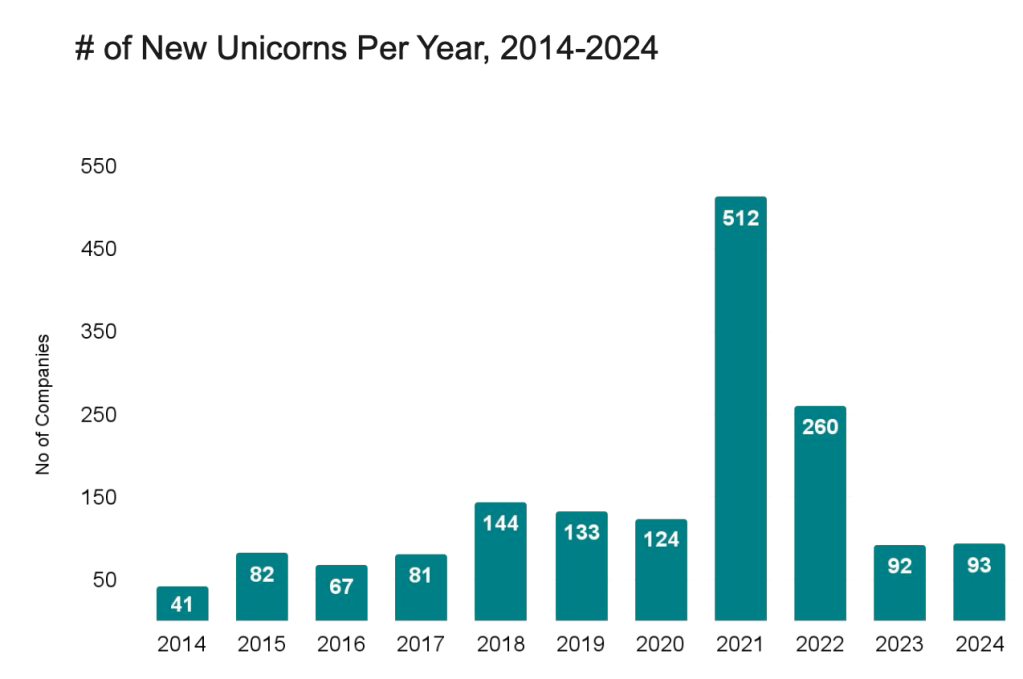

The report contrasts the current AI-driven growth with the “supernova” year of 2021, which birthed a record 512 unicorns. Berge told Fortune where low interest rates and investor FOMO (fear of missing out) drove a lot of this explosion, agreeing with a question this was a bit of too much of a good thing for the venture capital space: “The explosion in unicorns” may not be the most surprising story, “but it is really quite mindboggling,” he said, drawing a contrast between the recent, previous era as defined by capital abundance, while the current wave is defined by technological capability.

Berge acknowledged many valuations from that year were driven by speculation. In contrast, today’s young AI founders are often backing their high valuations with significant early revenue. While cautioning his report doesn’t go into individual funds, Berge said he thinks many people in the VC space would have the view 2021 was a bit excessive.

“But then I also think that people are very happy and perhaps relieved that, you know, from late 2023, there’s a new kid on the block, being AI, which makes everyone excited again,” he said. In many cases, he added, he’s now seeing companies with upwards of $10 million of revenue, even $100 million. “There’s a lot of real transactions behind a lot of these companies.” He again mentioned his portfolio company Lovable, which went from $1 million to $100 million in just eight months.

The global classroom

This democratization of tools is also leading to a democratization of geography. A decade ago, billion-dollar companies were concentrated in just 30 cities across eight countries. Today, they emerge from more than 300 cities in 45 countries.

“It’s quite mind-boggling,” he said, expressing surprise yet again about developments in the VC space. “And I think that countries and cities who want to be competitive in the future, they need to have a startup scene, they need to have a tech scene. And at least a lot of them have the potential to build that,” he said, reeling off Berlin, Stockholm, London, and Dubai as future startup hubs. He could have mentioned many other cities, too, he added, stressing the broader point that right now, cities and countries have a rare window to cement themselves as serious tech hubs.

As the barriers to entry crumble, the “move fast and break things” ethos of the early social-media era has returned, but with higher stakes and faster tools. For the venture capital industry, the data serves as a warning: the next industry-defining giant is likely being built by a 25-year-old with a laptop, operating at a speed that traditional business models can barely track.

“The ones that really hit the product market fit… take less time to become unicorns,” Berge said. “It’s just everything going on behind the scenes of building a business happening faster now.”

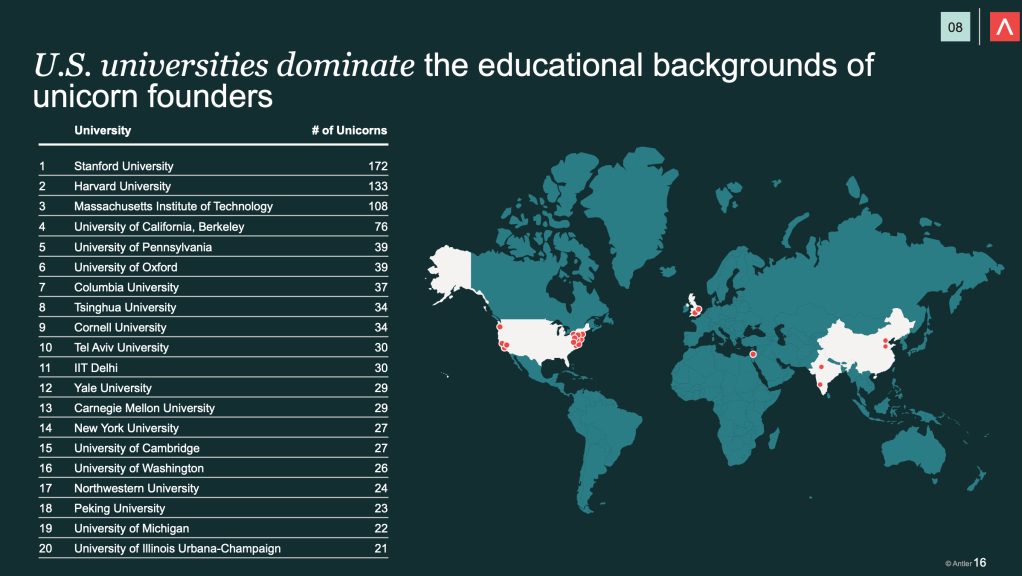

One factor remains unmoved, though: Founders overwhelmingly come from U.S. universities such as Stanford and Harvard.

“It’s quite incredible what the U.S. universities have produced in terms of outcomes and great companies,” Berge said, “not just in the U.S., but obviously founders coming with those Ivy League degrees to other countries.”

The post 25 is the new 30 when it comes to AI founders as Gen Z entrepreneurs lead the way on billion-dollar unicorn startups, top VC partner says appeared first on Fortune.