Anyone working in television will tell you that the Peak TV era has come and gone. But in 2025, a leaner new normal for Hollywood’s scripted programming came into focus as the industry and viewers bid farewell to the big-budgeted hits of yesterday’s business model.

The most high-profile of those conclusions this year is Netflix’s “Stranger Things,” arguably the biggest piece of original programming to come out of the streaming era. A sci-fi saga with horror flare consisting of 42 episodes produced over 10 years — spurring more than $1 billion in merchandising, spinoff products and storytelling across comic books and an upcoming animated saga — the final season was made with a projected budget of $400-$480 million for eight episodes, including a movie-length finale set for release the evening of New Year’s Eve.

The timing is almost poetic given that a project of that scale, based on an original idea, will be much harder to replicate within Hollywood’s new set of rules.

After a decade of unrestrained growth, 2025 saw Hollywood take a scalpel — and at times a chainsaw — to the scripted TV machine. Streaming giants and broadcasters ended many shows while cutting back on ordering new ones, as the last two years of strikes and consolidation rewrote the playbook on what a worthy bet looks like in the increasingly competitive fight for audience attention.

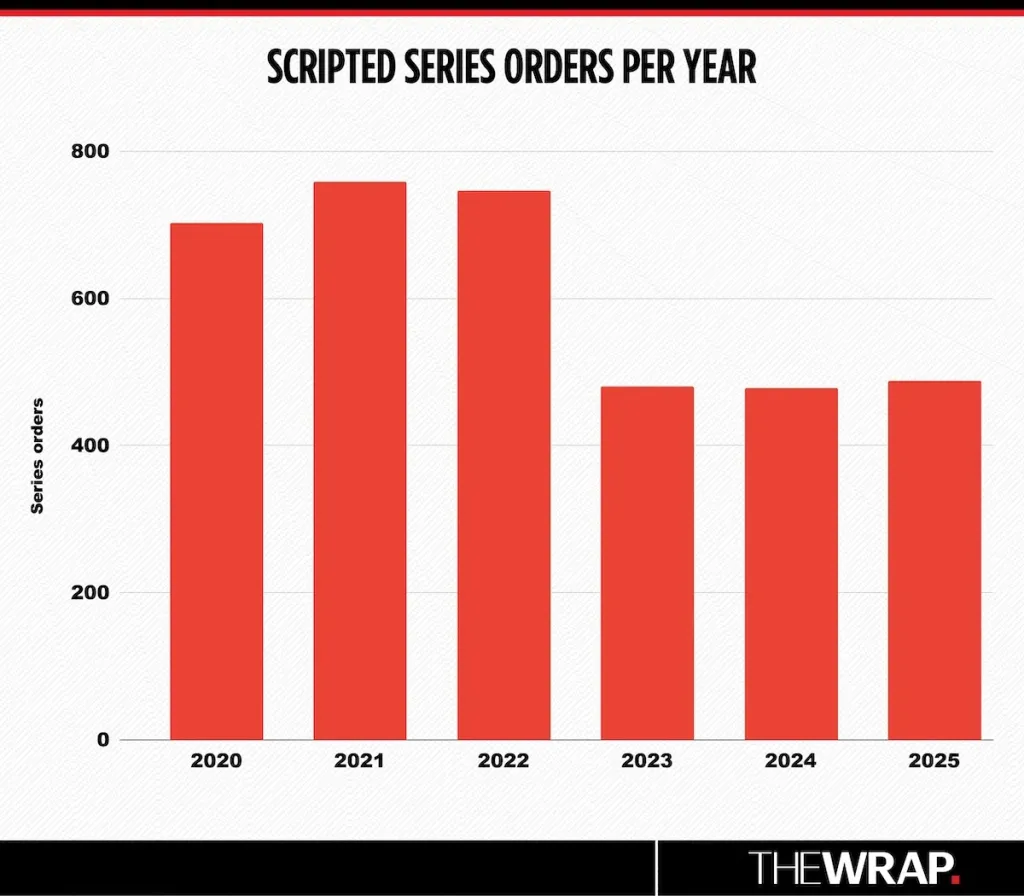

By the numbers, the total of shows ordered by U.S. distributors went from a peak of 759 in 2021, to around 478-493 shows per year in the last three years, according to data from Ampere Analysis. That’s as low as 37% fewer shows than the industry produced at the height of Peak TV — the name for the period roughly between 2013 and 2022, with the last two years especially seeing Hollywood on a spending spree to lure subscribers to their brand new streaming platforms to compete with Netflix.

TV fans and industry insiders felt the crunch of that new normal this year, with fewer new shows being announced across platforms and the end of tentpole series like Disney+’s “Andor,” Peacock’s “Bel Air” and Hulu’s “The Handmaid’s Tale.” The change even brought the end of longrunning broadcast favorites like “The Conners” on ABC and CBS’ “Blue Bloods,” making room for cheaper shows or franchise extensions to fill up schedules — while other shows cut series regulars or trimmed their screentime to save money.

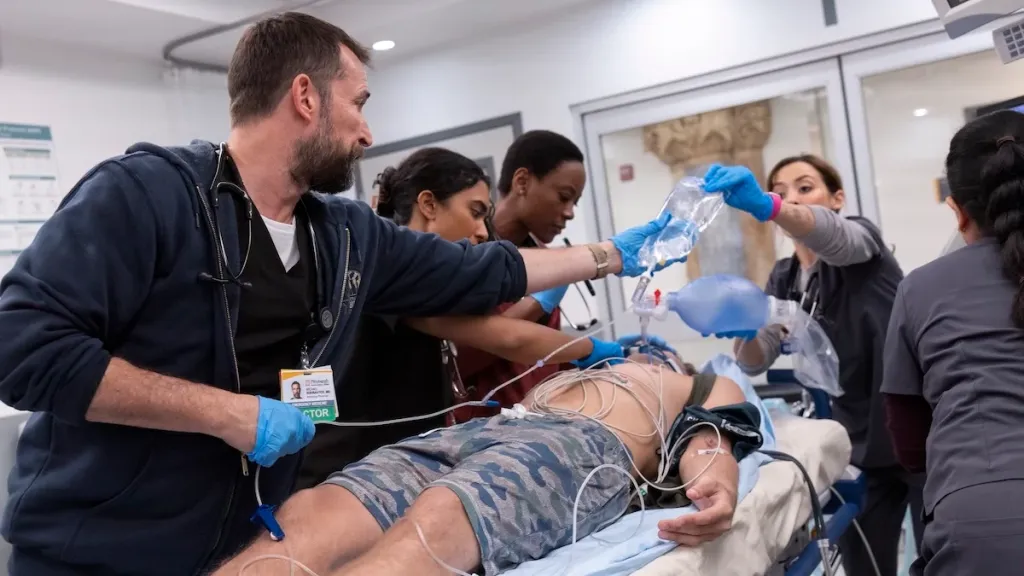

But TV’s rejiggered landscape also boasted success stories this year. HBO Max’s “The Pitt” — a 15-episode medical drama with a projected budget of $4-$5 million per episode — rose to prominence through a weekly run in its first season and won the Emmy for best drama series, besting the Apple TV sci-fi thriller “Severance,” which reportedly cost $20 million per episode. Netflix premiered “Adolescence,” a bold limited series that its creators hope can bring real change to the United Kingdom, and “Breaking Bad” creator Vince Gilligan debuted his most audacious hit yet in Apple TV’s “Pluribus.”

Spinoffs also proved a safe but successful bet for audience retention and interest in broadcast, particularly CBS’ “Boston Blue,” centered on Donnie Wahlberg’s “Blue Bloods” character and new partner Sonequa Martin-Green investigating crimes in the Massachusetts city; and ABC’s “9-1-1: Nashville,” taking the popular first responder franchise to the Tennessee city and matching the viewership of the Angela Bassett-led flagship in delayed data. Broadcast TV, touting solid year-to-year audience growth for much of its programming — also has its critical darlings, like CBS’ “Matlock” starring Emmy and Oscar winner Kathy Bates and audience favorites “Tracker” and “High Potential.”

“It’s a tough time in our business, I don’t want to sugarcoat that. But at the same time, I don’t think it’s all doom and gloom,” former Amazon MGM Studios executive and longtime film and TV producer Marc Resteghini told TheWrap. “There’s some great content that’s been made this year. There’s going to be some great stuff coming next year, too.

“I think they’ve vastly overstated our demise. I’m still optimistic,” he added.

The big change already happened

The industry course-correction after Peak TV started playing out in the middle of 2022, when media companies pivoted from subscriber growth to streaming profitability as their key measure of success. That meant the massive investment in high-budget original content — peaking at 759 series orders in 2021, according to research from Ampere Analysis — would start winding down, in exchange for programming that made a good return on investment at scale.

The decline grew steeper in 2023, as the Hollywood writers and performer strikes brought greenlight activity to a near halt, ending with a total of 480 series orders. The number has stayed relatively consistent since then — with 478 orders for 2024 and a projected 488-493 orders for 2025 — signaling that content commissioners found a new magic number for stability in the scripted industry, a jarring 35.7% decrease from 2021’s peak.

“We’re still dealing with the pain” of that transformation, Ampere Analysis analyst Fred Black told TheWrap after a year of job cuts across the industry. But, much like with the contraction of unscripted programming, he believes the content cutback is over — at least until the next wave of media consolidation prompted by the looming sale of WBD.

Adjustment period

TV’s new rules brought substantial change to Hollywood’s networks and streamers. Most entertainment companies turned to sports to grab viewer attention. They played their new and returning hits after football games, and trailers for their biggest titles on commercial breaks. NBC gave up a full night of entertainment programming to air NBA games — an incentive for bigger viewership and streaming subscribers.

“Blue Bloods,” the 14-season CBS family drama starring Tom Selleck, ended in December 2024, and was replaced with “Boston Blue” the following fall, trading an expensive show filmed in New York City with a more economic drama, starring “Blue Bloods” favorite Donnie Wahlberg with a new cast and filmed in Toronto. CBS got to keep the “Blue Bloods” fans and find some new streaming viewers too.

“We’ve definitely had to meet the moment financially, but we’ve worked really closely with the studio to figure out innovative ways to make sure our shows are able to stay viable from a financial perspective, as well as creatively strong,” CBS Entertainment President Amy Reisenbach told TheWrap in October.

ABC saw the continued success of the Kaitlin Olson-led procedural “High Potential,” one of the most-watched scripted shows on broadcast. Fox boldly returned to the world of 22-episode season orders with its hit ‘“Doc,” starring Molly Parker, reaching 15 million viewers in 11 days. Both networks have big projects on the horizon in 2026, including ABC’s “Scrubs” revival and Fox’s “Memory of a Killer” action drama starring Patrick Dempsey.

NBC is getting ready to ski toward ratings heaven with the Winter Olympics in February, which it will use to launch all kinds of programming for the network and streamer Peacock.

In streaming, YouTube and Netflix might be far ahead in reach, but rival platforms still have some cards to play to capture viewers. Peacock is reinforcing its hold in the comedy space, with originals like “The Paper” and the upcoming TV adaptation of “The Burbs,” starring Keke Palmer. The streamer also saw the release of its most-watched original yet with “All Her Fault” in November. Hulu had streaming hits like “Paradise” and FX’s “Alien: Earth,” while growing closer to sibling streamer Disney+.

Not even Netflix was spared from making cuts, but the No. 1 streamer remains in prime position to launch viewership and critical triumphs like “Adolescence” and countless others celebrated this year.

Paramount+ and Prime Video both saw wins in their respective niches, including the Taylor Sheridan universe of shows and hit series like “Reacher” and “The Summer I Turned Pretty,” respectively. Both streamers are in for potential transformation ahead, with new leadership in Netflix alums Cindy Holland (Paramount) and Peter Friedlander (Amazon) set to make their mark on their respective slates in 2026.

As for HBO Max, the success of “The Pitt” brought a potential new blueprint to making cheaper fare that gathers big viewership and wins awards love, and executives are hoping to replicate it. But with Netflix and Paramount vying to acquire Warner Bros. Discovery, it’s anyone’s guess what the future holds for this particular streamer.

Uncertainty ahead

Though Ampere Analysis research suggests we’ve reached the bottom of the content cutbacks, the looming WBD deal will certainly lead to a further reduction in scripted production — regardless of who wins the David Zaslav-led company. HBO Max, the No. 3 largest streamer, and Warner Bros. Television, the largest independent studio selling shows to third parties, getting absorbed by either company will have a massive impact on the industry.

Netflix has said it doesn’t plan to shutter HBO Max immediately after completing, pledging to keep it running as a separate streamer and pursue bundling options, and to preserve the creative operations for the media giant’s film and TV creative operations. How long that immediately lasts would remain to be seen.

Paramount, which this year completed its merger with David Ellison’s Skydance, leading to thousands of job cuts across its film, streaming, cable, news and other divisions worldwide, would combine HBO Max and Paramount+ into a single streamer to simplify services and increase subscriber appeal — leading to more job and programming losses.

For the creative community that drives the scripted machine forward, there remains a focus on the work even as the landscape prepares to shift again.

“It’s never been about the amount of things we’re doing. It’s about the quality of the things that we want to put on. We don’t think as much in volume,” Shondaland creative partner Betsy Beers said during TheWrap’s 2025 Power Women Summit. “It’s a harder-selling market and people are making fewer shows. We all know that. What hasn’t changed for us is we still have the same bars of quality.”

The post How 2025 Rewrote Hollywood’s Playbook for Leaner Scripted Shows | Analysis appeared first on TheWrap.