Hedge fund managers delivered another strong year in 2025, rewarding investors who poured hundreds of billions of dollars into the industry.

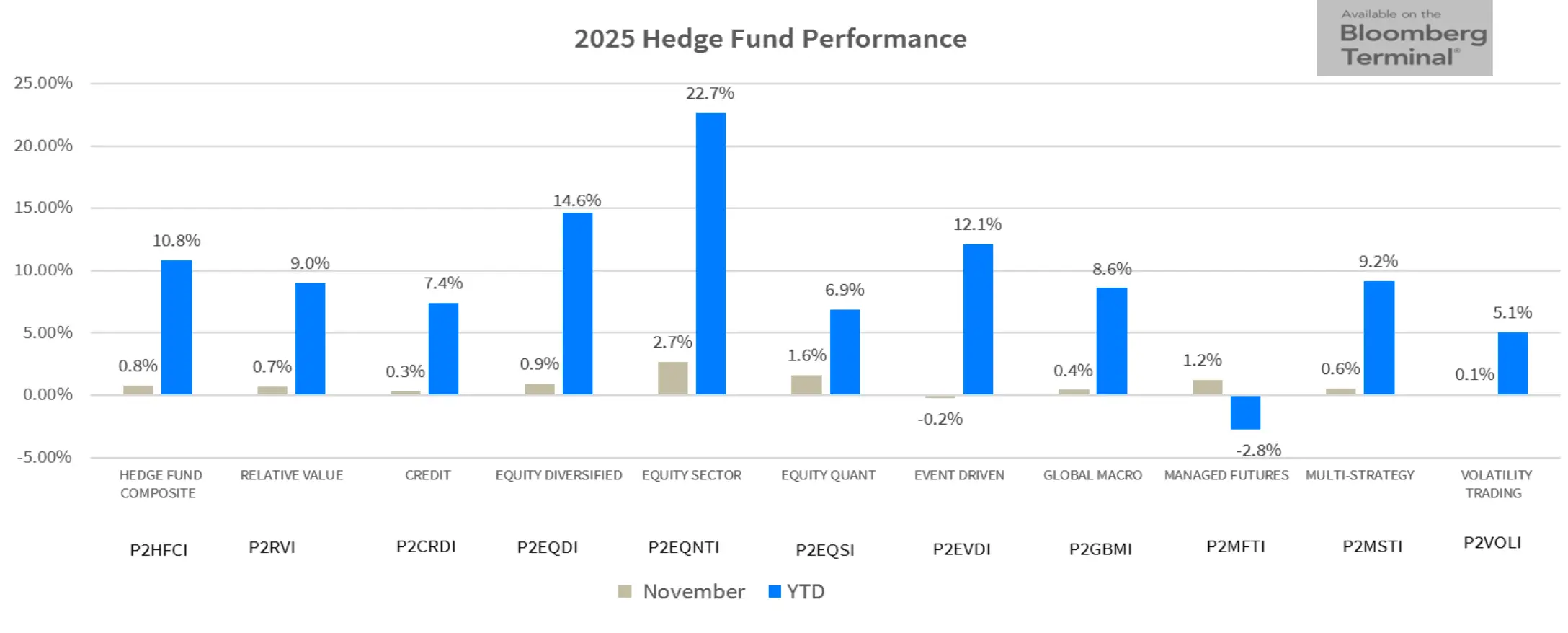

Through November, hedge funds gained 10.8% in 2025, according to industry research firm PivotalPath’s composite index, putting the industry on pace to eclipse 2024. Nearly every major strategy posted positive returns.

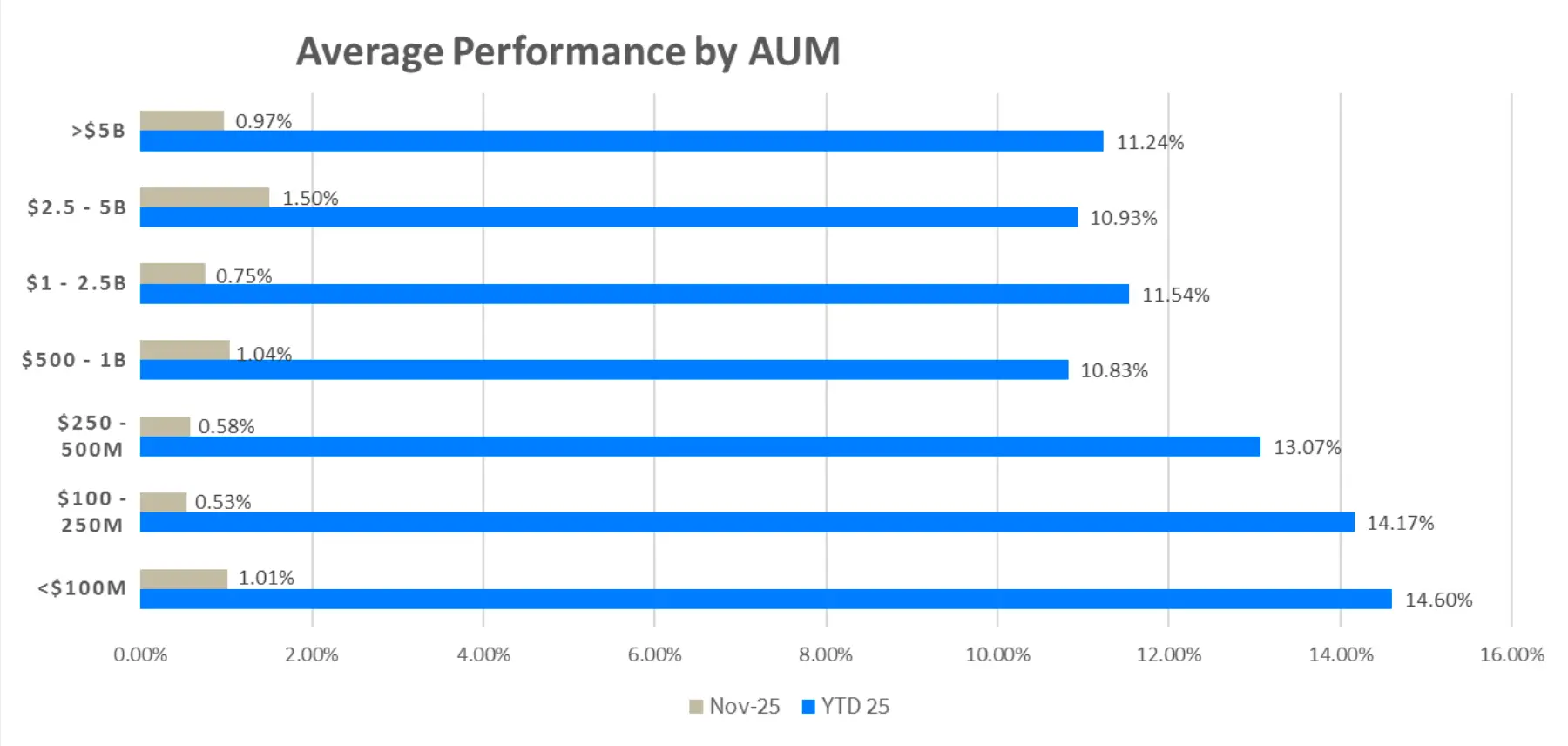

But it wasn’t the same story as 2024, when large hedge funds led the way to a stellar year for the industry. This year, it’s the small hedge funds that have ruled.

Funds managing less than $500 million outperformed their larger peers through November, according to PivotalPath data. The smallest firms — those overseeing less than $100 million — led the pack, returning 14.6%.

Even at large, multistrategy firms, it was their smaller funds that shone throughout most of the year.

Small funds aren’t predestined to win, but several forces worked in their favor in 2025. A scorching stock market was the biggest tailwind. With the S&P 500 up 18% and the Nasdaq up 21% through November, it was an especially strong environment for stock pickers.

Smaller firms tend to lean more heavily on long-short equity strategies, which require less capital and infrastructure to deploy.

“Typically, smaller funds outperform when equity markets outperform,” Jon Caplis, CEO of PivotalPath, said. “When there are big selloffs, smaller managers underperform.”

Their size also gives them greater flexibility about the stocks they wager on and in what size, Caplis said, allowing them to trade more nimbly.

With stocks near all-time highs and investors increasingly wary of crowding, there’s no guarantee the small-fund winning streak will extend into 2026.

Read the original article on Business Insider

The post Why small hedge funds ruled in 2025 appeared first on Business Insider.