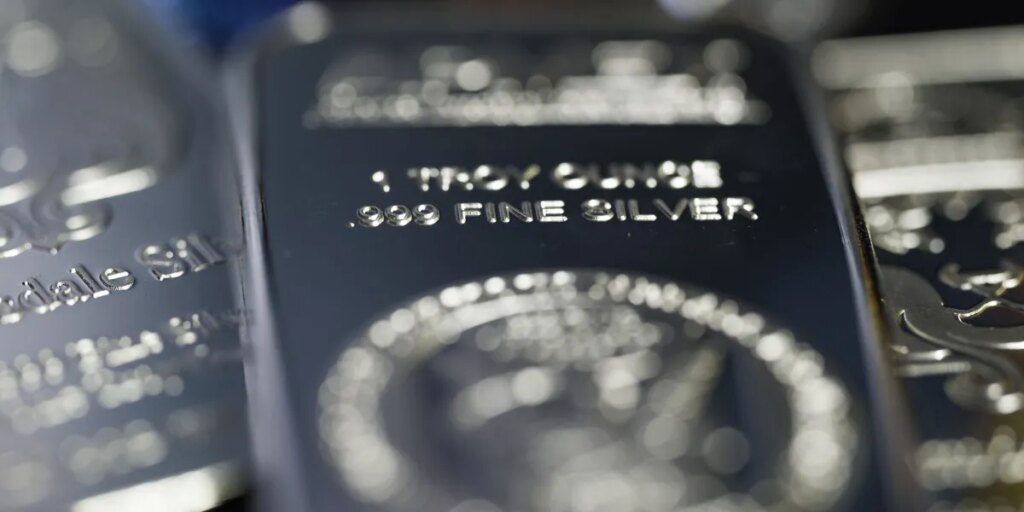

Silver climbed to a record, pushing beyond $80 an ounce for the first time to extend a historic end-of-year rally.

The white metal rose for a sixth session and is up about a quarter in that period — the biggest six-day increase in records since 1950. The recent advance has been buoyed by speculative inflows and lingering supply dislocations across major trading hubs after a short squeeze in October.

Read More: Why Silver Has Been Surging Even More Than Gold: QuickTake

Precious metals have rallied this year, underpinned by elevated central-bank purchases, inflows to exchange-traded funds and three successive rate cuts by the US Federal Reserve. Lower borrowing costs are a tailwind for the commodities, which don’t pay interest, and traders are betting on more rate cuts in 2026.

The Bloomberg Dollar Spot Index, a key gauge of the US currency’s strength, fell 0.8% last week, its biggest weekly drop since June. A weaker dollar is generally supportive of gold and silver.

Spot silver rose 5.5% to $83.65 as of 7:23 a.m. in Singapore. Gold edged up 0.1% to $4,539.93 an ounce. Platinum added 0.6% and palladium was up 1.5%.

The post Silver rises to record above $80 in historic end-of-year rally appeared first on Fortune.