The NFL is giving sports fans a triple header for Christmas this year, starting with the Dallas Cowboys vs. the Washington Commanders at 1 p.m. ET, plus a Snoop Dogg halftime performance. But you have to subscribe to Netflix or Amazon to watch all the action.

The tech giants have eaten the entertainment world, and now they’re coming for sports.

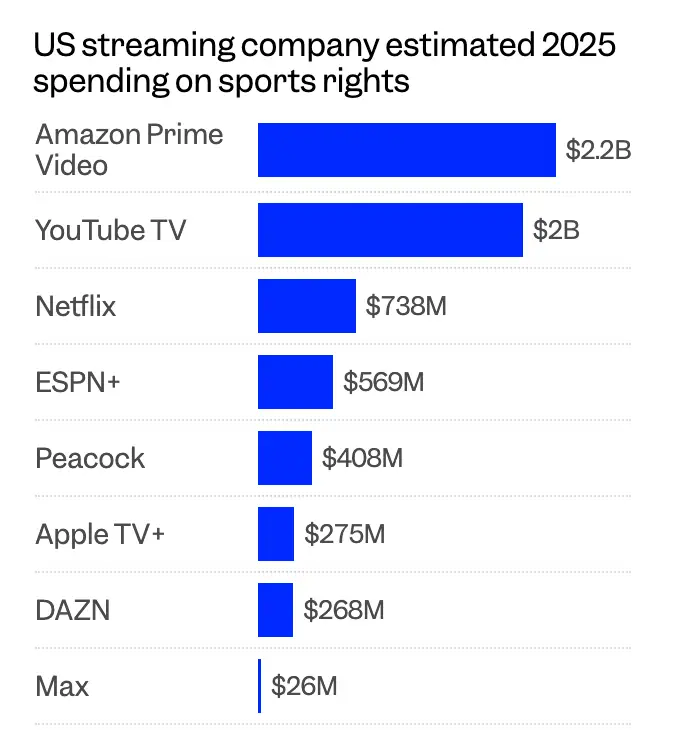

Together, Amazon and YouTube TV account for 65% of the $6.5 billion that streamers will spend on sports rights for US audiences in 2025 (34.4% and 30.6%, respectively), according to Ampere Analysis. The third biggest share went to Netflix, with 11.3%. Disney’s ESPN+ and Comcast’s Peacock held a distant fourth and fifth place.

Amazon and YouTube have actively pursued significant deals for sports rights in recent years, with Amazon paying $11 billion for the NFL’s Thursday Night Football and $19.8 billion for NBA rights, and YouTube paying $14 billion to secure NFL “Sunday Ticket” rights.

Netflix has also been active, scooping up NFL Christmas Day games and the Jake Paul vs. Mike Tyson fight, although it prefers to treat sports as part of a broader live events strategy that includes comedy specials and awards shows rather than “renting” full seasons of sports rights. A person familiar with Netflix’s spending said they pegged it at about $600 million versus Ampere’s calculation of $738 million.

Ampere’s data comes with a few caveats. Its measurements of eight platforms exclude spending for rights distributed internationally — such as Amazon’s spending on NFL rights outside the US, or on the UEFA Men’s Champions League within the UK — and for DAZN’s acquisition of the global FIFA Club World Cup 2025 rights for $1 billion.

Broadcasters remain the largest buyers of sports rights in the US, although streamers are making inroads.

Nearly half (47%) of US broadcasters’ content spending — $24 billion — went to sports rights in 2025, per Ampere. Most of US streamers’ content budgets still go to TV shows and films. This year, 10% of their content budgets overall went to sports in 2025, up from 6% in 2024. Even for Amazon, sports were about 19% of its spending on content, approaching the amount it spends on movies.

Sports can help streamers grow engagement and keep audiences subscribed. However, the rising cost of sports means less money for an already stagnating entertainment TV ecosystem that has been producing fewer shows since the end of Peak TV in 2022.

Disney said in its fourth quarter earnings call that it would spend $24 billion in the next fiscal year, driven in large part by sports rights. CFO Hugh Johnston justified paying a more than 73% step up for NBA rights in its 2024 deal by pointing to their value to audiences and advertisers, despite the cost creating “a little bit of bumpiness during the course of the year.”

Netflix compared its recent NFL deal to the cost of its movies, which it’s been making fewer of. Asked about the cost of the deal at an investor conference last year, Netflix exec Spencer Wang said he would characterize each game as “roughly the size of one of our medium-sized original films.”

The shift of sports to streaming platforms looks likely to continue.

Ampere forecasts global spending on sports rights to increase by 20% to $78 billion worldwide by 2030. Spending will be driven by the US, where new NBA and MLB rights will be up for grabs in the coming years. Talks for the next round of NFL negotiations could start as early as 2026, as the league seeks to maximize the value of its media rights.

YouTube TV is also expanding its play for sports fans, announcing a new sports bundle along with other niche packages that cost less than its regular $83-per-month service.

Read the original article on Business Insider

The post This chart shows how much streamers like Netflix, Amazon, and YouTube TV are spending on sports appeared first on Business Insider.