In Northern Virginia’s Data Center Alley, windowless buildings the size of aircraft hangars are powering America’s artificial intelligence industry, which is locked in a race against China.

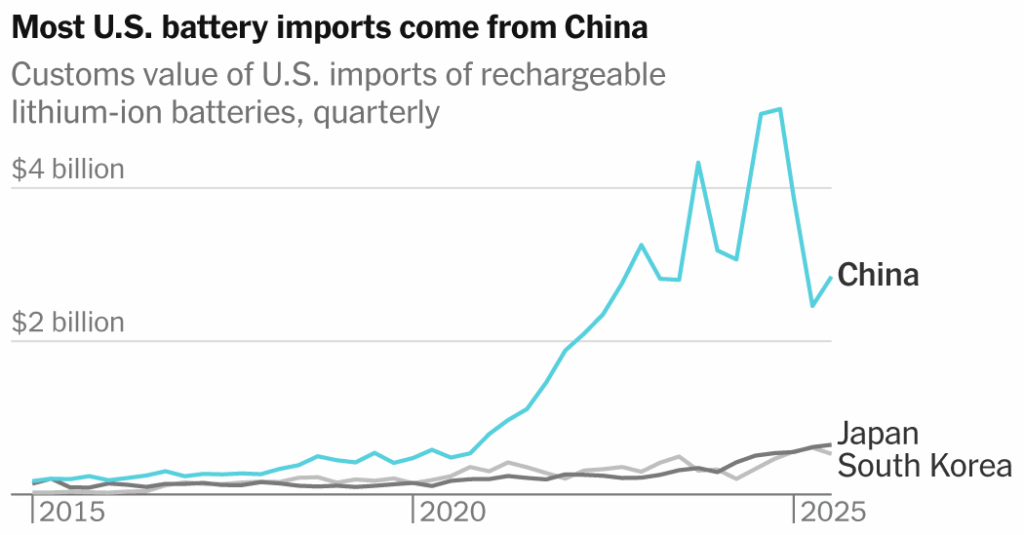

Yet, these data centers are increasingly reliant on China, America’s geopolitical rival, for a vital technology: batteries.

These facilities can use as much electricity as a small city, straining local power grids. Even flickers can have cascading effects, corrupting sensitive A.I. computer coding.

To cope, tech giants are looking to buy billions of dollars of large lithium-ion batteries, a field in which “China is leading in almost every industrial component,” said Dan Wang, an expert on China’s technology sector at Stanford’s Hoover Institution. “They’re ahead, both technologically and in terms of scale.”

A short drive from the data centers, at the Pentagon, military officials are sounding similar warnings, for different reasons. Military strategists, watching as modern warfare is reinvented in Ukraine, say the armed forces will need millions of batteries to power drones, lasers and countless other weapons of the future.

Many of those batteries, too, come from China.

Chinese battery dominance has long been a problem for industries like auto manufacturing, but now is increasingly being viewed as a national security threat. Currently, U.S. military forces rely on Chinese supply chains for some 6,000 individual battery components across weapons programs, according to Govini, a defense analytics firm.

“The reality is very stark,” Tara Murphy Dougherty, Govini’s chief executive, told a recent gathering of top defense and industry officials in California. “There are foreign parts in 100 percent of our weapon systems and military platforms.”

China understands the importance of these batteries. On Oct. 9, amid growing trade disputes, China threatened to limit exports of some of its most advanced lithium-ion technologies, including fundamental components like graphite anodes and cathodes.

The Trump administration is facing a dilemma.

When President Trump came to office, his administration initially froze billions of dollars in Biden-era federal grants for battery manufacturing, lumping batteries in with electric vehicles, solar farms, wind turbines and other clean energy technologies Mr. Trump had sought to de-emphasize. Mr. Trump has been scornful of electric cars, calling them a “scam.”

Yet more recently, the administration has come to see battery technology as pivotal for many of the things it cares most about, including A.I. and defense. In interviews, more than a dozen battery-industry executives, lobbyists, military experts and others close to the administration said the White House had taken a growing interest in fostering a domestic battery industry disentangled from China.

In recent weeks the White House has held high-level meetings on the battery supply chain, according to three people familiar with the matter. The National Energy Dominance Council, which Mr. Trump established to coordinate energy policy, has been meeting with battery companies. The Energy Department has quietly allowed many Biden-era grants for battery makers to proceed. It also recently announced up to $500 million for battery materials and recycling projects.

The administration has started investing in companies that develop battery components or critical minerals, including Eos, a next-generation battery company. As part of a trade deal, officials prodded Japan to promise to invest billions of dollars in U.S. battery manufacturing. And the National Defense Authorization Act, passed this month, includes Pentagon restrictions on battery purchases from “foreign entities of concern,” primarily China.

The administration is saying “we don’t like electric vehicles, but we do need batteries for drones and data centers and A.I.,” said Samm Gillard, executive director and co-founder of the Battery Advocacy for Technology Transformation Coalition, a trade group. “They’re recognizing that China’s stranglehold on the battery supply chain is undermining our national security.”

Taylor Rogers, a White House spokeswoman, said President Trump was “deploying all aspects of the government to work closely together” to “ensure the U.S. is the global leader in critical mineral and battery production.”

Experts say that building an industry not dependent on China will be enormously difficult. China is dominant in lithium iron phosphate batteries, or LFP, preferred for both E.V.s and for stationary storage.

In 2024, China made 99 percent of the world’s LFP cells and more than 90 percent of the main components, according to the International Energy Agency. That dominance extends to the refining of raw materials like lithium and graphite, as well as to fundamental components like cathodes and anodes that drive the movement of electrons within batteries.

The United States has its own lithium deposits and battery start-ups. But experts say it may take a coordinated effort and government support to compete against heavily subsidized Chinese competitors. Refining critical minerals can also be a hazardous process and American environmental standards could make the process much more expensive than in China.

Analysts estimate it would take at least half a decade for U.S. manufacturers to produce enough LFP cells to meet domestic demand, and much longer to create supply chains for underlying components.

Fatih Birol, the I.E.A.’s executive director, likened the world’s reliance on China to Europe’s dependence on Russian natural gas. After Russia attacked Ukraine, there were concerns that Moscow would cut supplies.

“Reliance for a strategic commodity or a technology on one single country, one single trade route,” Mr. Birol said, “is always risky.”

The dilemma represents a shift in the A.I. race, which increasingly hinges on a nation’s electrical infrastructure — its ability to reliably deliver vast amounts of electricity to power-hungry data centers — as much as on computing chips.

“Electricity is not simply a utility,” the A.I. giant OpenAI said in an October letter. “It’s a strategic asset that will secure our leadership on the most consequential technology since electricity itself.”

Trump Administration: Live Updates

Updated

- Trump administration orders nearly 30 U.S. ambassadors to leave their posts.

- White House invitees are asked about donations to Trump’s ballroom.

- Trump says he wants to build a ‘golden fleet’ for the Navy.

Battery dominance is a big part of China’s growing lead in power generation overall, including renewable energy. China has long seen batteries as an industrial and military priority, according to Mr. Wang, the Hoover Institution expert.

A.I. experts say U.S. companies still lead in computing capacity. Yet there is a rising concern that China’s advantage in energy infrastructure could help the country pass the United States.

“I’ve called A.I. ‘Manhattan Project 2,’” Chris Wright, the energy secretary, said in September, referring to America’s effort in the 1940s to make nuclear weapons. If “China got meaningfully ahead of us in A.I., we’d become the secondary nation of the planet,” he added.

Why data centers want batteries

The engineers who keep data centers humming refer to the “five nines” of reliability. That is, they strive to keep the facilities online 99.999 percent of the time.

Doing so demands reliable power. Tech giants have been scrambling for energy from natural gas or existing nuclear plants, which can run at all hours, and are making bets on nascent technologies like smaller reactors or advanced geothermal plants.

“It’s get what you can get,” said Justin Gruetzner, an executive with Burns & McDonnell, a data center engineering firm.

Batteries are increasingly critical: Most data centers rely on them for backup. Batteries can provide instantaneous power in an outage while generators fueled by natural gas or diesel fire up, helping ensure that data isn’t lost.

A.I. has particularly immense energy needs. An A.I. query can require about 10 times the electricity of traditional internet searches, the Electric Power Research Institute estimates. And the vast computing power can cause significant fluctuations in energy demand.

Power “can fluctuate dramatically multiple times a minute,” said Chris Brown, chief technical officer at the Uptime Institute, a data-center advisory body. At scale, these swings can amount to tens or hundreds of megawatts and even damage power grid infrastructure, Microsoft researchers have warned.

Even minor disruptions can lead to what’s known as “silent data corruption,” an emerging concern where A.I. hardware produces calculation errors. During one experiment, “a silent data corruption error actually broke the model,” said Jeffrey J. Ma, lead author of a paper on the phenomenon.

The lithium-ion batteries that China dominates are becoming increasingly prevalent. In February Google said that it had installed more than 100 million cells across its data centers and had started to replace diesel generators with batteries. Microsoft said it aimed for its data centers to eliminate diesel fuel for backup by 2030 to meet environmental goals.

Batteries and the realities of war

Among the lessons from the horrors of Ukraine is a daunting realization: The future of military power rests with batteries.

Many battlefield drones are powered with lithium batteries that rely on materials and technology from China. Within Ukraine, Chinese export controls have slowed production and tripled the prices for some components, according to defense analysts.

“Every Chinese export restriction since 2022 has reverberated directly onto the battlefield,” said Catarina Buchatskiy, a defense expert at the Snake Island Institute, which focuses on military technology. The U.S. could soon face the problem, she said, adding that the kinds of components Ukraine has struggled to secure “are embedded across Western defense programs.”

Lasers, hand-held radios, night vision goggles, satellites and drones use advanced batteries. The average soldier carries as much as 25 pounds of batteries for a standard 72-hour patrol.

And the shift toward stealthier vehicles, unmanned systems, electronic warfare and constellations of small satellites have swelled demand, said Jeffrey Nadaner, who was deputy assistant defense secretary for industrial policy during the first Trump administration. Shoring up America’s battery industry, he said, merits an effort on par with “the Apollo space program.”

The Pentagon is paying attention. The 2025 National Defense Authorization Act mandated a new battery strategy, and in a white paper published this year, the Defense Logistics Agency said the department should treat battery technology as mission-critical.

Elaine K. Dezenski, an expert on geopolitical risk and supply-chain security at the Foundation for Defense of Democracies, said, “When we think about the future of manufacturing and defense, and how we should be protecting critical supply chains, the chips are the brain, and batteries are the heart.”

Battery companies go to Washington

In 2024, the start-up Group14 Technologies won a $200 million Biden administration grant to build a factory in Moses Lake, Wash., to produce a substitute for graphite, a key material that today mostly comes from China. But after Mr. Trump took office, Group14’s grant got tied up in a broader effort by the administration to freeze clean energy funding.

After an extensive review, the Energy Department allowed many battery grants to move forward “because the administration recognized that this isn’t about left versus right or green versus not green,” Rick Luebbe, Group14’s chief executive, said.

Still, he said, the factories that Group14 is building will be able to displace only a fraction of Chinese materials. To compete with China’s industrial subsidies, Washington would need to do more. “I see more tolerance for battery projects. What I don’t see is investment,” he said.

Other battery companies have noticed the administration’s new receptiveness. “The Biden administration liked our sustainability story,” said Judy Brown, head of external affairs at South32, a company that has received federal support to develop an Arizona mine for manganese, a key battery material. “The Trump administration likes the national-security story.”

One question, experts say, is whether the United States can sustain a domestic industry, even as sales of electric vehicles slow, undermined by Mr. Trump’s policies.

Trump officials have “softened their tone on batteries,” said Noah Gordon, an expert on sustainability and geopolitics at the Carnegie Endowment for International Peace. “But the policy is still incoherent” because of its hostility toward E.V.s, he said. “They’re trying to boost battery manufacturing while also undermining the biggest sources of demand.”

Hiroko Tabuchi covers pollution and the environment for The Times. She has been a journalist for more than 20 years in Tokyo and New York.

The post The Pentagon and A.I. Giants Have a Weakness. Both Need China’s Batteries, Badly. appeared first on New York Times.