A Texas boy’ssecond dose of the MMRV vaccine cost over $1,400. A Pennsylvania woman’s long-acting birth control cost more than $14,000.

Treatment for a Florida Medicaid enrollee’sheart attack cost nearly $78,000 — about as much as surgery for an uninsured Montana woman’s broken arm.

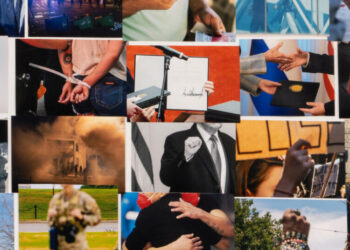

In 2025, these patients were among the hundreds who asked Bill of the Month to investigate their medical bills.

As millions of Americans grapple with the rising cost of health insurance next year, the Bill of the Month series will be approaching its eighth anniversary. Our nationwide team of health reporters has analyzed almost $7 million in medical charges, more than $350,000 of that this year.

Of this year’s 12 featured patients, five had their bills mostly or fully forgiven soon after we contacted the provider and insurer for comment.

Here are our 10 takeaways from 2025:

1. Most insurance coverage doesn’t start immediately. Many new planscome with waiting periods, so it’s important to maintain continuous coverage until the new plan kicks in. One exception: If you lose your job-based coverage, you have 60 days to opt into a COBRA policy. Once you pay, the coverage applies retroactively, even for care received while you were temporarily uninsured.

2. Check out your coverage before you check in. Some plans come with unexpected restrictions, potentially affecting coverage for care ranging from contraception to immunizations andcancer screenings. Call your insurer — or, for job-based insurance, your human resources department or retiree benefits office — and ask whether there are exclusions for the care you need, including per-day or per-policy-period caps, and what you can expect to owe out of pocket.

3. “Covered” does not mean insurance will pay, let alone at in-network rates. Carefully read the fine print on network gap exceptions, prior authorizations and other insurance approvals. The termsmay be limited to certain doctors, services and dates.

4. Get a cost estimate in writing for nonemergency procedures. If you object to the price,negotiate before undergoing care. And if you’re uninsured and receive a bill that’s $400 or more than the estimate, the federal Centers for Medicare and Medicaid Services has a formal dispute process.

5. Location matters. Prices can vary depending on where a patient receives care and where tests are performed. If you need bloodwork, ask your doctor to send the requisition to an in-network lab. Doctors’ officesconnected to health systems, for instance, may send samples to a hospital lab, which can mean higher charges.

6. When admitted, contact the billing office early. If possible, when you or a loved one has been hospitalized, it can help to speak to a billing representative. Ask whether the patient has been fully admitted or is being kept under observation status, as well as whether the care has beendetermined to be “medically necessary.” And while there may be no choice abouttaking an ambulance, ifa transfer is recommended, you can ask whether the ambulance service is in-network.

7. Ask for a discount. Medical charges are almost always higher than what insurers would pay, because providers expect them to negotiate lower rates. You can, too. If you’re uninsured or underinsured, you may be eligible for a self-pay or charity care discount.

8. Help is available for Medicaid patients. If you get a bill youdon’t think you should owe, file a complaint with your state’s Medicaid program and, if you have one, your managed-care plan. Ask whether there is a caseworker who can advocate on your behalf. A legal aid clinic or consumer protection firm specializing in medical debt can also help file complaints and communicate with providers.

9. Your elected representatives can help, too. While a call from a state or federal lawmaker’s office may not get your bill forgiven, those officials often havean open line of communication with insurance companies, local hospitals and other major providers — and advocating for you is their job.

10. When all else fails … you can write to Bill of the Month!

Bill of the Month is a crowdsourced investigation by KFF Health News and The Washington Post’s Well+Being that dissects and explains medical bills. Since 2018, this series has helped many patients and readers get their medical bills reduced, and it has been cited in statehouses, at the U.S. Capitol and at the White House. Do you have a confusing or outrageous medical bill you want to share? Tell us about it!

The post How to avoid or deal with an outrageous medical bill appeared first on Washington Post.