For Gen Z, the entry-level career ladder is getting steeper by the month—and there’s no sign of it letting up. Unemployment among recent grads has climbed to 5.8% (the highest since 2013, excluding the pandemic) as companies rethink hiring amid AI-driven productivity gains.

The pressure is already forcing young people to rethink what it takes to stand out—especially in fields where six-figure pay once felt like a given. But for those aiming for Wall Street, one Goldman Sachs executive has a blunt message for young professionals trying to get ahead: Know what you bring to the table.

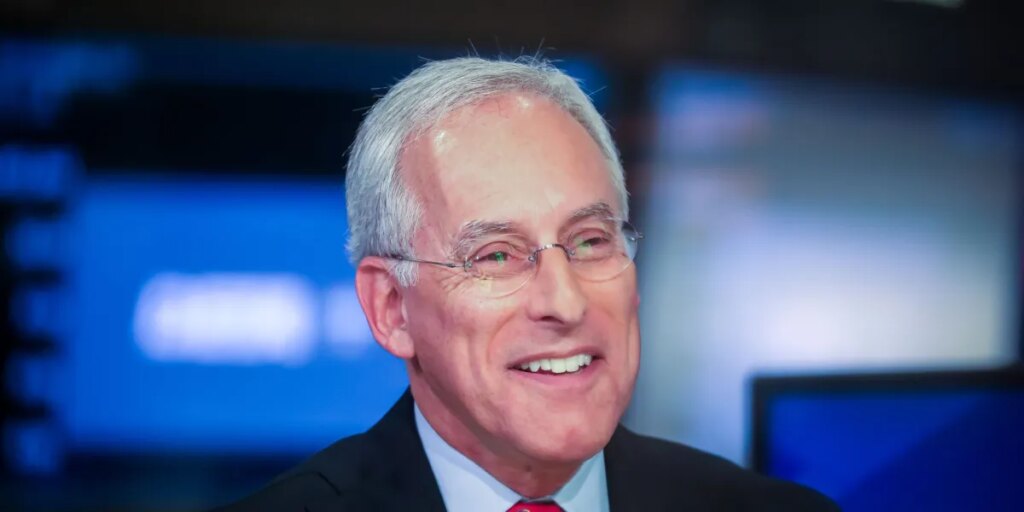

“Think about one’s role and how that fits into the broader business environment,” David Kostin, Goldman Sachs’ chief U.S. equity strategist, said on the Goldman Sachs’ Exchanges podcast.

“If you understand where you sit and your contributions to the commercial process, then you can see how that changes over time.”

As AI-powered automation replaces jobs at a fraction of the cost of human labor, understanding the value of your own skills—and whether tools like ChatGPT can outperform them—has never been more critical. Investing in the development of in-demand skills may well determine whether you remain employable in the future.

Don’t know your worth? Human skills are also in demand

Luckily for those unable to put an exact number to their job function, it’s not just commercial awareness that is key in the current market.

Kostin’s advice reflects a broader shift inside Wall Street firms, where technical skills, like using AI tools, are increasingly expected—but no longer enough on their own.

Judgement, context, and self-awareness are also becoming real differentiators.

Data from LinkedIn backs up Kostin’s thinking. While AI literacy tops the professional networking company’s list of the fastest-growing skills in the U.S., softer skills like conflict mitigation, adaptability, process optimization, and innovative thinking round out the top five.

AI won’t kill Wall Street jobs —but it’s ramping up competitive pressure

Goldman Sachs’ CEO David Solomon has echoed the view that for those with dreams to one day earn six figures on Wall Street, not all is lost, and AI is not expected to be an outright job killer for bankers.

“There is no question that when you put these tools in the hands of smart people, it increases their productivity,” Solomon told Axios in October. “You’re going to see changes in the way analysts, associates, and investment bankers work.”

“But if you’re looking at it and assuming an organization like Goldman Sachs…is just going to have less people, I don’t think it works that way,” he added.

Even so, the pipeline into Wall Street is tightening. At several business schools, including NYU (Stern), MIT (Sloan), and Dartmouth (Tuck), the share of graduates entering investment banking has slowly declined. At Harvard and Columbia, placements have held up better, underscoring how competitive the path has become.

And even for those who manage to break in, the ride isn’t always smooth. Layoffs remain a constant threat in an industry prone to cyclical downturns, and some junior bankers have already faced this reality.

Solomon has urged young employees not to shy away from opportunities.

“I would tell you that sometimes the best opportunities come from being asked to do something you don’t want to do, and actually taking it on and trying to do it. Because that’s when people grow the most. That’s where I grew the most,” Solomon told his company’s summer interns in July.

Looking ahead, Solomon encouraged patience in an era defined by uncertainty.

“You have no idea where your career will take you, you have no idea where your life will take you,” Solomon added. “But it’s an incredible journey and you’re at the beginning of it, and my biggest and most important message is don’t be in a hurry.”

The post As graduates face a ‘jobpocalypse,’ Goldman Sachs exec tells Gen Z they need to know their commercial impact appeared first on Fortune.