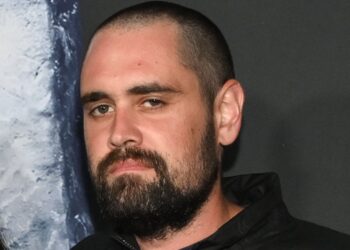

Shiloh Luckey, founder and former CEO of ComplYant, a Los-Angeles-based tax-compliance startup that raised more than $13 million from top venture capitalists, is under federal criminal investigation for alleged securities and bank fraud, according to court filings.

In a civil complaint, the SEC has charged Luckey with violating securities laws for using millions of dollars of company funds to pay for her home, Super Bowl tickets, and a destination wedding in the Caribbean. The SEC alleges she painted a rosy picture of the company’s booming revenue when ComplYant never brought in more than $620 in monthly revenue.

Reached by telephone, Luckey said, “I don’t have anything to offer you,” and hung up.

Startups face far less regulatory scrutiny than public companies, and founders sometimes present overly optimistic growth stories while VCs rush to fund hot companies with limited diligence. After high-profile scandals like Theranos and FTX, regulators have taken a tougher line.

“Startup founders cannot fake it until they make it by falsifying revenue metrics,” SEC regional director Monique Winkler warned in a statement. Recent cases, including the seven-year prison sentence for Charlie Javice and fraud charges against Mozaic Payments’ former CEO Marcus Cobb, show that regulators are increasingly willing to pursue criminal and civil penalties for these founders.

Luckey, who formerly went by Shiloh Johnson, founded ComplYant in 2019 to help small businesses navigate the labyrinth of tax regulations from state to state. In 2022, the company closed a $5.5 million seed round led by Craft Ventures, the San Francisco venture firm cofounded by the investor and White House advisor David Sacks.

A spokeswoman for Craft did not respond to a request for comment. The FBI and SEC declined to comment.

Luckey hired more than 50 employees, and when ComplYant abruptly shut down last year, she severed contact with them. It took seven weeks for all employees to get their final paychecks and some discovered 401(k) contributions were missing, as Business Insider previously reported. Luckey was informed in April of this year that she was under federal criminal investigation by the FBI and the United States Attorney’s Office for securities and bank fraud, according to a recent petition she filed to pause the civil case against her.

In that case, filed in October, the SEC alleges Luckey routinely misled investors.

“Luckey painted a rosy picture for investors of ComplYant’s business performance, allegedly telling investors that ComplYant’s monthly revenues had grown from around $2,500 in November 2020 to over $250,000 by September 2022, and that the company was bringing in dozens if not hundreds of new paying subscribers each month,” the SEC said in a statement. “However, ComplYant only generated on average monthly revenues of about $250 during roughly the same time period and averaged fewer than four new subscribers each month.”

Luckey also represented herself as a CPA, but there is no record of her ever having the accreditation, according to the complaint.

The SEC says she allegedly siphoned off $2.2 million for trips to Aspen, Miami Beach, Turks and Caicos, and Lisbon, and used the funds to pay for her Caribbean wedding, her car, and house.

Luckey, who is representing herself in court, has not responded to the SEC allegations.

Since ComplYant shut down last year, Luckey has continued to post instructional videos with advice for taxes and accounting on her TikTok channel with nearly 24,000 subscribers.

In October, records show, she launched a new startup called HabitLoop, which she describes as a digital financial assistant to help people manage their money.

“I grew up with very poor financial habits,” Luckey said in a video introducing her latest company as inspired by a lifetime of spending beyond her means.

“This is something I built on hard lessons,” she said.

Read the original article on Business Insider

The post The FBI is investigating a startup founder accused of using VC money to pay for her house and a Caribbean wedding appeared first on Business Insider.