Holiday shopping is well underway, but for many Americans, a financial holiday hangover is waiting for them in 2026.

This was revealed in a survey of 2,000 Americans who celebrate a winter holiday, which found that 35% of respondents are planning to use a credit card for holiday purchases.

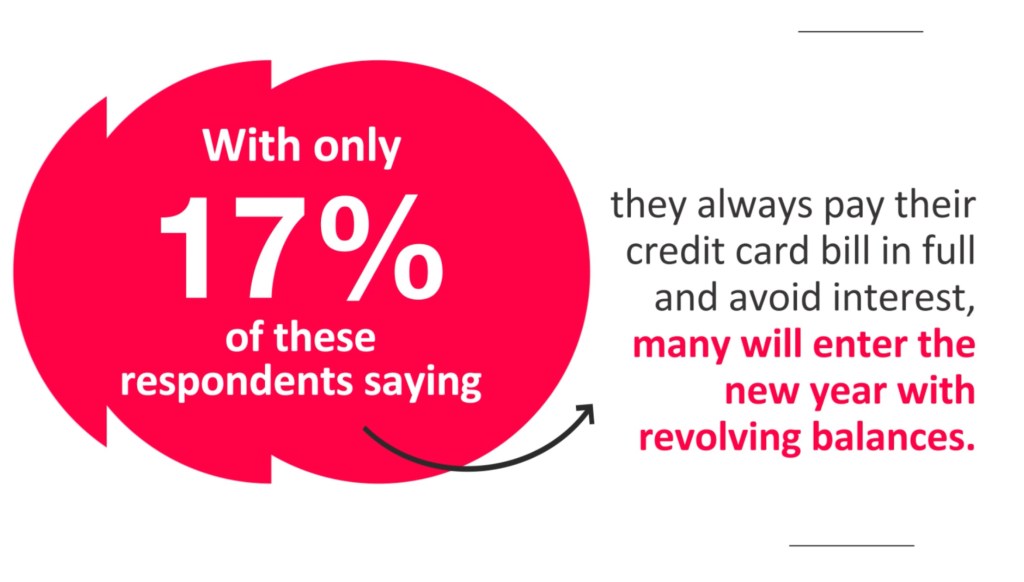

With only 17% of these respondents saying they always pay their credit card bill in full and avoid interest, many will enter the new year with revolving balances.

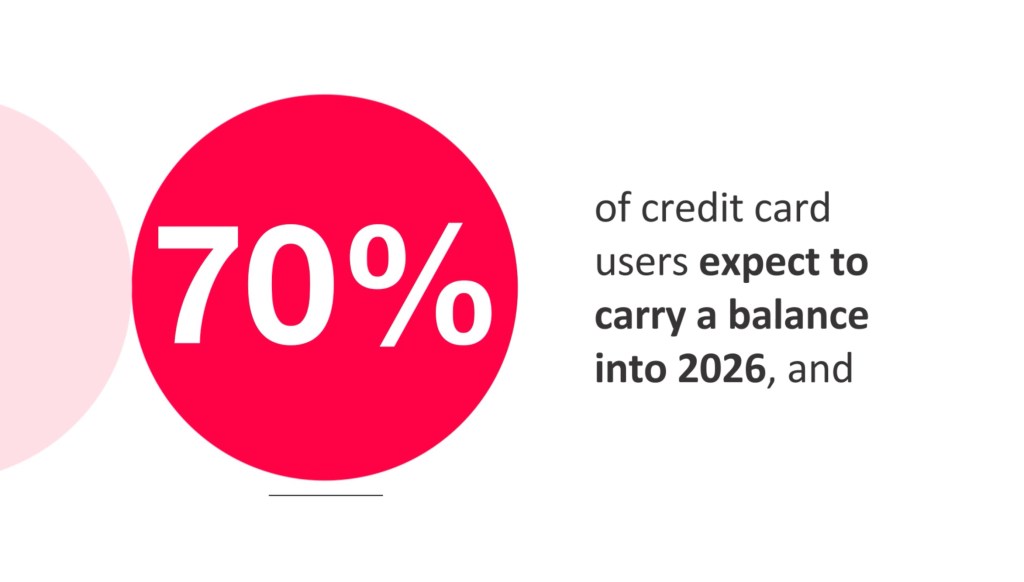

According to new research from Affirm conducted by Talker Research, 70% of credit card users expect to carry a balance into 2026, and 18% expect to still be paying off their credit card from holiday purchases into next summer, June or later.

“The issue isn’t just timing, it’s cost,” said Vishal Kapoor, Head of Product at Affirm. “Credit card interest that compounds month to month can make purchases significantly more expensive over time. That might be why 47% said they’ve been caught off guard by how much interest and/or fees increased the cost of their holiday shopping in the past.

“Those extra charges, not the act of paying over time itself, are what introduce unwanted financial surprises after the season has wrapped and the new year has started.”

Even so, many shoppers are still trying to stay thoughtful and disciplined with their spending.

In fact, the top “holiday spender” types Americans identify with are The Giver, with 35% saying they aim to be generous while staying realistic about their spending, and The Planner, with 27% saying they make lists, set a budget, and stick to it.

These more intentional spending habits are now being reinforced by AI tools. Forty-four percent of Americans surveyed have used or plan to use AI for their holiday shopping.

Younger adults are particularly likely to do so: 60% of Gen Z and 55% of millennials, compared with about 39% of Gen X and 21% of boomers.

Among those who use or plan to use AI, motivations are rooted in practicality, with respondents turning to AI for a variety of reasons, including to save time (46%), stay on budget (45%), or to find more meaningful or creative gifts (37%).

For many shoppers surveyed, AI isn’t just practical, it’s also reassuring.

Among those who use or plan to use AI for holiday shopping, 89% said they trust its recommendations.

The new survey data also shows that consumers wish that holiday shopping didn’t come with unexpected surprises in the form of hidden costs.

If every holiday purchase clearly showed its total cost over time, 44% said they would feel confident, and 39% would feel relieved.

And for many shoppers, this kind of upfront clarity is directly tied to feeling more in control of their spending.

If they could choose exactly how and when to pay every time they checked out — with total clarity — 40% said they’d feel more confident about spending, and 32% would plan ahead more.

“Shoppers are telling us something simple: they don’t want holiday bills to come with surprise costs,” said Vishal Kapoor, Head of Product at Affirm.

“When people know exactly what they’ll pay upfront — with no hidden fees and no compounding interest — they feel more confident and in control. That confidence helps them make spending decisions that align with their budget, rather than reacting to unexpected costs later. That’s the kind of clarity we aim to deliver, especially in a season when expenses add up.”

Methodology:

Talker Research surveyed 2,000 Americans who celebrate a winter holiday (and are planning on spending money to celebrate upcoming winter holidays) who have access to the internet; the survey was commissioned by Affirm and administered and conducted online by Talker Research between Nov. 13–19, 2025. A link to the questionnaire can be found here.

The post Americans dreading financial hangover waiting for them after the holidays, survey shows appeared first on New York Post.