Questions have been raised after White House Deputy Chief of Staff Stephen Miller sold shares in a mining company shortly after it announced a major deal with the Trump administration, sending the company’s share price skyrocketing, according to a report.

Miller, one of President Donald Trump’s most loyal allies, sold between $50,000 and $100,000 worth of shares in MP Materials after the government agreed in July to invest $400 million in the company in exchange for a 15 percent stake and a commitment to buy its products, The New York Times reported.

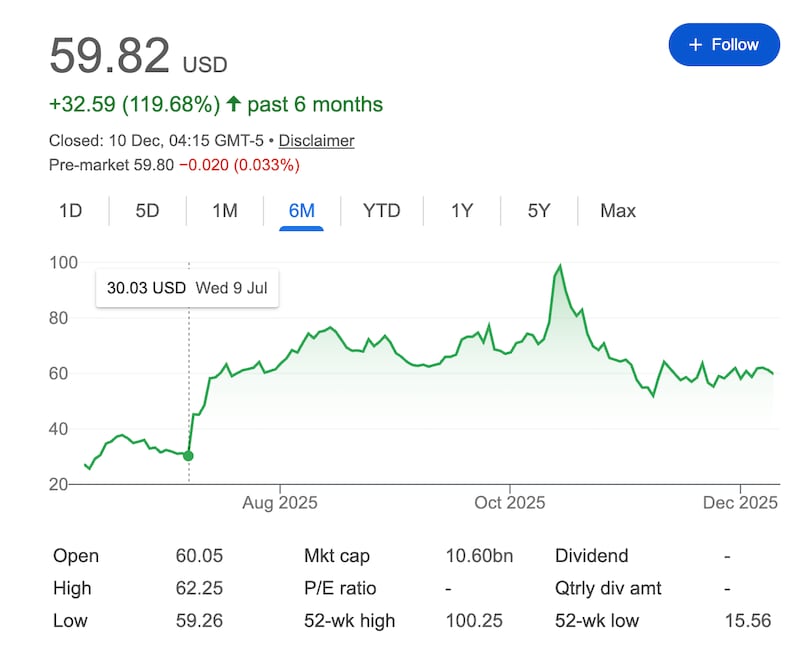

The day before the deal was announced, MP Materials’ share price stood at $30.03. The following day, it rose to $45.23 before hitting a historic high of $76.58 on Aug. 14, the date Miller sold his shares. The stock later peaked at just under $99 on Oct. 14, but has since fallen to $59.82 as of early Wednesday morning.

It does not appear that Miller broke any laws by selling his stock in MP Materials, which produces rare earth minerals and magnets, and a White House official told the Times he purchased the stock several years ago. However, ethics experts say there are potential concerns about conflicts of interest, given that a senior White House official held onto such shares for so long while working closely with the president.

“This is a large investment in an obscure company that just happened to massively benefit from the unusual interventions of the Trump administration,” Robert Weissman, co-president of Public Citizen, a government ethics watchdog group, told the Times. “At minimum, it’s a really bad look.”

Abigail Jackson, a White House spokeswoman, said in a statement that “there are no conflicts of interest.”

“Stephen fully divested from stock holdings early in the administration in proactive coordination with the Office of Government Ethics on the timeline guidance they provided,” Jackson added.

Miller played no part in the negotiations between the Trump administration and MP Materials. The deal was being finalized as China announced it would severely restrict its export of rare earth metals and minerals—vital for the production of everything from smartphones to military equipment—in response to Trump’s tariffs on Chinese imports.

In addition to the $400 million investment, the Defense Department offered MP Materials a $150 million loan, agreed to a minimum price floor for its minerals for at least a decade, and committed the Trump administration or U.S. commercial customers to purchasing all magnets produced by a newly built facility. The arrangement made the government the mining company’s largest shareholder.

A White House official told the Times that Miller consulted with the Office of Government Ethics before returning to government about which shares he might need to sell to avoid any potential conflicts of interest. The office took several months to respond with a divestment plan.

Hui Chen, a former government ethics adviser, said the sale of Miller’s stock “shouldn’t have taken that long,” especially given that it was clear he would be returning to the White House following Trump’s November 2024 election victory.

The Daily Beast has contacted the White House for comment.

The post Stephen Miller Slammed Over Stock Sales Right After Big Trump Deal appeared first on The Daily Beast.