Paramount CEO David Ellison has sent a new letter taking its $30 per share all-cash offer for Warner Bros. Discovery directly to shareholders, slamming Netflix’s $82.7 billion deal and calling the financing for his own $108.4 billion bid “air-tight.”

“Paramount began pursuing Warner Bros. Discovery (“WBD”) because we, along with our partner RedBird Capital, believe we are the best stewards not only to build long-term value for the asset but also delight audiences and help cultivate a more vibrant creative community,” the letter states. “We funded, founded and then merged Skydance with Paramount and know the sacrifices and investment it takes to capitalize and grow a media business. I am passionate and dedicated to this pursuit, committed to putting my own money in, and that is why I am writing to you today.”

The offer includes over $41 billion of equity and $54 billion in committed debt financing that is fully backstopped by the Ellison family, whose family trust has over $250 billion in Oracle stock and other assets, and RedBird Capital Partners. Approximately $17 billion is reserved to allow Warner Bros. Discovery to extend its existing bridge loan. Partners in the bid include Bank of America, Citibank, Apollo Global Management, Jared Kushner’s Affinity Partners and Middle Eastern sovereign wealth funds.

“The equity commitment papers submitted to WBD were identical in all material respects to commitments that the advisors to WBD had agreed to in other large transactions such as Twitter and Electronic Arts,” the letter continues. “To suggest that we are not “good for the money” (or might commit fraud to try to escape our obligations), as certain reports have speculated, is absurd. That absurdity is underscored by the fact that WBD and its advisors never picked up the phone or typed out a responsive text or email to raise any question or concern or to seek any clarification about either the trust or our equity commitment papers.”

Paramount added that the debt commitments are not condition upon its financial condition nor is there any “material adverse change” condition tied to the bid.

Paramount argued that Netflix’s $82.7 billion deal “appears to be in for a long and bumpy ride as it navigates the global regulatory review process. ” Meanwhile, the company said that it has already filed for Hart-Scott-Rodino (HSR) approval in the United States for its bid and announced the case to the European Commission to begin discussions with regulators.

“We look forward to working collaboratively with the relevant authorities to work through the review process and deliver this transaction to you and our other stakeholders,” Paramount said.

It also slammed Netflix’s acquisition of Warner’s streaming and studio business as a “blatant attempt to eliminate one of Netflix’s only viable international competitors in HBO Max” and shot down the argument that YouTube, TikTok, Instagram and Facebook should be categorized as Netflix’s direct competitors, calling it an attempt to “mask its dominance in SVOD by grouping together all internet-enabled video, media, social media, or otherwise.”

“No regulator has ever accepted such a broad approach to market definition, and to do so would require regulators to give up on merger enforcement in media and social media alike,” Paramount added.

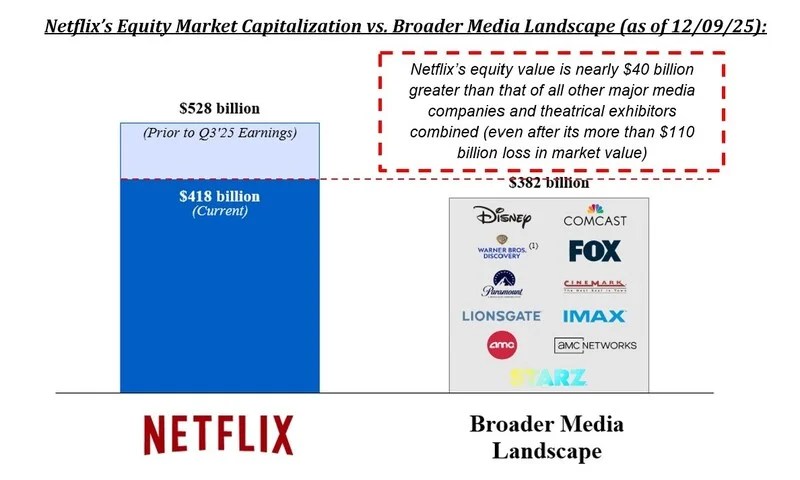

Graph via Paramount

Additionally, Paramount pointed out that Netflix has lot approximately one quarter of its market capitalization ($110+ billion) since its last quarterly earnings report and amid its pursuit of WBD and is leaving the latter’s shareholders with 100% of the risk of the Global Networks standalone plan. Paramount values global networks business at $1 per share.

It also pushed back on criticism that its $6 billion cost saving target would result in job losses at the combined company, noting that efficiencies would be found through “technology, linear networks optimization, and real estate rationalization.”

Paramount’s letter also slammed Warner Bros. Discovery’s board for a “murky” sale process arguing that it ignored the $30 per share offer – and the company’s statements that it was not “best and final” – to sprint towards a deal with Netflix

“Our proposal represents a compelling opportunity for WBD shareholders. We are committed to seeing this transaction through. ince Monday, we have had the opportunity to speak with a number of WBD shareholders who have expressed confusion and disappointment at the process that WBD conducted, which appears to have prioritized a deal with Netflix over shareholder value maximization. ” the letter concludes. “We urge you to register your view with the WBD board that you deem Paramount’s offer to be superior by tendering your shares today.”

Paramount’s tender offer will be open for 20 business days, or until Jan. 8, and Warner Bros Discovery’s board will need to respond with a recommendation within 10 business days, or by Dec. 22. Under the terms, shareholders have withdrawal rights that expire at 5 p.m. ET on Jan. 8. Those rights would be extended if Paramount extends the tender offer.

Netflix and Warner Bros. Discovery did not immediately return TheWrap’s request for comment on Paramount’s letter.

The post Paramount Takes $30-Per-Share Cash Offer for Warner Bros Discovery Directly to Shareholders appeared first on TheWrap.