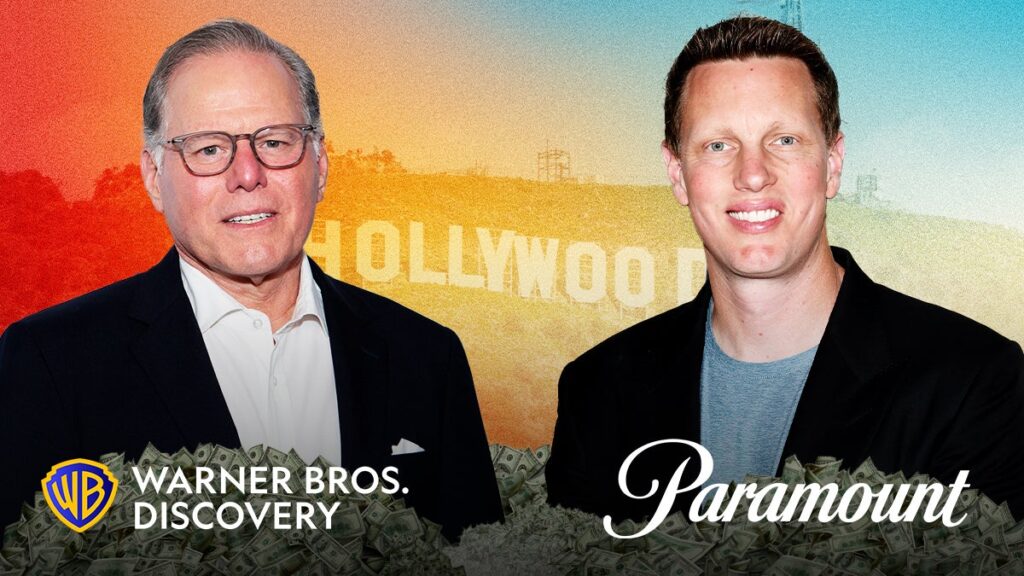

Paramount is taking its all-cash offer for Warner Bros. Discovery directly to shareholders, just the latest swerve in one of the greatest M&A sagas of all time. But what happens next?

The move throws a wrench in WBD’s plans to sell its studio and streaming assets to Netflix, a move that could lead to massive changes for the entertainment industry — especially given the streaming giant’s history of already disrupting Hollywood.

So what happens when an acquirer goes hostile? By going public with a tender offer, Paramount triggers a few actions taken over the coming weeks.

Paramount’s tender offer will be open for 20 business days, or until Jan. 8, and Warner Bros Discovery’s board will need to respond within 10 business days, or by Dec. 22. The response will come in the form of a filing with the Securities and Exchange Commission detailing the board’s rationale for going with the Netflix offer.

Paramount’s new SEC filing shares some insight. WBD CEO David Zaslav and the board expressed concern about Paramount’s financing and potential regulatory scrutiny related to the bid, despite the Ellison family’s deep pockets and close relationship with President Donald Trump. Of particular regulatory concern was the possibility of triggering a review by the Committee on Foreign Investment in the United States (CFIUS) due to the involvement of foreign investors from three Middle Eastern sovereign wealth funds and Tencent Holdings from China, according to the filing. Tencent was later nixed from the deal.

On Monday, Warner Bros. Discovery said it received and “will carefully review and consider” Paramount’s bid. The company also said it would not change its recommendation on the Netflix deal, which would require shareholder approval at a later date, and advised shareholders “not to take any action at this time with respect to Paramount Skydance’s proposal.” During this time, WBD shareholders can sell their shares to Paramount for $30.

Shareholders have the option of tendering their stock to sell to Paramount. But these offers require a minimum threshold for the deal to proceed. Once the window is closed and threshold is met, shareholders would get paid.

Following the 20 business days, Paramount has the option to extend the offer.

In addition, a threshold of just 20% of WBD shareholders who have held the stock for at least a year can also push for a special meeting to hold a vote.

If Paramount acquires 51% of outstanding shares, it would control the company. Netflix has the option of countering the $30 per share offer.

It remains unclear if WBD shareholders will go for the cash offer now, especially with the prospect of potential longer term upside with the Netflix deal, which offers cash, Netflix shares and shares in the pending spinoff of Discovery Global, which is scheduled to split in the third quarter of next year. There’s also the prospect Paramount raises its offer too.

In a call with analysts on Monday, Ellison argued Netflix’s deal would “solidify streaming domination” and be “harmful to the film and TV industry, undermine creative talent, threaten higher prices for consumers, and threaten the future of theatrical releases.” He also said it had a “highly uncertain regulatory outlook.”

“We’re taking our offer directly to shareholders because they deserve transparency and the ability to make an informed decision,” he continued. “Our proposal is superior to Netflix’s in every dimension: higher headline value, increased certainty in that value, greater regulatory certainty, and a pro Hollywood, pro consumer and pro competition future. We’re confident that once shareholders have the opportunity to choose for themselves, they’ll choose Paramount.”

Ellison’s Tease

A potentially major factor for shareholders is a tidbit from the filing detailing text messages sent by Ellison to Zaslav.

“Just tried calling you about new bid we have submitted,” Ellison texted Zaslav on the morning of Dec. 4. “I heard you on all your concerns and believe we have addressed them in our new proposal. Please give me a call back when you can to discuss in detail.”

When Zaslav and WBD failed to respond, Ellison followed up with another text, noting that Paramount was offering “complete certainty,” “strong cash value” and “speed to close.” He also said its bid was not the company’s “best and final” offer.

If $30-a-share in cash isn’t the best offer, shareholders may be holding out until they see how high Paramount could actually go.

The post What’s Next for Paramount’s Hostile Takeover Bid for Warner Bros. Discovery appeared first on TheWrap.