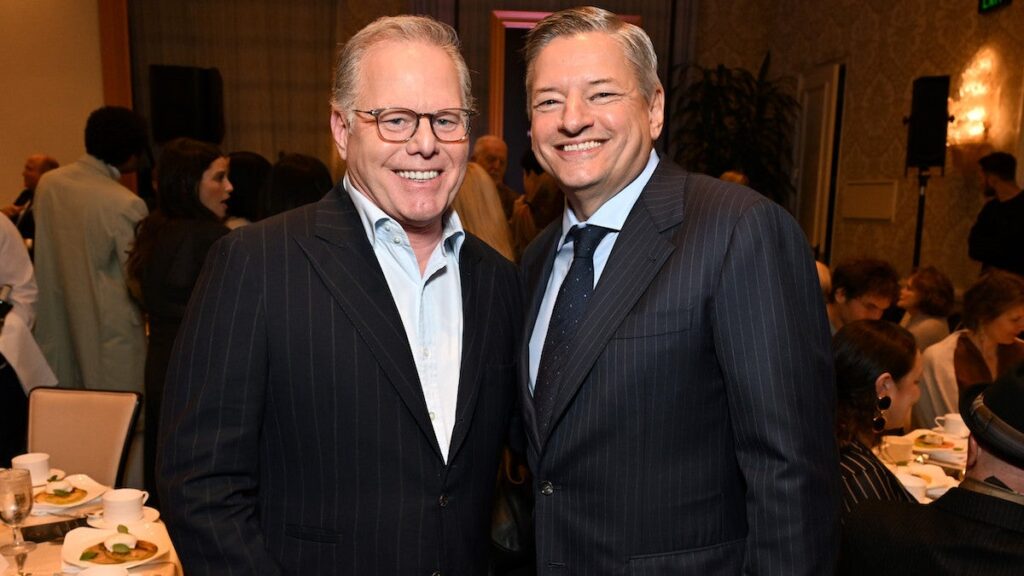

Warner Bros. Discovery is moving forward with exclusive deal talks with Netflix, TheWrap has learned.

WBD has selected Netflix after the streaming giant offered $30 a share for the studio and streaming assets, according to two people familiar with the deal talks. The deal also includes a $5 billion break-up fee to match the terms that Paramount added with its bid.

While its unclear what the makeup of the new bid looks like, the prior bid was a mix of mostly cash and stock.

Netflix securing a win over rival suitors Paramount and Comcast represents a stunning turnaround from just two months ago, when co-CEO Greg Peters shaded big media mergers as not having an “amazing track record,” and Paramount buying WBD seemed like a foregone conclusion. Fast forward to today, and Netflix has won a furious M&A bake-off after three rounds of bids.

Representatives for Netflix and WBD didn’t respond to a request for comment.

These exclusive talks clear the road for Netflix to acquire the Warner Bros. studios, HBO Max and a treasure trove of IP assets like “Harry Potter” and the DC Universe. Netflix, which once aspired to be like HBO when first embarking on original content, is on a course to become its next owner. Obtaining such assets could dramatically reshape the entertainment landscape and give Netflix even more power over Hollywood — concerns the streamer will have to assuage.

Regulatory hurdles

The willingness to include the unusually large breakup fee was likely critical with questions arising on how Netflix will get a deal with Warner Bros. through regulatory approval. It would face stiff antitrust scrutiny and opposition from the U.S. Department of Justice, New York Post’s Charles Gasparino reported on Tuesday.

A representative for the Department Justice declined to comment on the report.

In a Nov. 13 letter to U.S. Attorney General Pam Bondi, Federal Trade Commission Chairman Andrew Ferguson and Department of Justice antitrust division assistant attorney general Gail Slater, Republican Rep. Darrell Issa warned that a Netflix bid would raise antitrust concerns that could harm consumers and Hollywood alike. He noted that consolidation between the two companies would “diminish incentives to produce new content and major theatrical releases,” which could “undermine opportunities for the full range of industry professionals both in front of and behind the camera.”

California Attorney General Robert Bonta has previously voiced his opposition to any deals involving WBD. “Further consolidation in markets that are central to American economic life — whether in the financial, airline, grocery or broadcasting and entertainment markets — does not serve the American economy, consumers or competition well,” his office told TheWrap last month in response to Paramount’s initial offer.

“We are committed to protecting consumers and California’s economy from consolidation we find unlawful,” the spokesperson added.

The process of completing the deal could also distract the company from executing its core business. Netflix shares fell 5% on Wednesday when investors realized the prospect of a deal happening was very real.

There’s also the X factor of Netflix jumping into the deep end of the theatrical business, a part of the entertainment world it has kept its distance from. While Netflix has said it would honor Warner Bros.’s theatrical obligation, that isn’t enough to alleviate some in Hollywood. An anonymous collective of industry players on Thursday sent a letter to members of Congress warning of the damage such a deal would have, according to Variety.

It got ugly at the end

The third round of bids came a day after Paramount had issued a letter to Warner Bros. Discovery CEO David Zaslav claiming the bid process had been “tainted by management conflict.”

“WBD appears to have abandoned the semblance and reality of a fair transaction process, thereby abdicating its duties to stockholders, and embarked on a myopic process with a predetermined outcome that favors a single bidder,” Paramount said in its letter, which CNBC published.

This followed an earlier letter this week from Paramount arguing that a deal would not get regulatory clearance.

The second letter in particular signaled that Paramount CEO David Ellison likely sensed the tide shifting in another direction. The company had attempted to circumvent rival bidders by coming in early with an initial offer of $19 a share back in September (WBD had rejected three bids before starting its own strategic review).

Paramount, which was intent on buying all of WBD, could take its own offer to WBD shareholders, although the amount of its third-round bid is unclear. Even if it doesn’t match Netflix’s offer, Ellison could lean on the selling point that it could close a deal faster than the expected longer grind that the streaming giant would undergo.

A representative for Paramount declined to comment.

Paramount has already been through this process with the Trump administration before closing its merger with Skydance this summer. In September, it hired Makan Delrahim, former assistant attorney general of the Justice Department’s antitrust division during Trump’s first term, as its chief legal officer.

A threshold of just 20% of WBD shareholders who have held the stock for at least a year are needed in order to call a special meeting to vote on fending off a hostile takeover bid, according to a company filing.

Lucas Manfredi contributed to this story.

The post Netflix Wins the Warner Bros. Discovery Bidding War, Enters Exclusive Deal Talks appeared first on TheWrap.