In private equity, consolidation is now the name of the game.

After a burst of new fund launches — enough for one KKR executive to joke last month that the US now has more private equity funds than McDonald’s — more funding than ever is flowing into the biggest names.

So far this year, nearly 46% of all private equity capital raised in 2025 has been secured by the 10 largest funds, up from 34.5% in 2024, according to PitchBook’s private equity outlook report. PitchBook predicts that more than 40% will go to the largest funds in 2026 as well.

This fundraising consolidation happens while fundraising is down substantially, with only $259 billion raised so far this year compared to $372.6 billion last year. But even as the absolute amount raised by the top funds has dropped 8% year-over-year to $118.3 billion, their overall share of the pie went up.

Here are three charts from PitchBook’s report that show how the biggest funds in private equity are likely to get even bigger.

The top 10 funds are taking more of the fundraising haul than they have in the last 10 years

This chart breaks down the percentage of US private equity (and not credit) fundraising that went to the 10 largest funds. This year, the top 10 largest funds include two Blackstone funds and two Thoma Bravo funds, a Bain Capital fund, as well as funds from lesser-known names like Great Hill Partners.

After five years, with the 10 largest funds making up an average of 35.8% of funds raised — and a 10-year average of 39% — the number jumped to 45.7% so far this year.

With times tight for fundraising, asset allocators are choosing to go to the biggest players with their remaining capital. Even the biggest players are having a harder time fundraising compared to years past, but they’re clearly doing better than their competitors.

The consolidation story is even more striking when you examine the fundraising picture for the top three largest funds. The three largest raised $60.4 billion so far this year, accounting for 23.3% of the total amount raised, compared to $55.9 billion last year, which represented just 15% of the total amount raised.

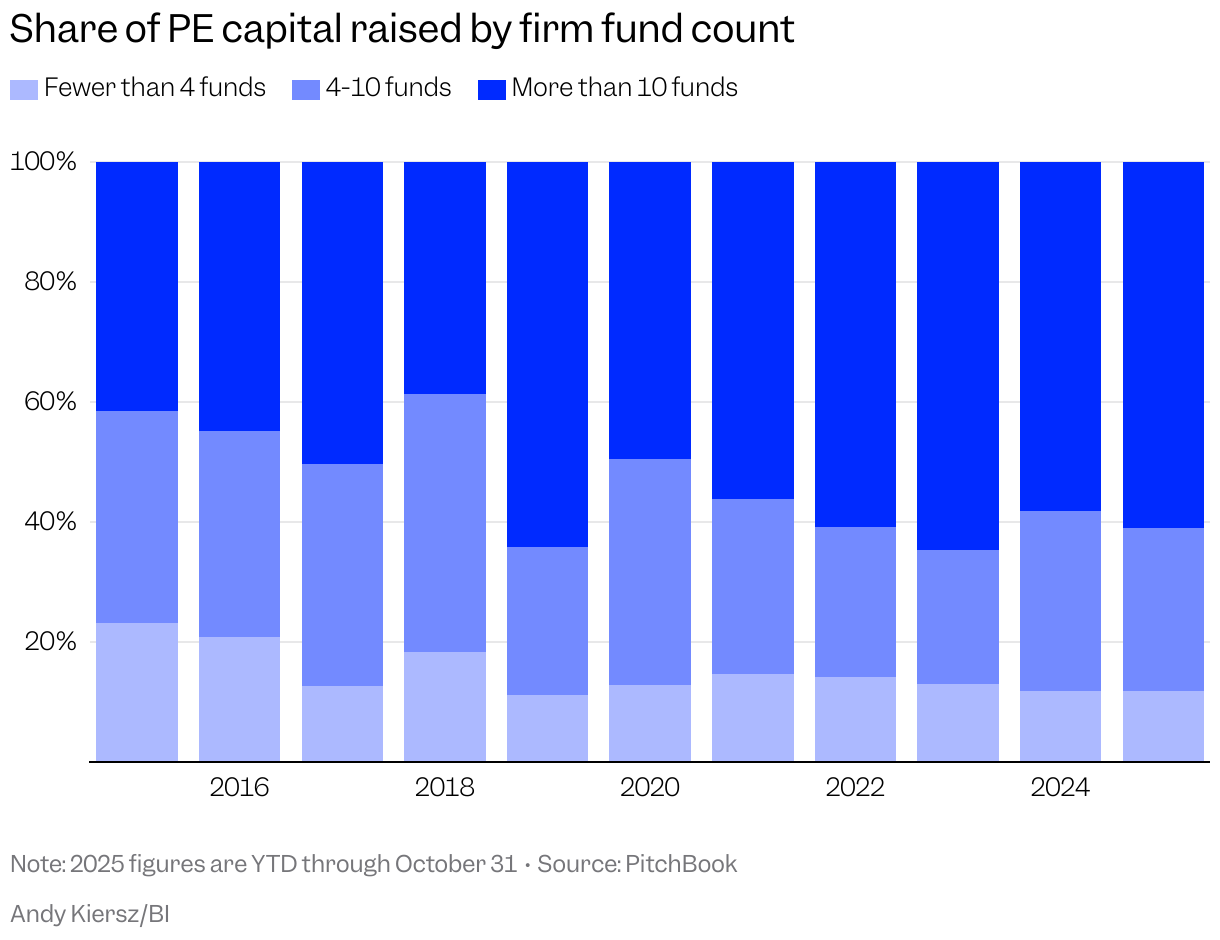

Forget flight to quality, there’s a flight to experience

Capital may be flowing to the biggest players in large numbers, but it’s also flowing to the most experienced firms. So far this year, 61% of capital raised has come from firms that have more than 10 funds in total. That’s above the five-year average of 58%.

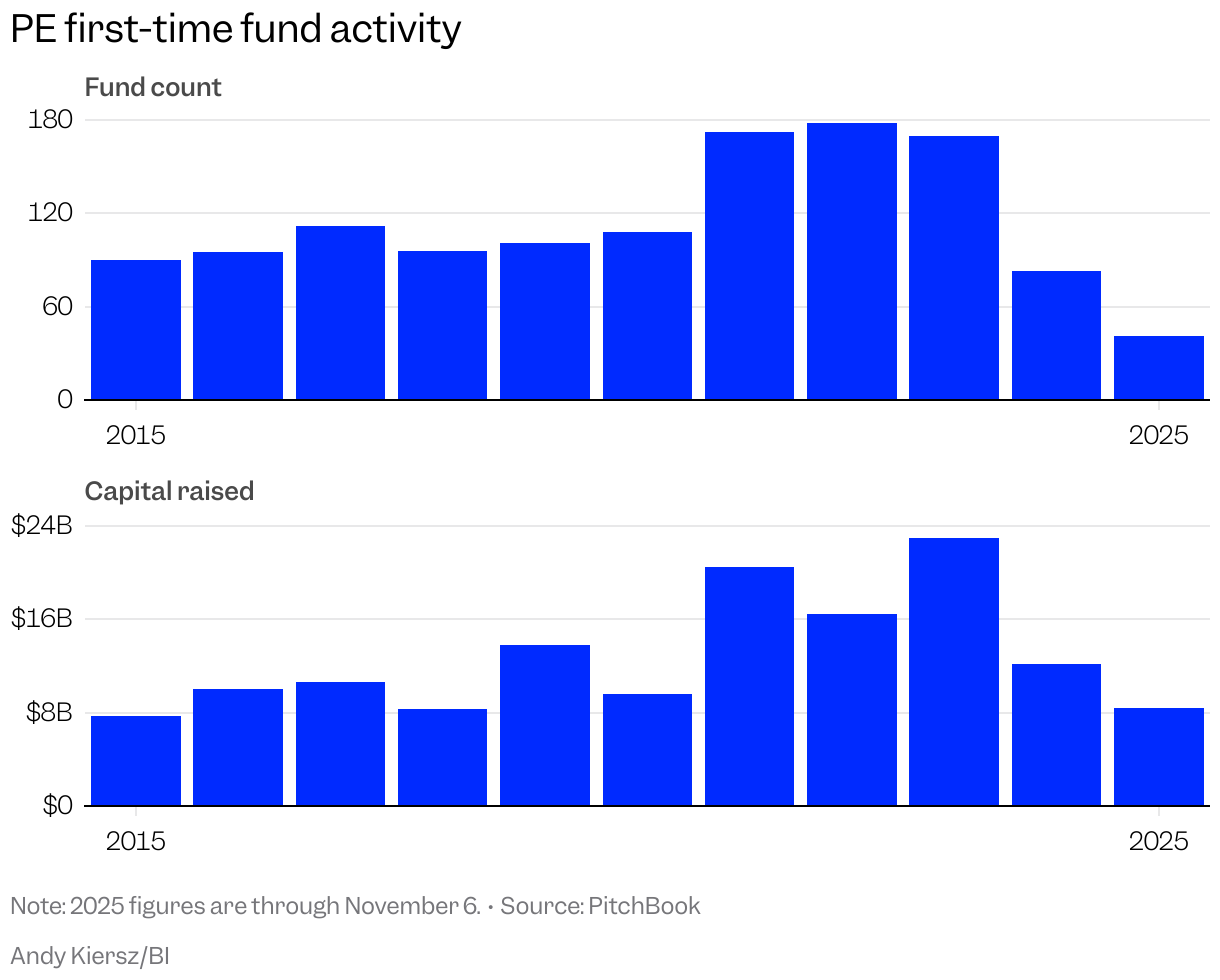

So far this year, only 41 first-time funds have closed their fundraising this year, a record low number. The total amount of capital in these closed funds, $8.4 billion, is also near record lows, though 2015 saw only $7.7 billion closed across 90 funds.

It’s even harder than it was last year, when the industry closed 83 first-time funds, the previous record low. With asset allocators flocking to established, large investors, it’s no surprise that the new launches are anemic.

Read the original article on Business Insider

The post These 3 charts show how the biggest private equity funds keep winning in a fundraising slowdown appeared first on Business Insider.