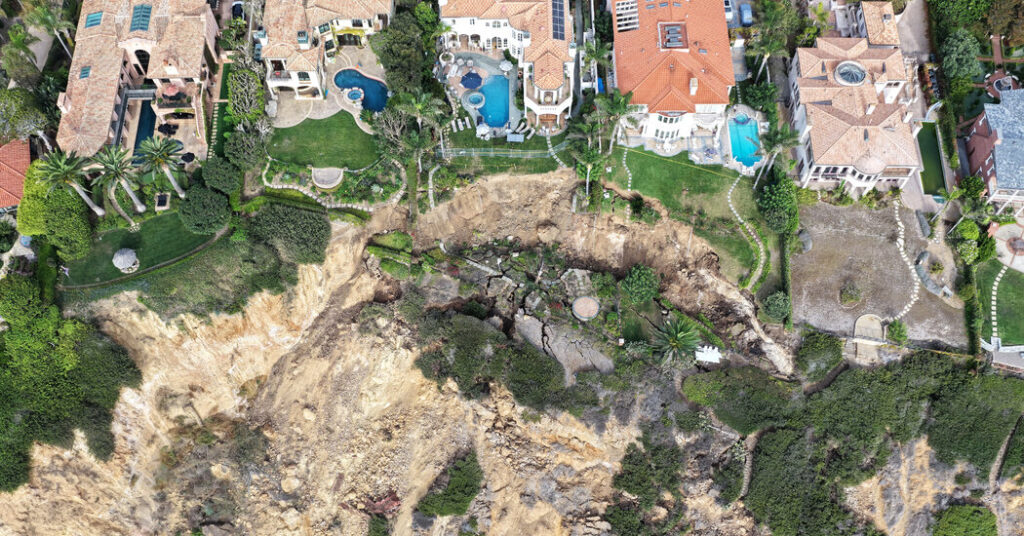

Last month, we reported on new research that found home insurance prices have increased drastically, particularly in areas most exposed to climate-related risk.

And the research showed something new and equally worrisome: The effects of the higher rates are spilling over into the broader real estate market, suppressing home prices in the ZIP codes most vulnerable to hurricanes and wildfires.

We asked you to send us your own stories of rising insurance costs. (You can still send along your story here and see what’s happening in your area.)

Hundreds of you responded. Some homeowners who wrote in have opted to pack up and move elsewhere. Others are dropping coverage and hoping for the best. Those who maintain their policies have seen deductibles creep upward in tandem with rising rates.

The data we analyzed captured only part of the picture. Under the surface, home insurance coverage is changing in big ways that are harder to see. Here’s what we learned from your stories.

Big increases with little explanation

We heard many horror stories about rate increases in places like Florida and California, where insurance markets have been turbulent for years. But we also heard similar anecdotes out of states like Ohio, Maryland and Massachusetts, where disasters are less frequent but homeowners say they’re seeing rates climb by 30 percent or more year after year.

-

A condo owner in Texas, a Dallas senior on a fixed income, said that her annual premium jumped to $1,239 in 2024, a 63 percent rise from the year prior, with no increase in coverage.

-

In Minnesota, a homeowner’s rates are set to jump up to between $6,000 and $8,000 after their insurer stopped offering coverage. They previously paid $3,300.

-

In the Colorado mountains, one reader saw their premiums climb to $8,600 last year, a more than a threefold increase over the past 15 years. They switched insurers.

-

A homeowner in New Orleans said their total home insurance costs, including flood protection, had jumped to about $21,100 a year, up from $3,800 in 2015.

One clear theme: Readers say insurance companies are not providing clear or detailed explanations for rising rates, and a lot of people feel as if they’re paying for someone else’s risk.

“It is as though we are being held up by the mafia,” wrote one Minnesota reader who saw rates for a small homeowners’ association more than triple since 2021. “We have to have insurance, but the coverage we have is abysmal.”

Dropping insurance, selling homes and returning to renting

Many of you told us that problems with home insurance — like lack of coverage, high rates or few local options — have been a driving force behind major life decisions.

We heard from an architect who abandoned plans to purchase a home in California after checking out insurance prices, and moved with his family to New England instead.

A pair of teachers in Colorado wrote in to say the burdens of rising insurance and property taxes have pushed them to consider relocating. “It is a strain,” they said.

And a few of you have decided insurance is not worth the hassle, opting to sell your homes and rent instead.

Quite a large number of people wrote in to say they’re keeping insurance only because their mortgage lender requires it. Several readers without mortgages have decided to drop their plans, reasoning that if disaster strikes they will pay out of pocket to rebuild or relocate.

“I surveyed all our friends who own outright, and NONE of them pay for wind insurance. It’s scary,” one Floridian wrote.

Avoiding making claims for fear of getting dropped

Many of you described a fear that making a claim — that is, using insurance for its intended purpose — could prompt an insurer to stop offering coverage.

Several readers wrote in with stories about sticking with an insurance company for decades only to be dropped after making a single claim. Often, this meant switching to a new provider with much higher premiums.

Others are paying for home repairs out of pocket, in some cases spending thousands of dollars just to avoid insurance headaches.

“I honestly doubt that insurance will cover anything without a fight, but I still feel it is better to have insurance than not,” one Floridian wrote. “We do not ever put in any claims for anything that we can reasonably cover ourselves in order to reduce the risk of being dropped.”

Deductibles are creeping upward, especially for wind damage

When we mapped rising insurance premiums across the country, the numbers captured the total rates homeowners are paying. But they didn’t tell us anything about the plans these premiums are actually buying.

Readers wrote in to tell us that even as their premiums rise, the underlying plans are offering less coverage. Think of it as shrinkflation for the insurance market.

“Make a claim and you are penalized. There is a ‘windstorm deductible’ of 5 percent,” wrote one reader from New Rochelle, N.Y. “You know who believes in climate change? Insurance companies!”

Mira Rojanasakul contributed reporting.

The Trump administration

Trump rolls back fuel economy standards, gutting Biden’s climate policy

President Trump on Wednesday threw the weight of the federal government behind vehicles that burn gasoline rather than electric cars, gutting one of the country’s most significant efforts to address climate change and thrusting the automobile industry into greater uncertainty.

Flanked by executives from major automakers in the Oval Office, Trump said the Transportation Department would significantly weaken fuel efficiency requirements for tens of millions of new cars and light trucks. The administration claimed the changes would save Americans $109 billion over five years and shave $1,000 off the average cost of a new car.

For the past half-century, the efficiency standards have compelled automakers to increase the distance their vehicles can travel on a gallon of gas, reducing fuel consumption and leading to innovations like electric and hybrid cars. Transportation is the largest source of greenhouse gases in the United States.

The key number: The plan calls for automakers to achieve an average of 34.5 miles per gallon for cars and light trucks in model year 2031, down from the standard of 50.4 miles per gallon set by the Biden administration.

G.M. leader says it will still make more efficient cars: Mary Barra, the chief executive of General Motors, said on Wednesday that her company would continue to seek “significant improvement from a fuel-economy perspective,” regardless of the federal rules.

She said people should buy electric cars based on their merits, not because of government incentives. “People choose an E.V. because it’s a better performance vehicle and it fits their life,” Barra said at The New York Times’s DealBook Summit before the White House announcement.— Lisa Friedman, Maxine Joselow and Jack Ewing

Ask NYT Climate

Is my morning coffee climate friendly?

You love your morning coffee and you love the planet. So, you might wonder what your caffeine habit means for climate change.

Coffee isn’t a huge climate polluter, but it does produce greenhouse gases. On the high end, a kilogram of roasted coffee can produce 40 kilograms or more of carbon dioxide equivalent, according to Dave White, director of the Global Institute of Sustainability and Innovation at Arizona State University. That means a single bag of beans can represent the same emissions as driving a few dozen miles in a gas-powered car.

We asked the experts about the ground rules for coffee and climate.

Read more. And read more from Ask NYT Climate:

The climate quiz

A 5,550-mile long blob of smelly ocean seaweed is rapidly growing in size, according to new research published this week in the journal Nature Geoscience. Where did it wash up in 2023, to the great dismay of beachgoers?

More climate news from around the web:

-

The Trump administration has moved to stop a wind farm from being constructed off the coast of New England, Bloomberg reports.

-

Heatmap News reports that a new working paper by former Treasury Department officials tries to quantify how much climate is affecting Americans’ everyday costs. The figure they arrived at: Heat and extreme weather are costing American households up to $900 per year.

Read past editions of the newsletter here.

If you’re enjoying what you’re reading, please consider recommending it to others. They can sign up here.

Follow The New York Times on Instagram, Threads, Facebook and TikTok at @nytimes.

Reach us at [email protected]. We read every message, and reply to many!

Claire Brown covers climate change for The Times and writes for the Climate Forward newsletter.

The post Higher Prices, Less Coverage: Your Stories of the Home Insurance Crunch appeared first on New York Times.