President Trump’s promise for “no tax on tips” has raised important practical questions for the Internal Revenue Service. What is the exact definition of a tip? Who typically receives them? Are photos of bare feet a type of pornography?

Maybe we should back up.

A sweeping tax cut that Republicans passed this summer created a new deduction for tips. While the tax break does not exempt tips from taxes entirely, it’s still an incentive for people to earn more of them. To avoid any economywide shift of earnings into tips, the I.R.S. and Treasury have had to impose some limits. Only people who work jobs that have “customarily and regularly” received tips can claim the deduction.

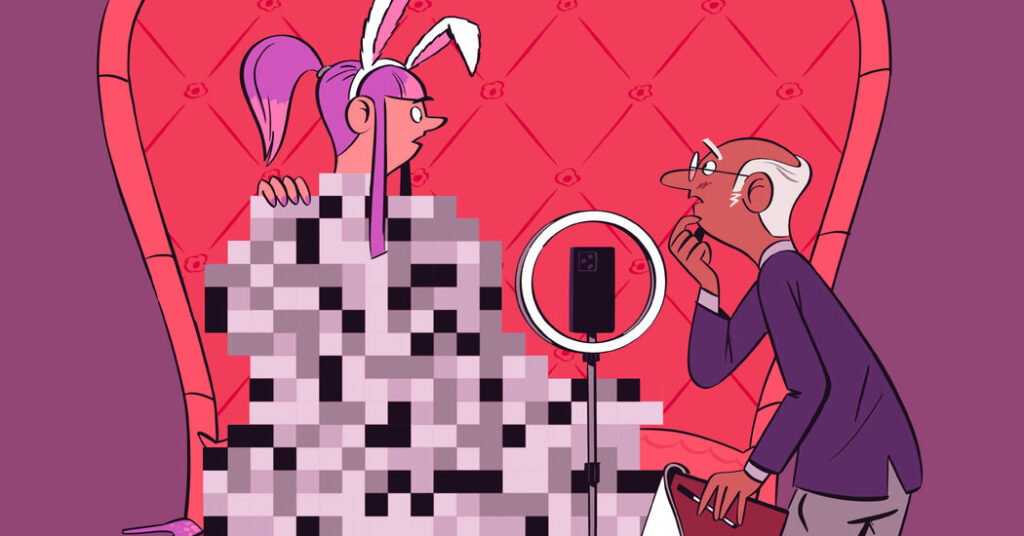

On the list of nearly 70 eligible occupations, detailed in a proposed regulation in September, were “digital content creators,” “entertainers and performers” and “dancers,” categories that, at first blush, seemed as if they could be a boon for America’s sex workers. But the Trump administration also added that tips for prostitution or “pornographic activity” would not be entitled to the new tax break.

The exclusion came as a disappointment to people who post sexually explicit, or even just sensual, content on platforms like OnlyFans where users can leave tips. Performers in the adult entertainment industry already face difficulties accessing basic financial services. And the I.R.S. rule seemed like another example of America’s hostile public attitude toward a type of work that, at least privately, is widely consumed. In 2024, there were more than 4.6 million creator accounts on OnlyFans, and more than 377 million fan accounts, according to public disclosures by the site’s parent company, though it is unclear how many of those accounts are based in the United States.

Tax professionals also wonder how a restriction on “pornographic activity” would actually work. The I.R.S. has not yet elaborated on which activities it would consider “pornographic.” It is unclear, for example, whether strippers could claim the tips deduction. There is plenty of activity that an accountant or tax lawyer could argue is merely titillating.

“Where’s the line?” said Katherine Studley, an accountant who counts many OnlyFans creators among her clients. “Just because you’re on OnlyFans, that doesn’t necessarily mean it’s pornographic. You could have a cooking channel or a yoga channel.”

The distinction between pornography and other material that just so happens to depict sex has long vexed the nation’s finest legal minds. Writing in 1964, the Supreme Court justice Potter Stewart famously declined to try to define the term, instead admitting, “I know it when I see it.” (To prepare for First Amendment cases like this at the time, the justices would, in fact, view the art/pornography in question at the Supreme Court).

Indeed, defining even decidedly decorous terms can be involved. Consider the I.R.S. definition of a citrus grove, itself vaguely prurient: “one or more trees of the rue family, often thorny and bearing large fruit with hard, usually thick peel and pulpy flesh, such as the orange, grapefruit, lemon, lime, citron, tangelo, and tangerine.”

Whether or not the I.R.S. tries to come up with its own definition of “pornographic activity,” enforcing the exclusion would most likely still involve auditing taxpayers who report tips from sources like OnlyFans. An I.R.S. agent would have to view a taxpayer’s content, decide if it was pornographic and then deny the deduction for tips, which is capped at $25,000.

“Ultimately, it would be the subjective determination of an I.R.S. examiner or a Tax Court judge,” Thomas Gorczynski, a tax preparer and educator. “Sometimes you look at something and it’s clearly pornography, but sometimes you look at something and you think, ‘Eh it’s subjective. Somebody might be really into it.’”

It was socially conservative and Christian groups who pushed the Trump administration to disallow these earnings from the new deduction for tips. In September, several of them wrote a letter to Treasury Secretary Scott Bessent, arguing that “our government should not give tax breaks to predatory industries that profit from exploiting young men and women, destroying marriages, families, and lives.” The administration put out the proposed restrictions days later.

John Shelton is the policy director for Advancing American Freedom, the conservative group founded by former Vice President Mike Pence that helped organize the letter. Mr. Shelton acknowledged that pornography is “sort of an embarrassing thing to bring up” but said he felt doing so was part of an important cause.

“Some of these things end up being part of the skirmishes on the right around what the Trump administration’s position is on social conservative issues,” he said.

Project 2025, the Heritage Foundation blueprint, called for outlawing pornography entirely, a step that Republicans in Washington do not seem to be considering. (Mr. Trump himself was found guilty last year of falsifying business records to cover a payment in 2016 to Stormy Daniels, a porn actress who has said she had a sexual encounter with the president.)

Still, the possibility of a federal crackdown has weighed on people in the adult entertainment industry.

“This is the direction that the government is moving in,” said Jessica Goedtel, a financial planner who works with sex workers. “That could mean a full scale ban on porn, it could mean something less than that, but it creates a lot of fear for my clients. The I.R.S. could be used as a tool.”

The possibility of the I.R.S. policing pornography is just one example of the challenges of transforming Mr. Trump’s four-word promise of “no tax on tips” into workable tax policy. After the Treasury and I.R.S. put out the list of occupations eligible for the deduction, many Americans submitted comments suggesting additions, including Santa Claus performers, clergy, eyelash technicians, chiropractors and pet groomers.

As part of the proposed regulations, the Treasury and I.R.S. also said that mandatory service charges, common for large parties at restaurants, would not count as tips for the purpose of the deduction. That rule could help prevent workers of all kinds from changing part of their regular fee into a deductible tip, but it also frustrated restaurant owners who have moved away from asking their staff to rely on tips. Other attempts to prevent abuse of the deduction have also caused confusion.

“If you’re trying to single out a type of income that’s not that well defined for special tax treatment, yeah it gets complicated,” said Annette Nellen, an accounting professor at San Jose State University. “Special rules are always complicated.”

For some OnlyFans creators, the question may ultimately be moot. Both Ms. Studley and Ms. Goedtel, the financial professionals, said they have clients who make more than the income cutoff for receiving the tips deduction, which begins to shrink for single Americans making more than $150,000 and is completely unavailable to individuals making more than $400,000.

Macy Hilt makes what she describes as “fully explicit pornographic content” on her OnlyFans page. The 24-year-old said she makes roughly $2 million a year, with about 5 percent of her earnings coming in the form of tips. While that means she makes too much money for the tips deduction, she still finds the exclusion of earnings from “pornographic activity” discriminatory and, in all likelihood, unenforceable.

“I’ve made a lot of money, and a lot of tips, based off just a foot picture,” she said.

Andrew Duehren covers tax policy for The Times from Washington.

The post For ‘No Tax on Tips,’ the I.R.S. Gets Intimate appeared first on New York Times.