When you’re saving to reach a personal financial goal, the pressure to spend in the name of holiday cheer can feel particularly stressful.

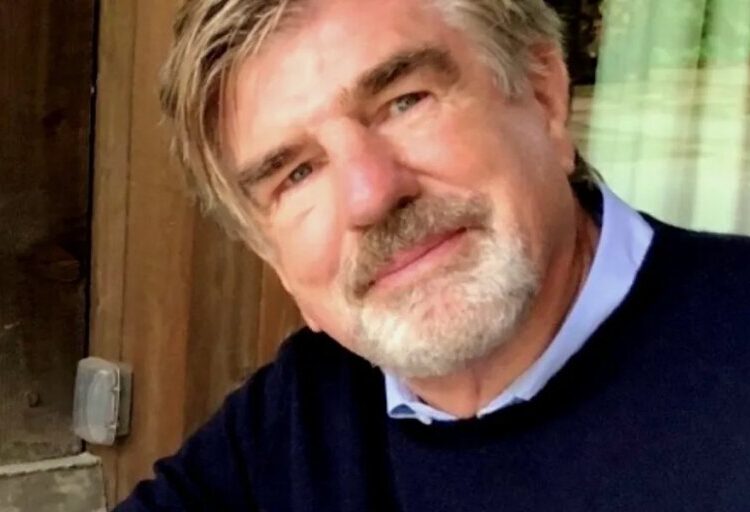

Whether you’re working toward a home down payment, building your emergency fund, or paying off a chunk of your student loans, there are simple strategies and mindset shifts that can help you stay the course, said Brittany Greene, a financial behavioral strategist and the head of community at Self Financial, a technology company with a mission to help people build credit.

“There’s nothing like building up your financial foundation and then having all of that hard work taken away from you. Take precautions and absolutely stick to your goals in this holiday season,” Greene told Business Insider.

She offered tips for taking stock of your current finances so that you can set realistic goals around holiday spending. She also shared creative ideas for having a low-spend season and how to manage others’ expectations when it comes to gift-giving.

Manage emotions ahead of time

Green said that when it comes to sticking to a holiday budget, setting expectations before family gatherings can help.

“Holiday time comes with a certain amount of pressure to show up for the people that we care about and if we’re not able to, there’s a guilt that sometimes surrounds that,” Greene said.

She suggested curbing feelings of guilt — which, if unaddressed, can lead to unnecessary spending — by having an honest talk with yourself, your immediate family, and any extended family you’ll be seeing this season.

To do this, Greene suggested being candid about how you want celebrations to look and feel this year and initiating this conversation as early as possible. She said that prioritizing experiences — like having a “secret Santa” gift exchange that requires just one purchase, or having a sightseeing outing with loved ones — can act as budget-friendly alternatives to buying gifts for multiple family members.

Set realistic expectations

Amid the season’s hustle, bustle, and seemingly endless shopping opportunities, it can be difficult to prioritize your budgeting goals. Understanding your spending habits can help here, Greene said.

She suggested that you review your bank statements from the past three months, taking note of where you’ve been spending — like on entertainment, subscription services, or clothing — to spot patterns.

“Taking a snapshot of where you are within your own financial journey is super important because this way you’re getting a chance to see where you are, what you have, and what you can allocate,” Greene said. She added that this step works best if you avoid guilting or shaming yourself for previous purchases.

Once you see your spending habits more clearly, get honest with yourself about expenses you can temporarily cut — like meals out or your streaming service subscriptions, Greene said. Then, you can determine an amount you’re willing and able to spend this holiday season.

“Stay firm with whatever your number is going to be because the most important thing is that you’re building toward your own financial future,” Greene said.

Flex your creativity

Exercising your imagination can help with saving during the holidays, said Greene.

She said that in the past, she often spent more than she budgeted for because she wanted to treat her loved ones to nice gifts. Now, she uses resources like Pinterest, Instagram, and TikTok to get ideas for do-it-yourself gifts that are more wallet-friendly.

Greene also recommends keeping a note on your phone with gift-giving ideas. Throughout the year, keep track of the experiences and items your loved ones mention. Then, find ways to create these gifts on your own.

“My best friend said that she dreamed of winning the Powerball Lottery and that the big check would get delivered to her house,” Greene told Business Insider. “I came to her house with flowers, a check I had hand-painted, and balloons.”

The bottom line: Understand your ultimate financial goal and make decisions in service of it, said Greene. To do that, she said she likes to ask herself, “Is this pulling me toward my financial goals or away from them?”

“If I’m ever in a decision fatigue space or have analysis paralysis, I focus on that solid yes or no,” Greene said.

Read the original article on Business Insider

The post 3 tips for protecting your budget during the holidays, from a financial behavior expert appeared first on Business Insider.