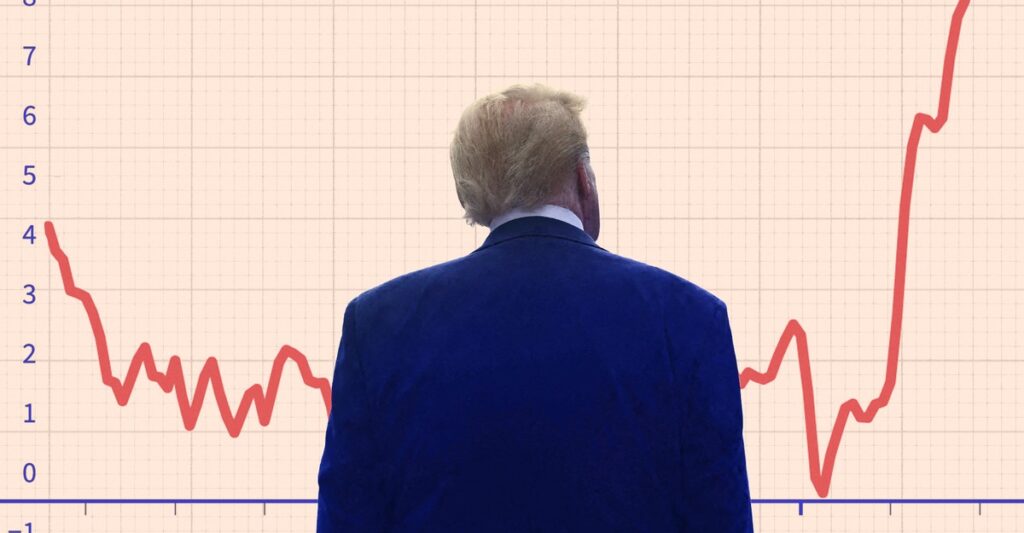

Americans are very unhappy with Donald Trump, and they’re very unhappy with him for one reason in particular: the cost of living. On the campaign trail last year, Trump promised voters who were upset about inflation that, if elected, he would slash energy and electricity costs and “rapidly drive prices down and make America affordable again.” He has not succeeded. The cost of living has risen since he took office (inflation today is at 3 percent, up from 2.9 percent in 2024), and Americans are now as angry at him as they were at Joe Biden. In a CBS News/YouGov poll released over the weekend, 64 percent of those surveyed disapproved of Trump’s handling of the economy, and 68 percent disapproved of his handling of inflation.

Trump’s reflexive response has been to lie. “We don’t have any inflation,” he insisted earlier this month. Also: “Our prices are coming down very substantially on groceries and things.” But because the president can’t quite convince people that they are paying less for beef or electricity than they are actually paying, he has had to come up with some policies to deal with inflation. Unfortunately his plans are little more than quick-fix gimmicks that—in the unlikely event they are ever enacted—promise to make things worse.

One of Trump’s challenges in dealing with inflation is that his signature policy—raising tariffs on imports from almost every country in the world—has made the stuff Americans buy more expensive, not less. Trump could, of course, just repeal the tariffs (he did finally lower the duties he imposed on coffee, beef, bananas, and other food imports). But Trump really loves tariffs. So instead of getting rid of them, he has suggested simply sending Americans $2,000 “dividend” checks paid from tariff revenues.

[Annie Lowrey: How are we still fighting about Obamacare?]

A problem with this plan is that there are no dividends to pay out: sending $2,000 checks to most American households would demand more than what the government has collected in tariff revenues so far. In other words, what Trump is proposing is dumping hundreds of billions of dollars in deficit-funded stimulus spending into the economy. That would fuel inflation, not help quash it.

Trump’s taken a similarly shortsighted approach to health insurance. The impending expiration of many Affordable Care Act subsidies at the end of the year means that lots of Americans face a massive spike in their health-insurance costs. That has focused the public’s attention on the outrageous cost of health care more generally. Figuring out how to make insurance affordable for healthy young people while also guaranteeing reasonable insurance prices for older Americans and people with preexisting conditions is an incredibly complicated problem. Trump doesn’t do complicated. His solution is to simply repeal the ACA and just give people money so they can “negotiate and buy their own, much better, insurance.”

Send money directly back to the people may sound good, but it is hard to see how this plan would help a 55-year-old man with diabetes secure affordable insurance. Instead, it seems like a great way to freeze out a lot of people from the health-insurance market entirely.

Perhaps the single biggest source of anxiety about rising prices involves housing costs. Rents have soared across the U.S. in recent years, and new homebuyers are struggling to get into the market. This is mainly a problem of supply, given high building costs, high interest rates (which deter homeowners with low-interest-rate mortgages from reentering the market), and tight regulations limiting new construction. Trump’s latest proposal for dealing with housing doesn’t address these issues at all. Instead, it’s a 50-year mortgage.

[Read: Trump is sleepwalking into political disaster]

A government guarantee of 50-year mortgages might seem appealing at first glance. By granting homeowners more time to pay back the money they borrow from banks, this plan lowers their monthly payments. But that benefit comes at a high cost. Most obviously, paying a mortgage off more slowly massively increases the amount of interest homeowners have to pay. For example, a homeowner with a $350,000 mortgage at current interest rates would end up owing about $350,000 more in interest with a 50-year mortgage than with a 30-year one. This means borrowers will be building almost no equity for a much longer period. Fifteen years of payments on a 50-year mortgage would chip away less than 10 percent of the principal—making the arrangement not that much different from renting, in economic terms. If the conventional argument for homeownership is that it helps people build wealth over time, the 50-year mortgage makes that harder, not easier.

What a government-guaranteed 50-year mortgage would do, however, is bring more demand into the market by making it easier for people to get mortgages (because they would have an easier time affording the monthly payments would be easier). This, of course, would then drive housing prices up, not down. As with so many of Trump’s ideas, this one promises to exacerbate the problem it is meant to solve.

It’s easy to understand why Trump is peddling these snake-oil solutions: Voters now hold him personally responsible for the cost of living (in part because he made all those promises about slashing prices), so he has to do something. But his latest schemes, if they ever materialize, will likely make voters angrier. Democrats routed Republicans in the recent off-year election cycle by attacking their failure to lower living costs. Trump seems keen to ensure that this messaging continues to serve Democrats well.

The post Trump Doesn’t Understand Inflation appeared first on The Atlantic.