The day before President Trump announced tariffs on trading partners across the globe in April, the German toymaker Tonies, which makes brightly colored audio boxes loved by legions of toddlers and their parents, celebrated the opening of a new factory in Vietnam.

The timing was a coincidence; preparations for the plant had begun a year earlier. But it meant that production of the latest version of the company’s audio player, called Toniebox, that was destined for the United States could be shifted to a country facing a lower tariff rate. And just in time for the holidays.

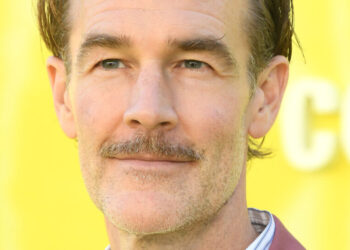

“This is where luck meets preparation, right?” Tobias Wann, the chief executive of Tonies, said in an interview in his Düsseldorf office as he demonstrated the Toniebox 2 with a Gabby’s Dollhouse game. “We were able from Day 1 to switch U.S. production from China entirely to Vietnam.”

The United States, as the world’s largest market for toys, is highly attractive for European toymakers, which have struggled in recent years. Hopes were high that they could turn things around in 2025. Then came the tariffs.

A vast majority of the world’s toys are produced in China, where manufacturing expertise has been built up over decades and cannot easily be replaced. But Mr. Trump initially imposed a 45 percent tariff on goods made in China, a rate that has since fallen to 30 percent.

Companies like Tonies that have been able to move production out of China to places like Vietnam, which faces a 20 percent tariff, are on stronger footing. But some competitors either have to increase prices or find ways to cut costs.

Ravensburger, a German company that makes board games and puzzles like Lorcana and Villainous, which it develops in collaboration with Disney, said it would absorb the tariff costs on products made in the European Union, which was hit with a 15 percent tariff rate. For toys made in China, however, there was no way around higher prices, although the company sought to keep the increase as low as possible, Katrin Seemann, a spokeswoman for Ravensburger, said in an emailed statement.

Even Tonies was not immune from price increases. Its new boxes are made in Vietnam, but the figurines used with the boxes that activate the storytelling, song and games are not. They are designed in a small town in southwestern Germany, but cast and hand-painted in China, Bosnia and Tunisia.

“All at all different tariff rates,” Mr. Wann said, including 30 percent on goods from Bosnia and 25 percent from Tunisia.

As a result, the company said, it has no choice but to raise the price for many of its popular characters, including stars from Disney and Marvel, a new Bow Wizzle figure from “Doggyland” — voiced by Snoop Dogg — and an in-demand Ms. Rachel with her pink headband and blue overalls.

“That was purely tariff-driven,” Mr. Wann said of the decision to charge $2 more for top figurines. “Fortunately, we have not seen any dent.”

Toy sales in the United States rose 7 percent in the first nine months of the year, compared with a flat performance the same period last year, according to Circana, a marketing research firm. The jump came despite the new tariffs, which contributed to, on average, a 4 percent increase in retail prices, it said.

Uncertainty over tariffs does not diminish children’s need to play, said Juli Lennett, a toy industry adviser at Circana.

“The toy industry has a unique advantage and tends to be resilient in turbulent times as toys serve as emotional anchors for families, offering joy and a welcome distraction in our lives,” she said.

Tonies also has the added advantage of a long anticipated upgrade to its product. The newest Toniebox focuses on storytelling, but the company has added lights, a sleep timer and games.

In the first three months of the year, Tonies reported, revenue increased nearly a third, to 321.8 million euros, from a year earlier. Half of that was generated in the United States, where its toys are sold at major retailers including Kohl’s, Target and Walmart.

“I think there’s a clear shared understanding among parents and caretakers that ‘Every single year I can push out the phone or the screen and create an alternative is a very valuable year for the development of the kids,’” Mr. Wann said.

Still, not all German toymakers have been so lucky.

Amigo Spiele, a small company in Dietzenbach that makes card and board games including Halli Galli, Bohnanza and Wizard, relies on distributors to get its games onto the shelves of big retailers. In 2018, the company set up a subsidiary in the United States to better understand the market and American consumers and promote its games there. Then came the pandemic and later the uncertainty surrounding Mr. Trump’s trade war.

In October, the company said in a statement that it would close its U.S. subsidiary at the end of the year, blaming the difficulties created by “the constantly changing situation with rising shipping and component costs.”

“It was the straw that broke the camel’s back,” said Andrea Milke, a spokeswoman for Amigo Spiele.

Melissa Eddy is a Times reporter based in Berlin who reports on Germany’s politics, businesses and economy.

The post How One German Toymaker Made Money Despite U.S. Tariffs appeared first on New York Times.