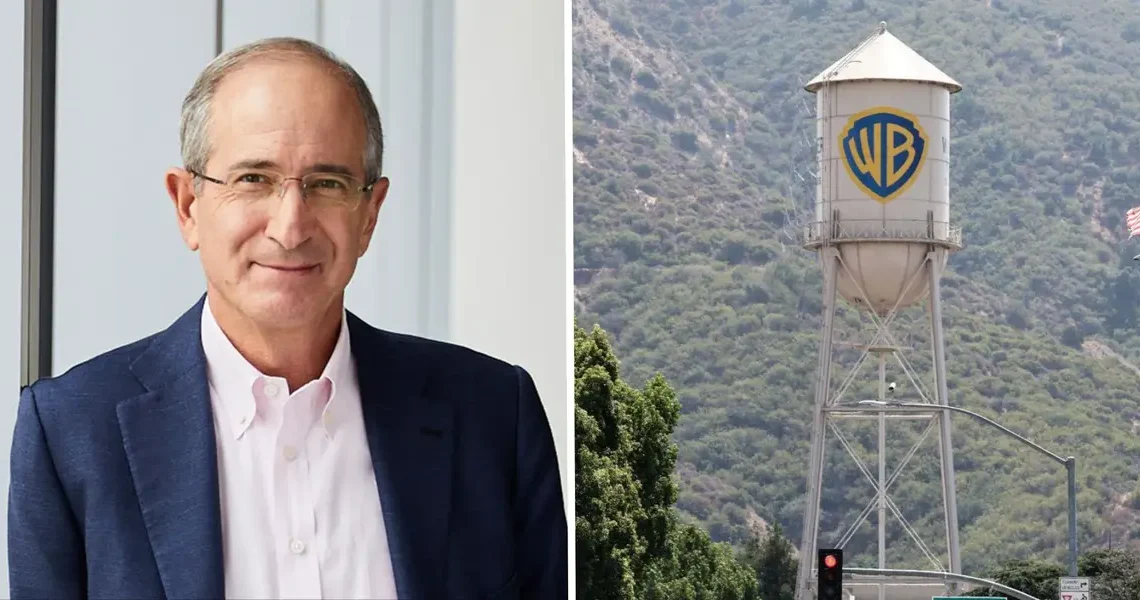

The battle for Warner Bros. Discovery has officially begun. But for all the talk about Paramount Skydance, Comcast could be the most motivated bidder.

Many in Hollywood have assumed for months that David Ellison’s Paramount has the inside track. Ellison seems to have a strong relationship with President Donald Trump and is backed by his father Larry Ellison’s astronomical wealth.

However, Comcast and Netflix are also suitors for WBD’s movie studio and streaming business. And while Netflix may not need those assets, several media analysts believe Comcast does. Rich Greenfield of LightShed Partners led this charge with a trio of late October notes, and he’s far from alone.

“We believe it’s time for Comcast Chairman and CEO Brian Roberts to make a bold move to change the narrative around Comcast,” Greenfield wrote. He also said buying WBD would be “a once-in-a-generation opportunity” for Roberts and Comcast.

Brandon Katz of entertainment data provider Greenlight Analytics also thinks the NBCUniversal parent needs WBD. He told Business Insider that “it’s clear that NBCU has the most to gain in raw streaming upside from a WBD acquisition.”

If NBCU and Peacock’s parent company can add Warner Bros. Studios and HBO to its arsenal, it could become a media powerhouse that could challenge the likes of Disney.

“Comcast has always had Disney envy, and now it has a clear opportunity to create a Disney-like story, with an asset mix that could be even more compelling than Disney,” Greenfield wrote.

Comcast declined to comment, and WBD didn’t respond to requests for comment.

WBD could solve Comcast’s streaming shortcomings

Both Comcast and Paramount would greatly benefit from integrating HBO Max, said Joe Bonner of Argus Research.

But Peacock may need it more. Comcast’s flagship streamer is US-only and has been stuck at 41 million subscribers for three straight quarters, while Paramount+ is global and has grown steadily to 79.1 million subscribers. Both streamers could use a viewership boost, with roughly 1.5% to 2% of US TV viewership each, according to Nielsen.

Veteran media analyst Craig Moffett of MoffettNathanson told Business Insider that HBO Max is “the most obvious partner” for the “inarguably sub-scale Peacock.”

“It’s hard to call any asset ‘must-have,’ but HBO Max and the studios would be a great fit for Comcast,” Moffett said.

Peacock may be the best dance partner for HBO Max, since only 20% of HBO Max subscribers in the US also have Peacock, according to Greenlight Analytics. The firm also found that 40% of HBO Max customers pay for Paramount+ and two-thirds have Netflix.

The limited overlap across Peacock and HBO Max means a bundle between the two may drive more incremental revenue than a tie-up with Paramount+ or Netflix could.

Comcast has also shown its commitment to the streaming wars by spending heavily on NBA and MLB media rights and luring star showrunner Taylor Sheridan away from Paramount.

“They must have something cooking beyond just the hopes of landing the studio and streamer side of WBD,” Katz said. “The massive outlay for sports rights alone doesn’t make sense for US-only distribution.”

Comcast’s cost savings opportunity may outweigh risks

Outside streaming, Comcast could save a boatload by owning both Universal Pictures and Warner Bros. Studios.

“NBCUniversal should have greater synergies with Warner Bros. Discovery, given far less cost-cutting than has been done at Paramount or Warner Bros. in the past five years,” Greenfield wrote.

Buying WBD could jump-start Comcast’s streaming business and its stock price, both of which have been stagnant.

Comcast isn’t a perfect bidder for WBD, however. Like Netflix, it’s only interested in WBD’s studio and streaming business, since it’s spinning off most of its cable TV networks, while Paramount wants all of WBD.

Unlike the Ellison-backed Paramount or cash-gushing Netflix, Comcast also may be limited by its languid stock and hefty debt load. Moffett said that Comcast’s price-to-earnings ratio is the lowest of any S&P 500 stock, so a big deal “is probably out of Comcast’s reach.”

Still, the market caps of Netflix ($446 billion) and Comcast ($100 billion) are a lot bigger than Paramount’s $17 billion.

Another potential headache for Comcast is the regulatory process, as Trump has spoken negatively about Roberts and the company — which owns the left-leaning TV network MS NOW — in the past.

“It’s hard to imagine that this administration would greenlight a deal over what they could, or would, claim to be antitrust concerns,” Moffett said.

Comcast could be very motivated to figure out a way forward, as losing out on WBD could leave “Peacock stranded without an obvious merger partner and at a meaningful content deficit,” Greenfield wrote. He thinks Comcast could secure regulatory approval to buy WBD by placating Trump. The media giant recently donated to Trump’s new White House ballroom project.

Comcast has a history of shaking up bidding wars, as WBD found out during the NBA media rights negotiations. If the cable giant decides it needs WBD, Ellison shouldn’t be surprised if securing his prize is harder than he anticipated.

Read the original article on Business Insider

The post Why Comcast could go all out to buy Warner Bros. Discovery appeared first on Business Insider.