On Wednesday night, Nvidia released its highly anticipated-slashed-dreaded quarterly earnings report — and Wall Street let out a sigh of relief, at least initially.

The multitrillion dollar chipmaker at the center of the AI boom reported a ludicrous $57 billion in quarterly revenue, netting it nearly $32 billion in profit. Compared to the same quarter from the year before, it amounted to a 62 percent surge in sales, and a further 65 percent increase in profit.

Nvidia’s stock spiked by over four percent when trading resumed on Thursday morning. Other tech stocks received a boost, too, as did the S&P 500 overall. The chipmaker’s “blowout” quarter calmed fears of an AI bubble bursting on the horizon. If the nearly $5 trillion behemoth responsible for providing the hardware used by AI makers was still seeing its profits balloon, then perhaps the economy collapsing wasn’t in the cards just yet, and everyone could feel secure about pouring more money into AI.

But the fuzzy feelings didn’t last.

While headlines were still trickling out today about the stock market’s rally in the wake of Nvidia’s awesome third quarter, Nvidia’s stock did a swift 180, plunged again, and is now down by over 4 percent over the course of the day.

And once again, other tech stocks followed. Microsoft shares are now down by 1.6 percent, and Google’s by around 1 percent, even though it just released its hot new Gemini 3 AI model.

Perhaps cooler heads finally prevailed. In reality, the fact that the company which is selling all the shovels for an AI gold rush is doing well doesn’t really reflect on the prospects of the companies who are actually mining for all that elusive gold.

“The people who are selling the semiconductors to help power AI doesn’t alleviate the concerns that some of these hyperscalers are spending way too much money on building the AI infrastructure,” Robert Pavlik, senior portfolio manager at Dakota Wealth, told Reuters. “You have the company that’s benefiting it, but the others are still spending too much money.”

The fizzling stocks also come as the Wall Street analysts lowered their expectations of the Federal Reserve cutting interest rates in December, NBC News noted, due to a better than expected September jobs report.

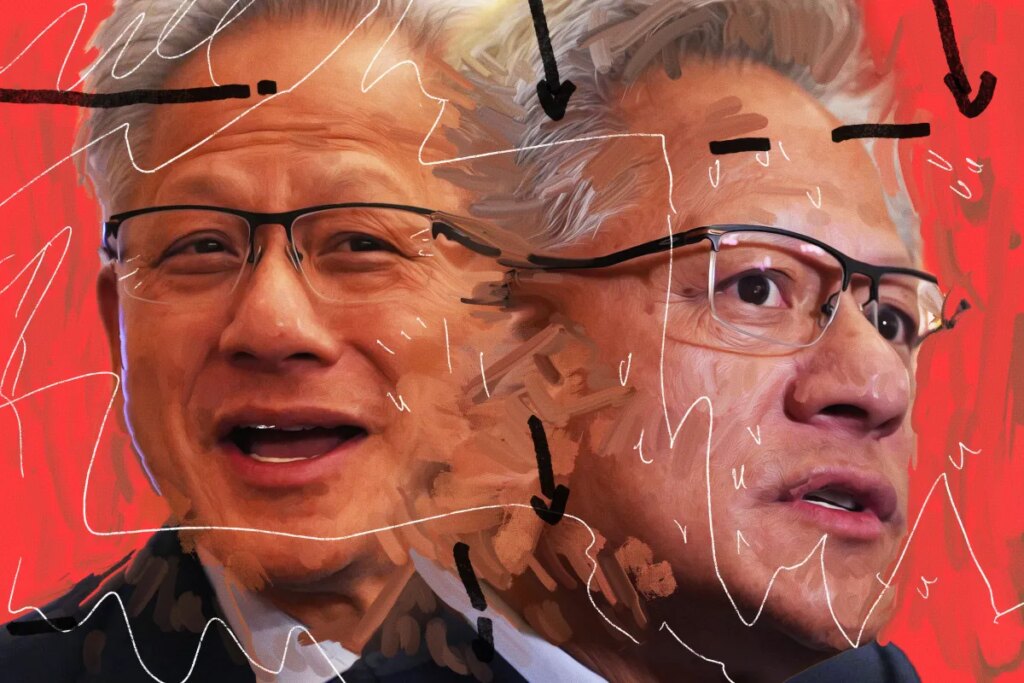

The vicissitudes of the stock market can be cruel. It didn’t care, for instance, that Nvidia CEO Jensen Huang had just gloated about Nvidia’s earnings.

“There’s been a lot of talk about an AI bubble,” Huang told investors during the earnings call, before stocks started shriveling again. “From our vantage point, we see something very different. As a reminder, Nvidia is unlike any other accelerator. We excel at every phase of AI from pre-training to post-training to inference.”

More on AI: OpenAI Is Suddenly in Trouble

The post Oops! Nvidia’s Stock Is Falling Again After Its “Blowout” Earnings Report appeared first on Futurism.