It has become routine practice to turn to Trump administration spokespersons to learn how Democrats and illegal immigrants are the source of all our problems. The high price of beef? Check.

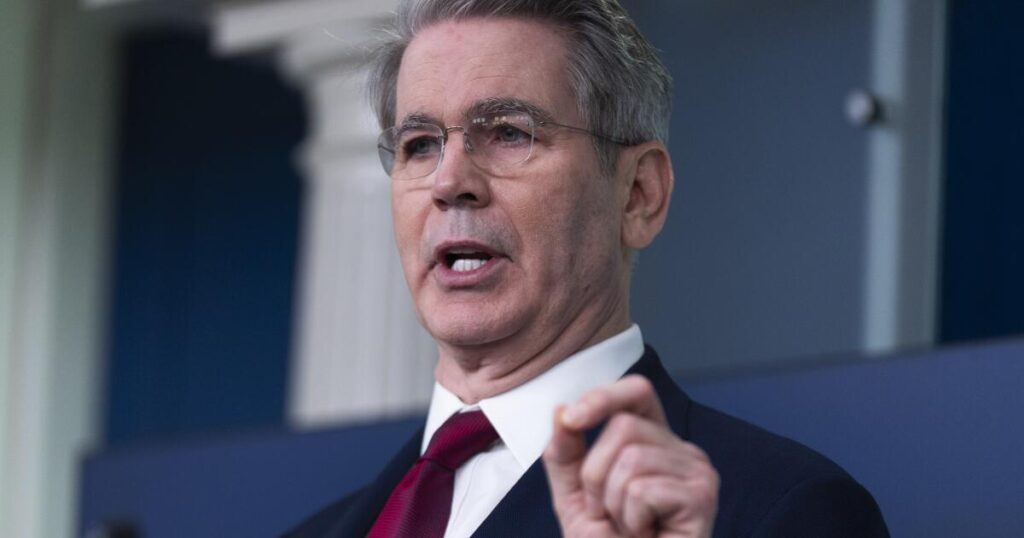

Here, for example, is Treasury Secretary Scott Bessent explaining for Fox News on Sunday why beef prices have been soaring:

“This is the perfect storm,” he said, “something we inherited.” (That’s the blaming the Democrats part.)

“Also,” he continued, “because of the mass immigration, a disease we’d been rid off in North America made its way up through South America as these migrants, they brought some of their cattle with them. So part of the problem is we’ve had to shut the border to Mexican beef.”

As is sometimes the case with Bessent, there’s a tiny nugget of truth in his words, surrounded by a bodyguard of misrepresentation.

The truth nugget is that the U.S. Department of Agriculture shut the border to Mexican cattle in March, in order to block the spread to the U.S. of the New World screwworm, a gruesome parasite that has been found in Central and South American herds.

But Bessent’s image of immigrants smuggling their infected beeves across the border is transparent fantasy. The USDA’s announcement of the blockade didn’t tie the screwworm peril to immigration, illegal or otherwise, but to commercial imports. The agency also stated that the infestation hadn’t yet penetrated farther north than Oaxaca and Veracruz, 700 miles from the U.S. border.

The Treasury Secretary’s spiel can properly be seen as standard Trumpian deflection.

That’s because at least some of the run-up in beef prices at the supermarket can be blamed on Trump policies, including his tariff on beef imported from Brazil, which has been a major exporter to the U.S. Trump himself implicitly acknowledged this Friday, when he announced that he was scrapping tariffs on beef and other foodstuffs to bring prices down.

Trump’s budget-cutting also has contributed to the crisis. Agriculture Secretary Brooke Rollins in June announced a “five-pronged plan” to combat the parasite south of the border. What she didn’t mention was that in March, the Trump administration cut off funding for anti-screwworm efforts operated by the U.N. Food and Agriculture Organization as part of its decimation of the U.S. Agency for international Development.

That said, much more is driving beef inflation than tariffs and the screwworm. And an examination of all the root causes indicates that things are likely to get worse at the meat counter before they get better. A recovery in beef prices, according to agricultural experts, may take years.

Before going further, let’s look at the raw numbers. It won’t be news to most shoppers that beef prices have been on a long-term ascent. The average price of uncooked beef steaks reached a record $12.26 per pound in September, up 15.2% from just before Trump took office.

That’s the tail of a long trend, however: The price was $3.64 in January 1998, according to the Bureau of Labor Statistics, meaning that it has more than trebled during a period in which the overall consumer price index merely doubled.

In recent months, major food processing companies have felt more than a slight pinch. Donnie King, chief executive of Tyson Foods, which owns such lunch meat and sausage brands as Hillshire Farms, BallPark, Jimmy Dean and Aidells, told investors at its fourth-quarter earnings roundup Nov. 10 that “the beef segment remains our only soft spot.”

The company reported an adjusted operating loss of $426 million on beef in fiscal 2025 and projected a loss of up to $600 million in the category for the 2025-26 fiscal year, in part because cattle costs had increased by $1.84 billion, a far larger cost increase than it experienced for any other input. It said that its earnings have been protected by gains in chicken, which has attracted shoppers shunning beef. Overall, for the fiscal year that ended Sept. 27, Tyson reported a profit of $507 million on revenue of $54.4 billion.

That brings us to the real factors driving beef prices higher. To a great extent, they’re secular. One is a long-term decline in the size of the U.S. cattle herd, which has fallen to about 87.2 million head of cattle and calves, its lowest level since 1951. Among the factors in that slide was a drought that struck the cattle-raising prairie states starting in 2020 and lasting through 2022. The all-time peak in the U.S. herd came in 1975, when it reached 132 million head.

Hay prices shot up by about 45% in 2022. With feed costs consuming the value of livestock, ranchers sold off their herds or stepped up the slaughter of their cows and heifers — producing a short-term glut of beef at store shelves but mortgaging their future supply.

Raising an animal from calf to marketable beef takes at least three years. Tyson executives told investors that they had seen signs that ranchers were finally rebuilding their herds, but that means a continued shortage of beef in the years just ahead.

Into this uncertain environment, Trump threw another complication: tariffs. These included a 50% levy on imports from Brazil, which Trump imposed in July not as a protectionist step, but because he was discontented with the prosecution of former Brazilian President Jair Bolsonaro for an alleged coup plot. (Bolsonaro was convicted and sentenced in September to more than 27 years in prison.)

That was a problem because, although foreign beef doesn’t account for a large share of overall beef consumption, it’s important for some categories, notably “lean beef trim,” which gets mixed in with fattier U.S. ground beef to yield the hamburger meat favored by American consumers. Brazil’s production of lean trim helped its beef exports reach more than 25% of all U.S. beef imports.

The long-term rise in beef prices has provoked market participants into a spate of finger-pointing, not all of which is groundless. In 2019, consumer advocates accused Tyson, Cargill and other meat-packers in a lawsuit of conspiring to fix beef prices. Tyson and Cargill settled the accusations against them last month without acknowledging guilt, Tyson paying $55 million and Cargill, $33.5 million. Two foreign-owned companies, JBS USA and National Beef Packing, are still in court.

Others have pointed to putative profiteering by cattle ranchers, whose profits per animal have spiraled higher, even as many have pared the size of their herds.

One might also point to American consumers, who haven’t moderated their beef buying enough to subject the commodity to the rigors of supply-and-demand economics.

The administration’s approach to the rise in beef prices has been chaotic and incoherent. Last month, Trump said he would alleviate the price spike by importing more beef from Argentina.

The proposal garnered instantaneous backlash from American cattle producers. They said the plan “only creates chaos at a critical time of the year for American cattle producers, while doing nothing to lower grocery store prices,” in the words of Colin Woodall, CEO of the National Cattlemen’s Beef Assn. The group noted that Argentina accounts for a bare 2% of U.S. beef imports, meaning that even a significant expansion of the trade flow would do little to moderate prices.

In sum, there’s little Trump can do to influence beef prices, except to make the situation worse, as happened because of his tariffs. Now that he has reversed course and lifted his thumb off the Brazil trade, prices might improve, if modestly. But all those other factors such as drought, the long-term decline in domestic herds and disease, will still be with us, for some time.

The post Why are beef prices so high? Blame tariffs, drought and a disgusting parasite appeared first on Los Angeles Times.