Warner Bros. Discovery, the media giant that owns HBO, CNN and the Warner Bros. movie studio, has been sold and renamed three times since the turn of the century. Here comes the fourth.

The company announced plans to consider a sale last month, and the deadline for initial bids is Thursday. Three heavyweights — Netflix, Comcast and Paramount — are expected to pursue all or part of the company to cement their primacy in Hollywood.

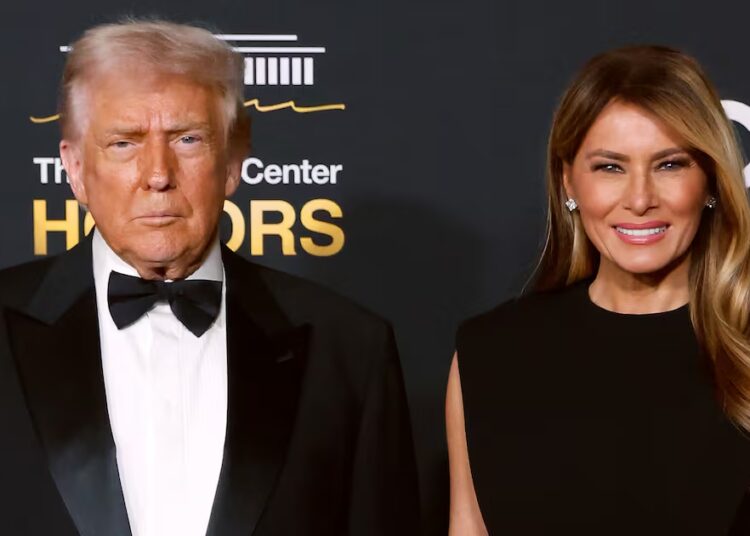

Each of the three companies is preparing arguments for why it is the best option, according to several people with knowledge of their plans. And the arguments are not just about money (though a lot of them are about money). They are also about politics. The deal, like all major mergers and acquisitions, will need approval from federal enforcers, and President Trump has often made clear his preferences for media ownership.

So the bidders will need to make a persuasive case to Warner Bros. Discovery’s board of directors that they can navigate the financial and regulatory hurdles. Here is the situation facing the three of them:

Paramount: Deep Pockets and Ties to Trump

Paramount, the conglomerate behind CBS News, films like “Top Gun” and fading cable networks like MTV, is widely viewed as the front-runner in the bidding contest. And that is because of its financial and political advantages.

David Ellison, who took control of Paramount in August, is putting together a bid with backing from his billionaire father, the Oracle co-founder Larry Ellison, giving him access to a deep well of cash not as easily available to his competitors.

The older Mr. Ellison is also a longtime supporter of Mr. Trump. The Trump administration blessed the Ellison family’s takeover of Paramount, and the president has praised the younger Mr. Ellison in briefings with reporters.

But the new mogul has not yet convinced the board of Warner Bros. Discovery that Paramount’s approach would be best for shareholders. David Zaslav, the company’s chief executive, will be a power broker with board members as they weigh offers, not least because of his relationships with influential shareholders like John Malone. Paramount has offered Mr. Zaslav a role as co-chief executive of the combined company, giving him a seat at the table in any potential deal. Mr. Ellison wants to buy all of Warner Bros. Discovery, including traditional cable channels like TNT, saying it would give shareholders the most lucrative way to cash out.

Competitors and possibly consumer groups are also likely to raise concerns with regulators about any Paramount deal, because shared ownership of Warner Bros. and Paramount Pictures would strengthen the movie studios’ hand at the struggling box office. The combined company would also own a huge group of cable networks as well as overlapping businesses in Europe, where regulators must also approve any deal.

Paramount has privately resolved to keep the movie studios separate, and has argued that media companies need to be larger to compete with deep-pocketed technology giants like Amazon and Google. In a letter to the board of Warner Bros. Discovery, Mr. Ellison argued that a deal between the two would be good for the industry, “creating a more robust streaming platform to compete with the dominant tech giants and larger media players.”

Comcast: An Open Role for Zaslav?

Comcast, the cable and wireless giant that owns NBC, the Universal movie studio and lucrative theme parks, is taking a different approach.

Comcast wants only Paramount’s studio and streaming service, in an effort to supercharge its own businesses, a person with knowledge of discussions inside the company said. That would avoid regulatory scrutiny of a concentrated ownership of cable networks. (Like Paramount, though, Comcast would need to contend with questions stemming from its ownership of two major movie studios.)

Comcast has at least one other carrot for Mr. Zaslav: It could offer him a major role overseeing its media business, because NBCUniversal hasn’t had a dedicated media chief executive since 2023. Brian Roberts, the chairman and co-chief executive of Comcast, shares a mentor with Mr. Zaslav in Mr. Malone.

But Comcast has roughly $99 billion in debt, reducing its ability to make a lucrative cash offer to compete with Paramount. (Comcast has abundant free cash flow and is in good standing with its ratings agencies, meaning it could take on additional debt at favorable terms for a bid.)

And Mr. Trump has a well-known grudge against Mr. Roberts, whom he has called a “disgrace to the integrity of broadcasting.” Still, the company has joined many others in trying to cultivate a relationship with the president in his second term; Comcast recently donated millions to help fund the construction of a ballroom at the White House.

Netflix: Plenty of Money and Motivation

Netflix, the king of the entertainment industry, is also focused on buying only Warner Bros. Discovery’s streaming service and studio, a person with knowledge of discussions inside the company said. And with a market value of about $470 billion, it has plenty of money at its disposal.

Buying Warner Bros. Discovery’s studio and streaming businesses could further distance Netflix from competitors like Disney and Paramount. The deal would come with intellectual property, including characters like Batman and Harry Potter, that is a potential gold mine for Netflix. The Warner Bros. studio lot in Burbank, Calif., could also be valuable.

But all of that may raise red flags with government antimonopoly enforcers. Some lawmakers have already criticized a potential deal over antitrust concerns. Representative Darrell Issa, a Republican from Southern California, sent a letter last week to Pam Bondi, the attorney general, raising concerns about the potential combination.

In the letter, Mr. Issa wrote that combining Netflix’s “300 million global subscribers” with “HBO Max’s subscribers and Warner Bros.’ premier content rights” would push the entity to “above a 30 percent share of the streaming market: a threshold traditionally viewed as presumptively problematic under antitrust law.”

But Netflix may argue that the company is dwarfed by tech companies like Google, whose YouTube has leapfrogged its rivals to become one of the most popular streaming services.

Netflix may also argue that it poses a reduced antitrust risk because it does not already own one of the major Hollywood studios. Netflix and HBO Max, the Warner Bros. streaming service, already have significant overlap, and Netflix could argue that combining the two services would give customers more bang for their buck.

Benjamin Mullin reports for The Times on the major companies behind news and entertainment. Contact him securely on Signal at +1 530-961-3223 or at [email protected].

The post Who Will Win Hollywood’s Big Prize? appeared first on New York Times.