Xu Mingnan/Xinhua via Getty Images

- Hedge funds are on pace for their best year since 2020, according to fund administrator Citco.

- Multistrategy funds lead with a 19.3% return on average, attracting $30 billion in net inflows.

- Sign up for Business Insider’s daily markets newsletter here.

In a year rife with macroeconomic and geopolitical uncertainty, hedge funds are cruising toward the industry’s strongest annual showing since the pandemic era.

Through three quarters, hedge funds have gained 16.6% on average and pulled in more than $40 billion in net inflows from investors, according to new data from fund administrator Citco.

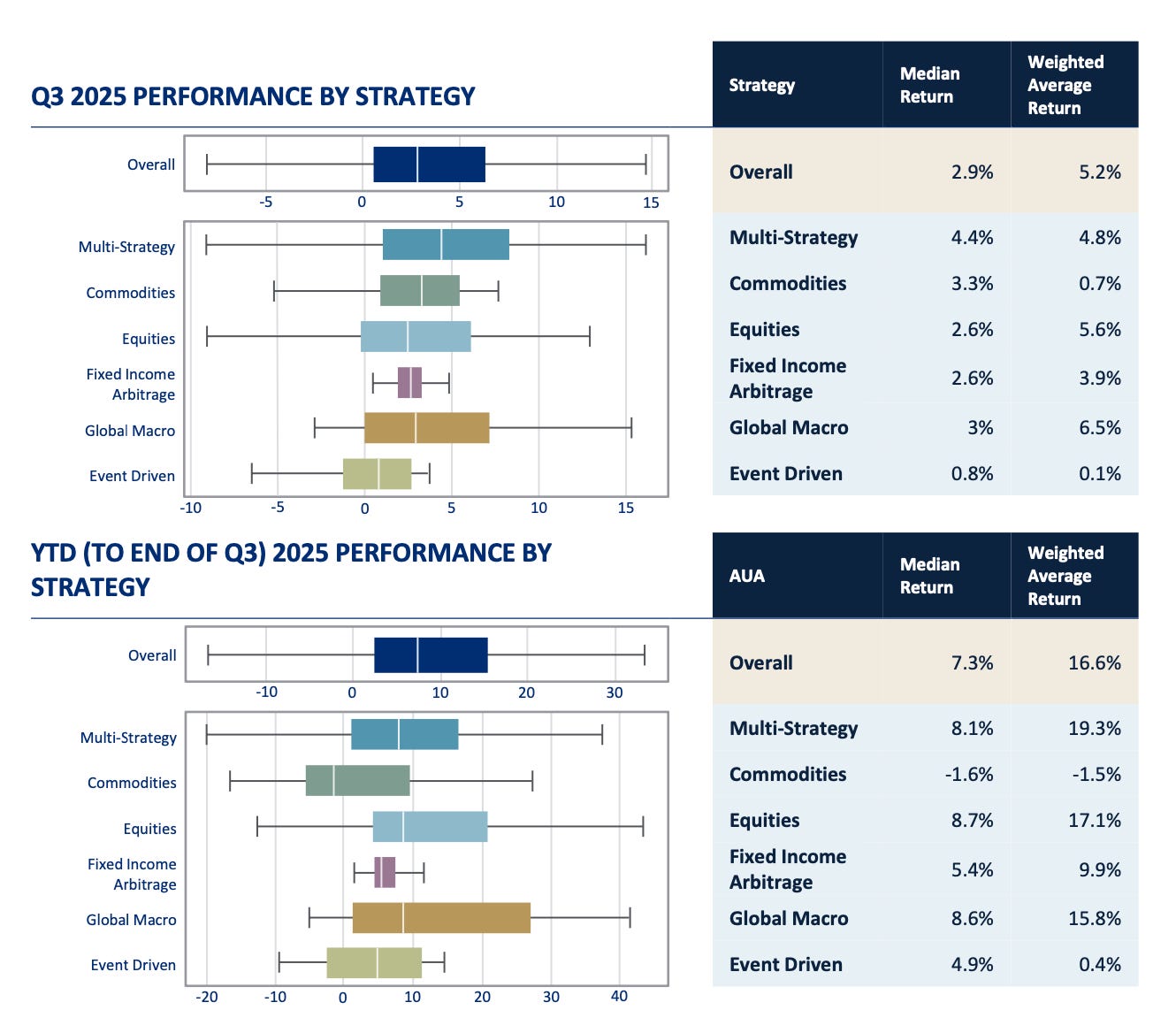

The industry is on pace for its best year since 2020 following a 5.2% weighted average gain in the third quarter, with each major strategy and 80% of funds posting positive returns, Citco reported this week. Along the way, money managers have navigated a roller coaster of tariff policy shocks, a changing rate environment, turmoil in the Middle East, and worries of an AI-induced stock bubble.

Multistrategy funds — which, as the name suggests, place bets across a diversified array of investment strategies — have performed particularly well in 2025, gaining 19.3% on average, followed by equities funds at 17.1% and global macro funds at 15.8%.

Two of the largest multistrats, however, are having modest years by their standards and underperforming peers. Citadel, which manages $69 billion, was up 5% through September while Millennium, which manages $79 billion, was up 6%.

Global macro was the best performer in Q3, with a 6.5% gain, followed by equities at 5.6% and multistrategy at 4.8%.

Commodities and event-driven strategies have struggled in 2025, but both managed to eke out gains in the quarter.

Citco

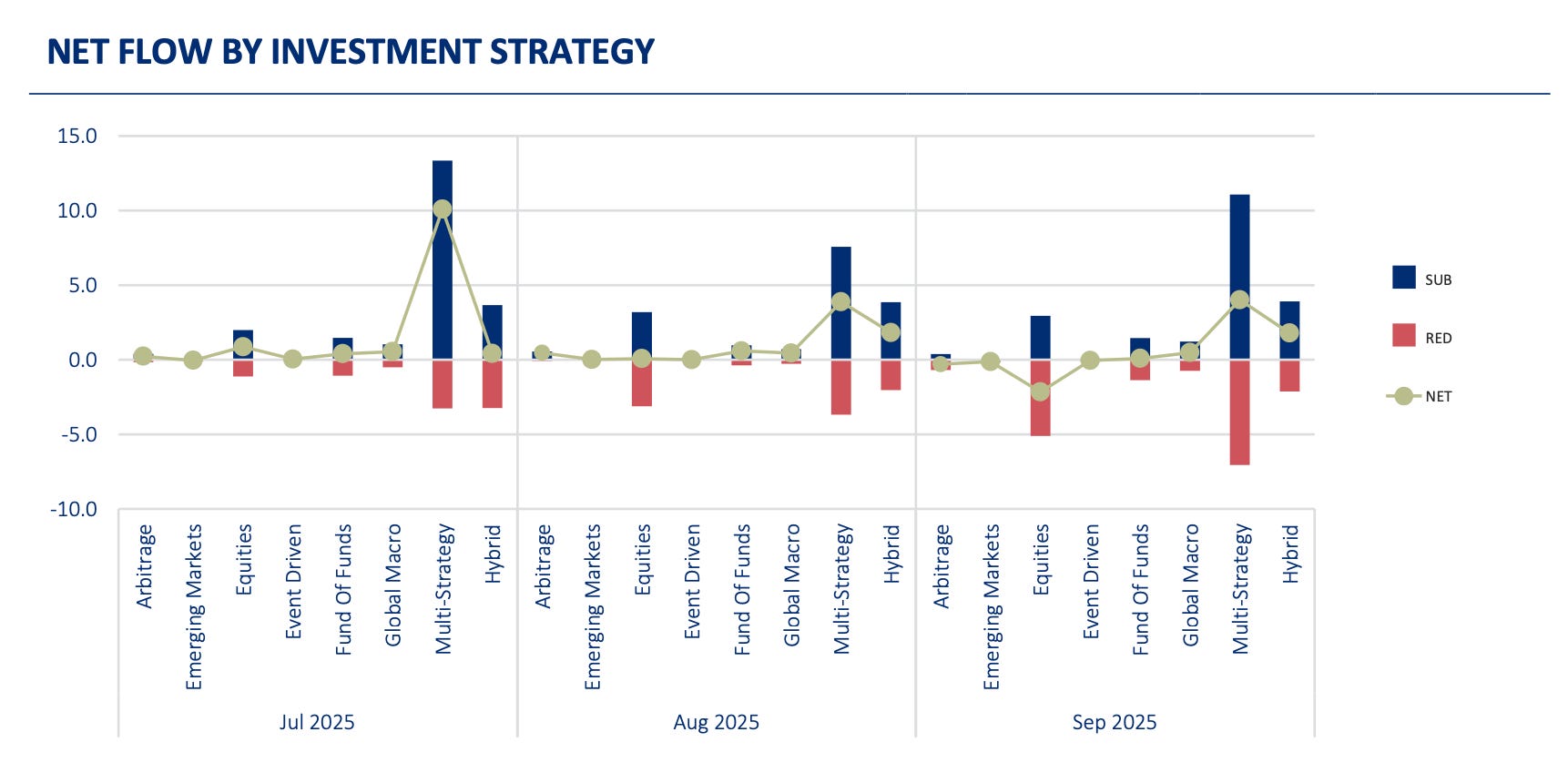

Investors continue to flock to multistrats, which have taken in an overwhelming majority of the industry’s investment inflows, accounting for $30 billion of the $41.3 billion in net inflows in 2025. Multistrats added $18 billion in the third quarter alone, more than 75% of total net inflows for the period. The next closest was global macro, at $1.4 billion in inflows.

The multistrat category overlaps significantly with so-called multimanager funds, which deploy dozens of independent investment teams and typically pass most of their costs on to investors. They’ve become a dominant force in the industry in recent years, and one of the most popular among investors, growing assets under management to over $425 billion — more than double their size in 2020 — according to a recent Goldman Sachs report.

“Investors are taking advantage of this consistent run of performance, with inflows every month in Q3, as the combination of diversification and returns continues to prove enticing,” Declan Quilligan, Citco’s head of hedge fund services, said in a press release.

Citco

Citco said it was a record-breaking quarter for trading volumes among its clients, with daily average trade volumes reaching nearly 30 million in September, thanks to a heavy uptick in traffic in corporate and convertible bonds, equity options, and credit default swaps.

Read the original article on Business Insider

The post Hedge funds are on track for a banner year — but 2 charts show one group of money managers is the industry darling appeared first on Business Insider.