Summary

- Sotheby’s revenue dropped nearly 20 percent in 2024, posting a $248 million USD pre-tax loss as the art market slowed

- The auction house secured a $909 million investment from Abu Dhabi’s ADQ to pay down debt and buy a new Madison Avenue building

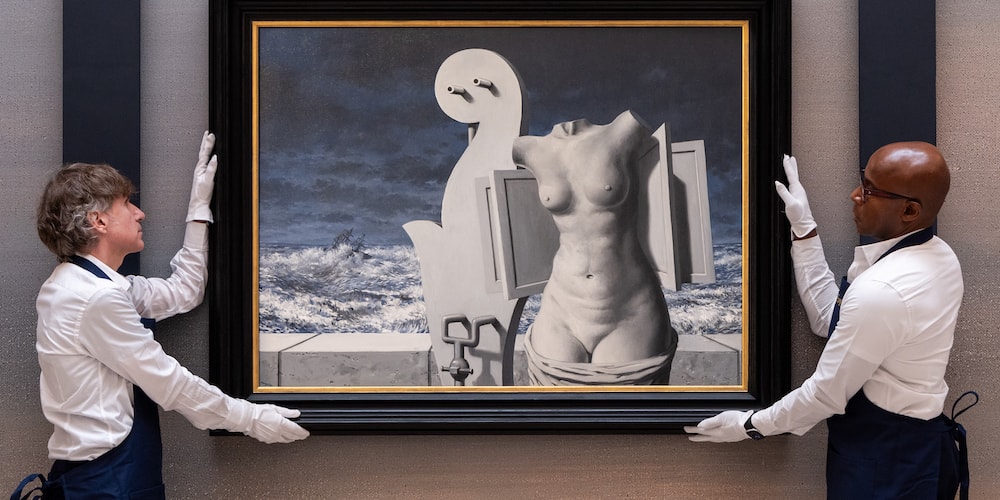

The art world’s blue-chip auction house just had a rough year. Sotheby’s, the 280-year-old giant that sells everything from Picassos to Patek Philippes, saw its revenues tumble nearly 20% in 2024 which means that fewer collectors purchased luxury goods and fine art and the house took a major hit.

According to filings in Luxembourg, Sotheby’s brought in $1.13 billion USD in 2024, down from $1.36 billion USD the year before. The losses stacked up fast, with the company posting a pre-tax loss of about $248 million USD, more than double its $106 million USD loss in 2023.

So what happened? Commissions and fees, the bread and butter of Sotheby’s, shrank as big-ticket auctions cooled as per Business of Fashion. The global art market has been sluggish and even a powerhouse like Sotheby’s is feeling it. Last year, Abu Dhabi’s sovereign wealth fund, ADQ, bought a 24 percent stake for $909 million USD. Sotheby’s used the cash along with a top-up from owner Patrick Drahi to pay down debt and buy a new Madison Avenue building in New York.

The big picture is that Sotheby’s is not just about gavel drops anymore. They are also lending money against art, flipping buildings and leaning on wealthy backers to weather the storm. But with sales still sliding, the question is whether this old-school auction house can be relevant in a world where hype culture and social media are already setting the rules.

The post Sotheby’s Down Bad With Auction Giant Posting Big Losses appeared first on Hypebeast.