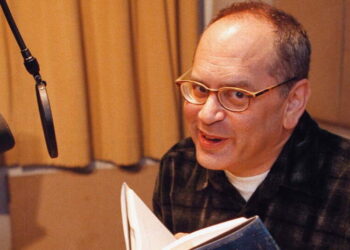

In a complex decision, the Supreme Court on Friday struck down tariffs President Trump had imposed under the International Emergency Economic Powers Act, IEEPA for short. Stephen Stromberg, an editor in Opinion, convened the Opinion writer Binyamin Appelbaum, the Opinion contributing writer Josh Barro and the economics commentator Catherine Rampell to discuss the 6-3 ruling, whether it will curb the president and what it means for the economy.

Stephen Stromberg: We have a tariff ruling. Binya, is it fair to say that the decision is about what most observers expected?

Binyamin Appelbaum: Yeah. It was pretty clear from the oral arguments that most justices were skeptical, at best, of the Trump administration’s claim that the president could impose tariffs on any country, for any reason — or, more often, no reason at all — for any length of time.

But a lot of us were still waiting to see whether the court would actually check Trump — something it has been reluctant to do.

Josh Barro: Most of the justices did appear skeptical of the administration’s broad assertion of tariff authority, but one of the questions looming over this decision was how a majority of the court might reach a decision to rein in President Trump.

The liberals on the court have generally resisted the “major questions” approach that the conservatives have used to block creative executive policymaking in other areas, such as carbon emissions regulation. The conservatives have said that Congress has to be especially clear when it grants a sweeping power to the executive, while the liberals have been more willing to let administrations read statutes creatively. Here, the court got to a majority by agreeing to disagree about the basis of the ruling: Three of the conservative justices found the claimed tariff powers violated the major questions doctrine. The three liberals said that IEEPA simply didn’t authorize the president to impose tariffs and there was no need for the court to conduct a major questions analysis.

Appelbaum: I’m not sure the conservatives on the court have managed to articulate a coherent or consistent major questions doctrine. They certainly didn’t agree about what it meant in this case.

A cynic might say that the three conservatives who voted against the administration are really invoking the legal principle of “C.R.E.A.M.,” or Cash Rules Everything Around Me (Wu-Tang Clan, 1993). They seem most inclined to stand up to the Trump administration when their retirement savings are at stake.

Stromberg: Josh points to a potential problem for those hoping that the court will rein in Trump’s future efforts to impose tariffs. In a dissent, Justice Brett Kavanaugh stressed that other statutes explicitly empower the president to impose tariffs for various reasons, and Trump announced shortly after the ruling came down that he would establish a new 10 percent global tariff under different legal authorities.

With three conservatives showing they would let Trump go hog wild on tariffs, it will be much harder for Chief Justice John Roberts to assemble a majority to restrain the president when he tries to impose tariffs under different sections of the law — ones that more explicitly give the president tariff-setting power.

Barro: The president has other statutory powers to impose tariffs, but they are all significantly more limited than the powers he had claimed under IEEPA. For example, he can set country-specific tariffs under Section 122 of the Trade Act of 1974, but this law limits him to imposing tariffs of no more than 15 percent for no more than 150 days. He also has — and has used — Section 232 authority to impose tariffs on specific commodities such as steel and aluminum, but those tariffs must go through an investigative process at the Commerce Department and can’t be set and lifted at will in the way the president likes.

There is a reason the president wanted to use IEEPA, a law that he claimed allowed him to set tariffs in any amount on any products from any country for any period for any reason. His ability to create economic chaos through tariffs — and tariff threats — will be significantly curtailed when he has to rely on the narrower authorities that come from other laws — even though I agree those authorities are likely to be upheld.

This decision is going to rein in the president’s trade policy in a material way.

Catherine Rampell: Yes, Trump has lots of other powers he can use, and the administration has been telegraphing for months that it would use them to reconstitute any tariffs the court struck down. But because those other authorities are more limited, or require a lot more process, they will be much harder for the president to wield as a cudgel against other countries from whom he’s demanding concessions or fealties of various kinds. He can’t just use his itchy Twitter finger to levy new tariffs on an ally — or, for that matter, roll them back when they show up bearing gold bars.

Stromberg: I think you mean his itchy Truth Social finger, Catherine.

Not to get all wonky here, but what about Section 301 of the Trade Act of 1974? Kavanaugh mentions it repeatedly in his dissent, and it seems pretty powerful.

Barro: We’ll see, but similar to Section 232, the Section 301 tariffs have to be tied to an investigation — in this case, by the Office of the U.S. Trade Representative — and designed to address a specific unfair trade practice. Section 301 tariffs are not the sort he can impose immediately because he feels the president of Switzerland was rude to him on a phone call, and the process requirements will give taxpayers a hook to argue that any tariffs set are untethered to the problems the statute was intended to address.

Appelbaum: I part company with Catherine and Josh on this issue. While the other tools available to Trump are not as easy to use, and that might have some consequences, I still think Trump has plenty of other, more legally defensible ways to discourage trade.

Tariffs are only one kind of tool in that box. Trump, for example, has broad authority to limit imports and exports for national-security reasons. Countries, including the United States, also can and do wield regulations as barriers to trade. The level of ease in driving a truck across the U.S.-Mexico border can be more consequential than the tariff on the cargo.

So I don’t think the effect on trade policy is the real headline here.

The bigger things, to my mind, are first, the court is finally checking Trump’s tendency to declare everything an emergency and to do what he wants by invoking emergency powers. That’s a victory for the rule of law, and the rule of law could use one.

And second, this removes a diplomatic cudgel from Trump’s arsenal. He has used tariffs to pursue a wide range of foreign policy goals. The other ways of imposing tariffs are harder and slower and don’t allow him to bully countries more or less arbitrarily.

Stromberg: Let’s expand on that thought, Binya. What happens now when Trump tries to use economic pressure to force other countries to strike trade deals? Or even when countries come back and say, “All those deals we agreed on before are null, now that we know you can’t punish us as easily?”

Appelbaum: This ruling upends a lot of stuff that’s happened over the last year. Companies that paid tariffs on imports to the United States are lining up to sue the government for refunds. Some estimates put the government’s potential liability north of $100 billion.

And countries that signed deals in part to obtain lower tariff rates from Trump have now lost the ostensible upside of those agreements.

Kavanaugh was the only justice in the decision or in the dissents to mention the potential for chaos. It’s a bad argument for maintaining an illegal system, but he’s not wrong that ending these tariffs is going to create some messes that won’t be easy to clean up.

But I want to note again that this isn’t just about trade. Trump has used the threat of tariffs to demand that other countries limit the flow of fentanyl; to press Brazil for gentler treatment of its would-be dictator, Jair Bolsonaro; and to threaten countries that participate in efforts to dethrone the dollar as the world’s de facto currency.

The tariff authorities that remain in his arsenal can’t really be used to make those kinds of threats, because they need to be grounded in specific economic objectives.

Rampell: The executive branch has managed to rebate huge amounts of tariffs before, relatively efficiently. (See this amicus brief.) Admittedly not this huge, but there’s still precedent. It is a worrying sign that the Supreme Court punted on whether or how to manage that endeavor now.

Stromberg: Why worrying, exactly, Catherine?

Rampell: Because it shows once again a level of cowardice that court observers were hoping the justices would escape.

And it leaves thousands of companies in limbo. Many had been betting on getting this money back a while ago — because the court had been expected to strike down the IEEPA tariffs — and have been putting off paying bills and raising prices to the extent possible, or delaying investment and hiring decisions, because they have struggled with cash flow. That uncertainty now persists because the high court couldn’t manage to make a decision on rebates here.

In the meantime, there have been calls from Trump’s allies in Congress to officially give him the authority to impose these IEEPA tariffs. I think it’s unlikely there are enough Republican lawmakers willing to do this, but the possibility will still mean more costly uncertainty for businesses, their workers and their customers.

Barro: There is no way Congress will reimpose the tariffs. Both houses of Congress have, at various times, passed resolutions seeking to block certain IEEPA tariffs the president had issued. A sufficient number of Republicans have already shown their willingness to defy him on the issue.

Rampell: Yeah, in a way the court has done both Congress and the Trump administration a huge favor, by — at least temporarily — removing a major tax on the economy. This could be a nice shot in the arm for the economy, which, by the way, slowed significantly last quarter. If Trump is smart he will accept that gift. But he seems keen on snatching defeat from the jaws of victory.

Appelbaum: Not great for the government’s fiscal health, however. Trump sees the tariff revenue as an offset for the big tax cuts he’s already pushed through.

Rampell: Oh, yeah, Trump has earmarked the tariffs for seemingly everything. Not just an offset for the his latest tax cuts, but also allegedly: $2,000 stimulus checks, a farmer bailout, child care, increasing the military budget, replacing the income tax and a sovereign wealth fund!

Stromberg: Catherine, any thoughts on how this might affect the Federal Reserve’s thinking?

Rampell: It depends a little on how the administration responds, and whether or when tariff money gets remitted back.

If the tariff money gets refunded, that could produce a modest but still sizable fiscal stimulus, at a time when fiscal policy is already looking pretty stimulative this year thanks to Trump’s recent tax cuts. Other policies, such as credit regulatory policy, are also somewhat expansionary. So the Fed might look at a refund and say: Hey, maybe there’s enough stimulus here. We don’t need to step on the gas further as we consider what to do with interest rates.

However, as mentioned, if Trump backfills those tariffs with other tariff authorities, that will blunt the impact of any stimulus from a big refund. And, of course, the leadership of the Federal Reserve is about to change, too. Kevin Warsh, Trump’s nominee to be the next Fed chair, has publicly said he plans to cut rates.

Barro: The tariffs have been a bit of a puzzle for the Fed. Tariffs cause a one-time rise in the price of goods, but they don’t necessarily push up inflation on a sustained basis. At the same time, any tax increase — including a tariff increase — ought to discourage inflation, because it reduces consumers’ capacity to spend. To the extent this decision deepens the federal budget deficit, it creates upward pressure on inflation and makes it harder for the Fed to cut rates.

All the more reason Congress should not have passed a major tax cut last year: The budget deficit is too big and is making it impractical for the Fed to deliver the interest rate relief that American borrowers would like. Don’t count on 4 percent mortgage rates anytime soon.

Appelbaum: As Josh says, the Fed is more concerned about changes in tariff policy than the level of tariffs. Directionally, this change is inflationary. But the magnitude is a big question mark.

Stromberg: Let’s get back to Binya’s big picture. Do we have any specific predictions about how this will affect 1) the economy and 2) global politics?

Barro: Tariffs are inefficient taxes that particularly burden lower-income consumers, who spend a larger fraction of their income on tradable goods. They also discourage investment in domestic manufacturing, because they raise the cost of inputs and — if you have a president who likes to change tariff rates daily based on his moods — they make it difficult for businesses to estimate their future costs. This is one of the big ironies of the president’s trade policy: He thinks he’s a champion of domestic manufacturing and, yet, he’s making it harder for American manufacturers to buy the raw materials they need to make products.

So the court’s action to invalidate many of the tariffs the president has whimsically imposed will benefit the economy in certain ways. But striking them down also raises the already-too-high budget deficit and could therefore create upward pressure on inflation and interest rates. It’s a mixed bag, economically.

Appelbaum: My fearless prediction is that this ruling will establish once and for all that tariffs are taxes.

Rampell: I get asked a lot whether a Supreme Court decision striking down the tariffs means consumers will get a rebate for the extra money they’ve paid, since companies passed along at least some of their tariff costs to customers. Alas, this is very unlikely. If you paid 20 percent more (or whatever) for your Coach bag, violin or tattoo, you’re not getting that money back. Sorry!

Stromberg: Maybe the president will find a way if he can put his face on the checks and call them Trump rebates.

The Times is committed to publishing a diversity of letters to the editor. We’d like to hear what you think about this or any of our articles. Here are some tips. And here’s our email: [email protected].

Follow the New York Times Opinion section on Facebook, Instagram, TikTok, Bluesky, WhatsApp and Threads. Catherine Rampell is the economics editor of The Bulwark and an anchor for MS NOW.

The post ‘A Victory for the Rule of Law’: 3 Experts Assess How Much the Court Reined In Trump appeared first on New York Times.